Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(p) An investor must choose what proportion of wealth to spend on each of two risky assets. Let the return to these two assets

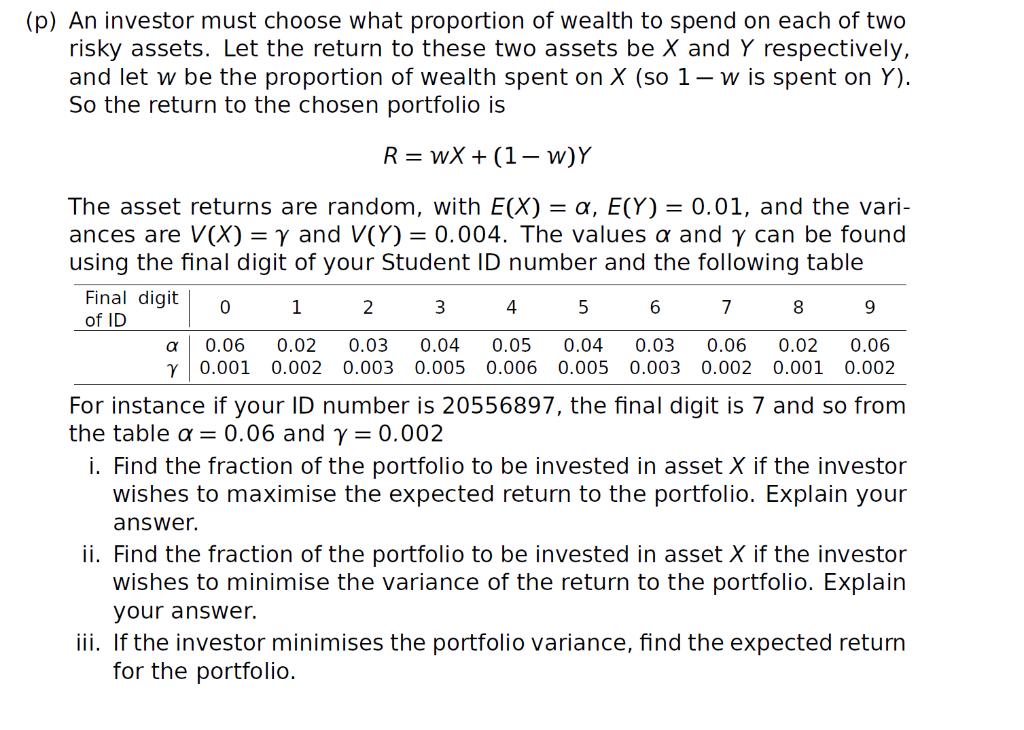

(p) An investor must choose what proportion of wealth to spend on each of two risky assets. Let the return to these two assets be X and Y respectively, and let w be the proportion of wealth spent on X (so 1- w is spent on Y). So the return to the chosen portfolio is R=WX + (1-w)Y The asset returns are random, with E(X) = a, E(Y) = 0.01, and the vari- ances are V(X) = y and V(Y) = 0.004. The values a and y can be found using the final digit of your Student ID number and the following table Final digit 0 of ID 1 0.06 0.02 Y 0.001 0.002 9 2 3 4 5 6 7 8 0.03 0.04 0.05 0.04 0.03 0.06 0.02 0.06 0.003 0.005 0.006 0.005 0.003 0.002 0.001 0.002 For instance if your ID number is 20556897, the final digit is 7 and so from the table a = 0.06 and y = 0.002 i. Find the fraction of the portfolio to be invested in asset X if the investor wishes to maximise the expected return to the portfolio. Explain your answer. ii. Find the fraction of the portfolio to be invested in asset X if the investor wishes to minimise the variance of the return to the portfolio. Explain your answer. iii. If the investor minimises the portfolio variance, find the expected return for the portfolio.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer the questions we need to consider the expected return and variance of the portfolio for di...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started