Answered step by step

Verified Expert Solution

Question

1 Approved Answer

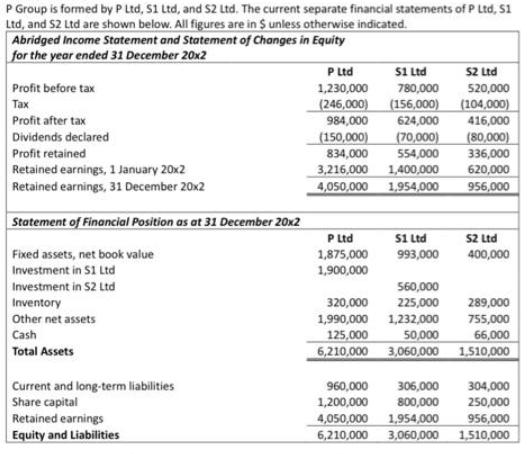

P Group is formed by P Ltd, S1 Ltd, and 52 Ltd. The current separate financial statements of P Ltd, 51 Ltd, and 52

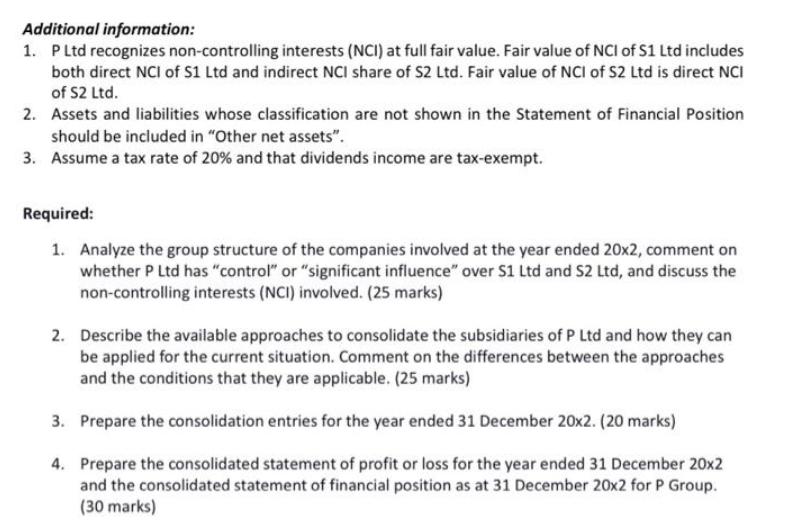

P Group is formed by P Ltd, S1 Ltd, and 52 Ltd. The current separate financial statements of P Ltd, 51 Ltd, and 52 Ltd are shown below. All figures are in $ unless otherwise indicated. Abridged Income Statement and Statement of Changes in Equity for the year ended 31 December 20x2 Profit before tax Tax Profit after tax Dividends declared Profit retained Retained earnings, 1 January 20x2 Retained earnings, 31 December 20x2 Statement of Financial Position as at 31 December 20x2 Fixed assets, net book value Investment in S1 Ltd Investment in 52 Ltd Inventory Other net assets Cash Total Assets Current and long-term liabilities Share capital Retained earnings Equity and Liabilities P Ltd 51 Ltd 1,230,000 780,000 (246,000) (156,000) 984,000 624,000 (150,000) (70,000) 834,000 554,000 3,216,000 1,400,000 4,050,000 1,954,000 P Ltd 1,875,000 1,900,000 $1 Ltd 993,000 560,000 225,000 1,232,000 52 Ltd 520,000 (104,000) 416,000 (80,000) 336,000 620,000 956,000 52 Ltd 400,000 320,000 289,000 1,990,000 755,000 125,000 50,000 66,000 6,210,000 3,060,000 1,510,000 960,000 306,000 304,000 1,200,000 800,000 250,000 4,050,000 1,954,000 956,000 6,210,000 3,060,000 1,510,000 Information regarding the acquisition of S1 Ltd and 52 Ltd are as follows: 51 Ltd 1 Jan 20x1 90% Date of acquisition by immediate parent Percentage acquired by P Ltd Percentage acquired by $1 Ltd Shareholders' equity at date of acquisition by immediate parent Share capital Retained earnings 800,000 1,015,000 1,815,000 52 Ltd 1 Jan 20x0 200,000 60% 250,000 500,000 750,000 Retained earnings of S2 Ltd at 1 January 20x1 550,000 Fair value of NCI at 1 January 20x1 450,000 Fair value of NCI at 1 January 20x0 350,000 The fair value of identifiable net assets of S1 Ltd and 52 Ltd were close to book value at both date of acquisition, except for a fixed asset of 52 Ltd. The book value and fair value of the fixed asset were $600,000 and $700,000, respectively, as at 1 January 20x0, and were $500,000 and $800,000, respectively, as at 1 January 20x1. The estimated useful life of the fixed asset was 5 years at 1 January 20x1 with no residual value. Additional information: 1. P Ltd recognizes non-controlling interests (NCI) at full fair value. Fair value of NCI of S1 Ltd includes both direct NCI of S1 Ltd and indirect NCI share of S2 Ltd. Fair value of NCI of S2 Ltd is direct NCI of S2 Ltd. 2. Assets and liabilities whose classification are not shown in the Statement of Financial Position should be included in "Other net assets". 3. Assume a tax rate of 20% and that dividends income are tax-exempt. Required: 1. Analyze the group structure of the companies involved at the year ended 20x2, comment on whether P Ltd has "control" or "significant influence" over S1 Ltd and S2 Ltd, and discuss the non-controlling interests (NCI) involved. (25 marks) 2. Describe the available approaches to consolidate the subsidiaries of P Ltd and how they can be applied for the current situation. Comment on the differences between the approaches and the conditions that they are applicable. (25 marks) 3. Prepare the consolidation entries for the year ended 31 December 20x2. (20 marks) 4. Prepare the consolidated statement of profit or loss for the year ended 31 December 20x2 and the consolidated statement of financial position as at 31 December 20x2 for P Group. (30 marks)

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 P Ltd has control over both 1 Ltd and 2 Ltd because it has a majority shareholding in both companies P Ltd also has the power to appoint and remove the majority of the board of directors of both com...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started