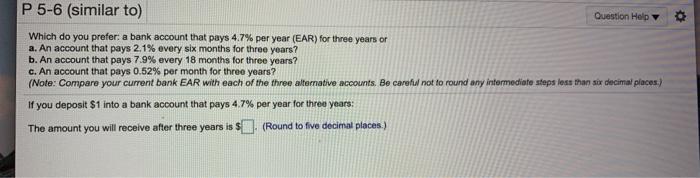

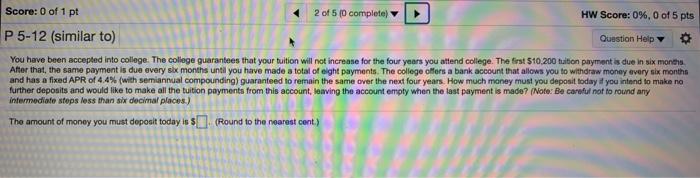

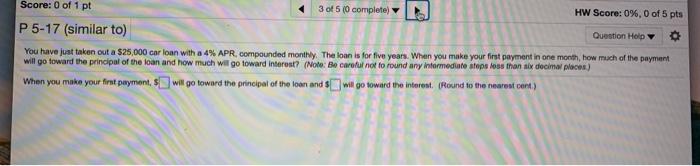

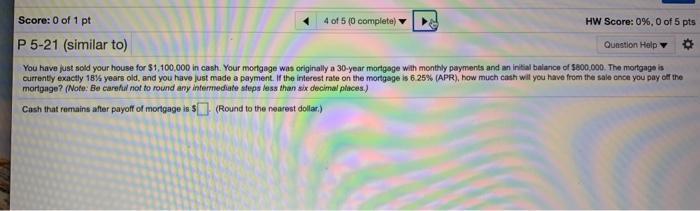

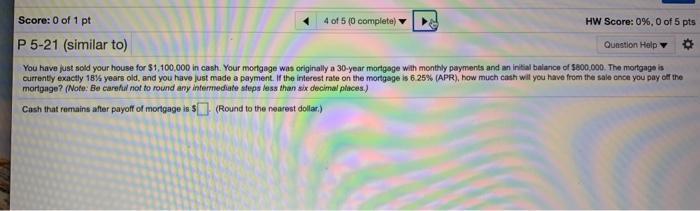

P 5-6 (similar to) Question Help Which do you prefer: a bank account that pays 4.7% per year (EAR) for three years or a. An account that pays 2.1% every six months for three years? b. An account that pays 7.9% every 18 months for three years? c. An account that pays 0.52% per month for three years? (Note: Compare your current bank EAR with each of the three alternative accounts. Be careful not to round any intermediate steps less than six decimal places) If you deposit $1 into a bank account that pays 4.7% per year for three years: The amount you will receive after three years is $. (Round to five decimal places.) Score: 0 of 1 pt 2 of 5 (0 complete HW Score: 0%, 0 of 5 pts P 5-12 (similar to) Question Help You have been accepted into college. The college guarantees that your tuition will not increase for the four years you attend college. The first 510.200 tuition payment is due in six months After that, the same payment is due every six months until you have made a total of eight payments. The college offers a bank account that allows you to withdraw money every six months and has a fixed APR of 44% (with semiannual compounding) guaranteed to remain the same over the next four years. How much money must you deposit today you intend to make no further deposits and would like to make all the tuition payments from this account, leaving the account empty when the last payment is made 7 (Note: Be careful not to round any Intermediate stops less than six decimal places.) The amount of money you must deposit today is (Round to the nearest cont.) Score: 0 of 1 pt 3 of 5 (0 complete HW Score: 0%, 0 of 5 pts P 5-17 (similar to) Question Help You have just taken out a $25,000 car loan with a 4% APR compounded monthly. The loan is for five years. When you make your first payment in one month, how much of the payment will go toward the principal of the loan and how much will go toward interest? (Note: Be careful not to round any informediate stops less than six decimal places) When you make your first payment, $will go toward the principal of the town and will go toward the interest (Round to the nearest port) Score: 0 of 1 pt 4 of 5 (0 complete HW Score: 0%, 0 of 5 pts P 5-21 (similar to) Question Help You have just sold your house for $1,100,000 in cash. Your mortgage was originally a 30-year mortgage with monthly payments and an initial balance of $800.000. The mortgage is currently exactly 18% years old, and you have just made a payment. If the interest rate on the mortgage is 6.25% (APR), how much cash will you have from the sale once you pay of the mortgage? (Note: Be careful not to round any intermediate steps less than six decimal places) Cash that remains after payoff of mortgage is $(Round to the nearest dollar)