Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P 11-15: Toby Manufacturing Toby Manufacturing produces three different products in the same plant and uses a job order costing system to estimate product costs.

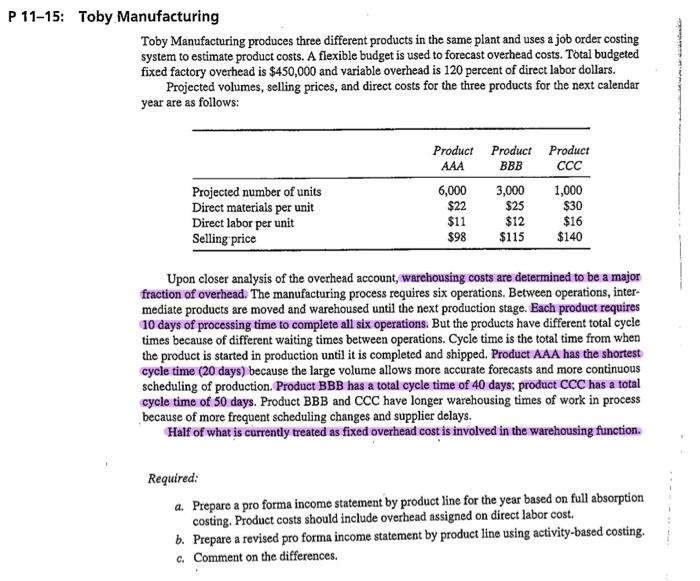

P 11-15: Toby Manufacturing Toby Manufacturing produces three different products in the same plant and uses a job order costing system to estimate product costs. A flexible budget is used to forecast overhead costs. Total budgeted fixed factory overhead is $450,000 and variable overhead is 120 percent of direct labor dollars. Projected volumes, selling prices, and direct costs for the three products for the next calendar year are as follows: Projected number of units Direct materials per unit Direct labor per unit Selling price Product AAA 6,000 $22 $11 $98 Product BBB 3,000 $25 $12 $115 Product CCC 1,000 $30 $16 $140 Upon closer analysis of the overhead account, warehousing costs are determined to be a major fraction of overhead. The manufacturing process requires six operations. Between operations, inter- mediate products are moved and warehoused until the next production stage. Each product requires 10 days of processing time to complete all six operations. But the products have different total cycle times because of different waiting times between operations. Cycle time is the total time from when the product is started in production until it is completed and shipped. Product AAA has the shortest cycle time (20 days) because the large volume allows more accurate forecasts and more continuous scheduling of production. Product BBB has a total cycle time of 40 days; product CCC has a total cycle time of 50 days. Product BBB and CCC have longer warehousing times of work in process because of more frequent scheduling changes and supplier delays. Half of what is currently treated as fixed overhead cost is involved in the warehousing function. Required: a. Prepare a pro forma income statement by product line for the year based on full absorption costing. Product costs should include overhead assigned on direct labor cost. b. Prepare a revised pro forma income statement by product line using activity-based costing. c. Comment on the differences.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started