Answered step by step

Verified Expert Solution

Question

1 Approved Answer

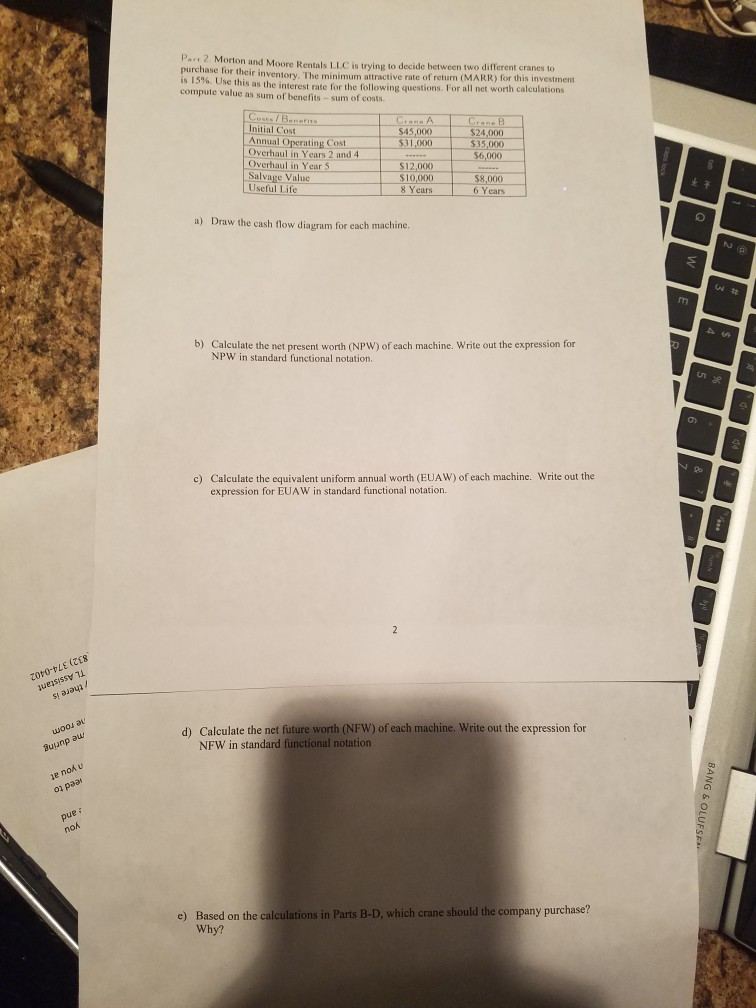

P.. 2 Morton and Moore Rentals LLC is trying to decide between two different cranes to ventory. The minimum attractive rate of return (MARR) for

P.. 2 Morton and Moore Rentals LLC is trying to decide between two different cranes to ventory. The minimum attractive rate of return (MARR) for this investment Use this as the interest rate for the following questions. For all net worth calculations compute value as sum of benefits- sum of costs Initial Cost Annual Operating Cost Overhaul in Years 2 and 4 Overhaul in Year 5 Salvage Value Useful Life $45,000 $31,000 $24,000 535,000 S12,000 $10,000 Years $8,000 6 Years a) Draw the cash flow diagram for each machine. b) Calculate the net present worth (NPW) of each machine. Write out the expression for NPW in standard functional notation Calculate the equivalent uniform annual worth (EUAW) of each machine. expression for EUAW in standard functional notation. c) Write out the LE (E8 uesissv 1 d) Calculate the net future worth (NFW) of each machine, Write out the expression for NFW in standard functional notation Based on the calculations in Parts B-D, which crane should the company purchase? Why? e)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started