Answered step by step

Verified Expert Solution

Question

1 Approved Answer

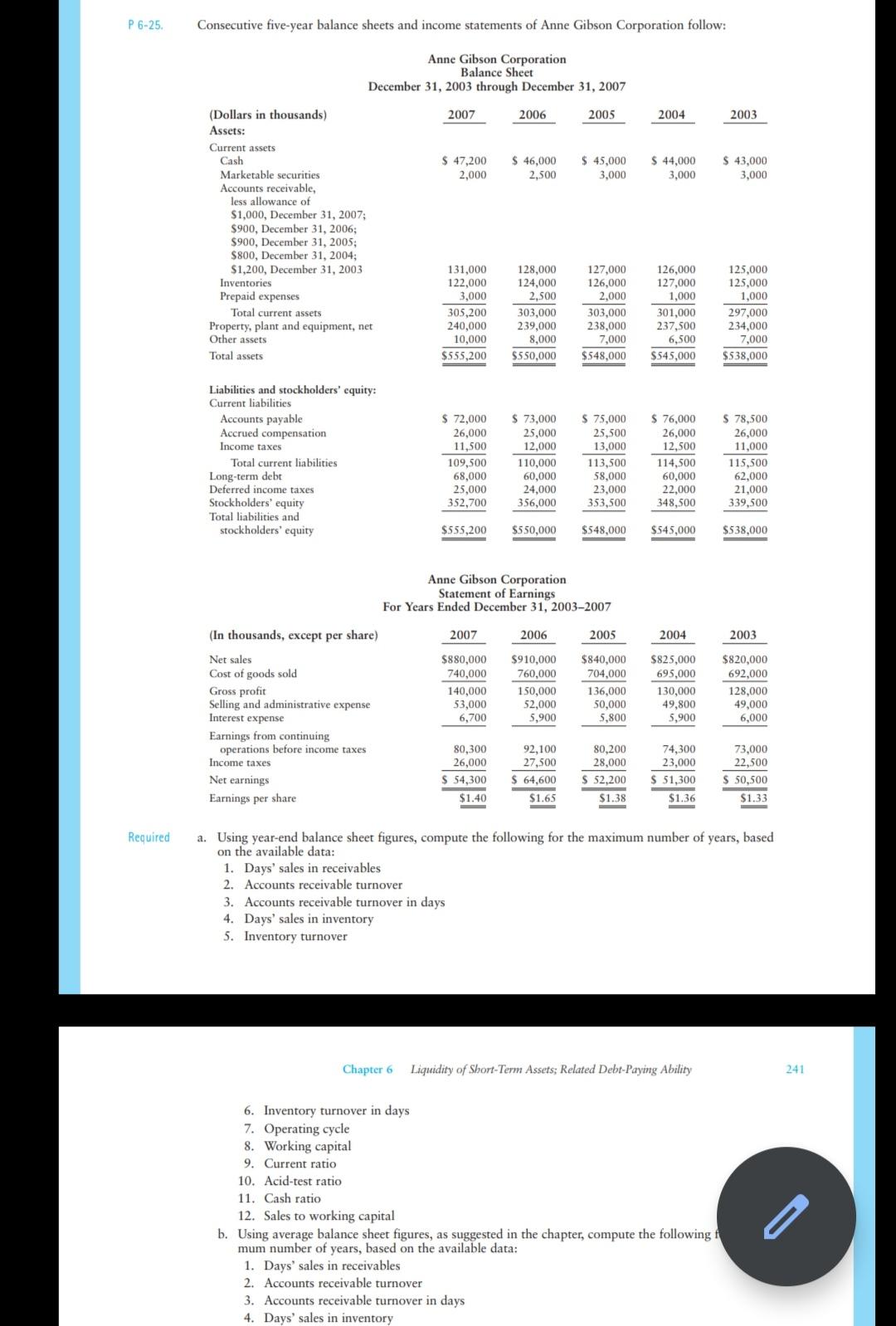

P 6-25. Consecutive five-year balance sheets and income statements of Anne Gibson Corporation follow: Anne Gibson Corporation Balance Sheet December 31, 2003 through December

P 6-25. Consecutive five-year balance sheets and income statements of Anne Gibson Corporation follow: Anne Gibson Corporation Balance Sheet December 31, 2003 through December 31, 2007 (Dollars in thousands) 2007 2006 2005 2004 2003 Assets: Current assets $ 47,200 $ 44,000 3,000 $ 46,000 $ 45,000 3,000 Cash $ 43,000 Marketable securities 2,000 2,500 3,000 Accounts receivable, less allowance of $1,000, December 31, 2007; $900, December 31, 2006; $900, December 31, 2005; $800, December 31, 2004; $1,200, December 31, 2003 Inventories 128,000 131,000 122,000 3,000 127,000 126,000 2,000 126,000 125,000 127,000 1,000 125,000 1,000 124,000 Prepaid expenses 2,500 Total current assets 305,200 240,000 10,000 303,000 Property, plant and equipment, net Other assets 239,000 8,000 303,000 238,000 7,000 301,000 237,500 6,500 297,000 234,000 7,000 Total assets $555,200 $550,000 $548,000 $545,000 $538,000 Liabilities and stockholders' equity: Current liabilities Accounts payable Accrued compensation Income taxes $ 72,000 $ 73,000 $ 75,000 $ 76,000 26,000 11,500 25,000 12,000 25,500 13,000 $ 78,500 26,000 11,000 Total current liabilities Long-term debt Deferred income taxes Stockholders' equity Total liabilities and stockholders' equity 113,500 58,000 23,000 353,500 26,000 12,500 114,500 60,000 22,000 348,500 109,500 68,000 25,000 352,700 110,000 60,000 24,000 356,000 115,500 62,000 21,000 339,500 $555,200 $550,000 $548,000 $545,000 $538,000 Anne Gibson Corporation Statement of Earnings For Years Ended December 31, 2003-2007 (In thousands, except per share) 2007 2006 2004 2005 2003 Net sales Cost of goods sold $825,000 695,000 $880,000 $910,000 $840,000 $820,000 740,000 760,000 704,000 692,000 Gross profit Selling and administrative expense Interest expense 140,000 53,000 6,700 150,000 52,000 5,900 136,000 130,000 50,000 5,800 128,000 49,000 6,000 49,800 5,900 Earnings from continuing operations before income taxes 80,300 26,000 92,100 27,500 80,200 28,000 74,300 23,000 73,000 22,500 Income taxes Net earnings $ 54,300 $ 64,600 S 52,200 $ 51,300 $ 50,500 Earnings per share $1.40 $1.65 $1.38 $1,36 $1,33 Required a. Using year-end balance sheet figures, compute the following for the maximum number of years, based on the available data: 1. Days' sales in receivables 2. Accounts receivable turnover 3. Accounts receivable turnover in days 4. Days' sales in inventory 5. Inventory turnover Chapter 6 Liquidity of Short-Term Assets; Related Debt-Paying Ability 241 6. Inventory turnover in days 7. Operating cycle 8. Working capital 9. Current ratio 10. Acid-test ratio 11. Cash ratio 12. Sales to working capital b. Using average balance sheet figures, as suggested in the chapter, compute the following f mum number of years, based on the available data: 1. Days' sales in receivables 2. Accounts receivable turnover 3. Accounts receivable turnover in days 4. Days' sales in inventory

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer a 1 Days Sales in Receivables Net Receivables Net Sales365 2009 131000 1000 5475 days 880000365 2008 128000 900 5170 days 910000365 2007 127000 900 5558 days 840000365 2006 126000 800 5610 days ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started