Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P t =(D t+1 )/(1+rp+rf)+(E t P t+1 )/(1+rp+rf) assume the log (E(x))=E(log(x)) and assume no dividends are paid out. Derive a mathematical expression that

Pt=(Dt+1)/(1+rp+rf)+(EtPt+1)/(1+rp+rf)

Pt=(Dt+1)/(1+rp+rf)+(EtPt+1)/(1+rp+rf)

assume the log (E(x))=E(log(x)) and assume no dividends are paid out. Derive a mathematical expression that describes the evolution of (log) stock prices over time. Describe in words the behavior of log stock prices. Can you tell whether stock prices at time t will go up or down if the economy booms in period t+3? Show why or why not.

Pt= price of stock at time t

Dt+1 = dividend payment at time t+1

rp= risk premium

rf= risk free rate (treasury rate)

EtP t+1= expected price of stock at period t+1

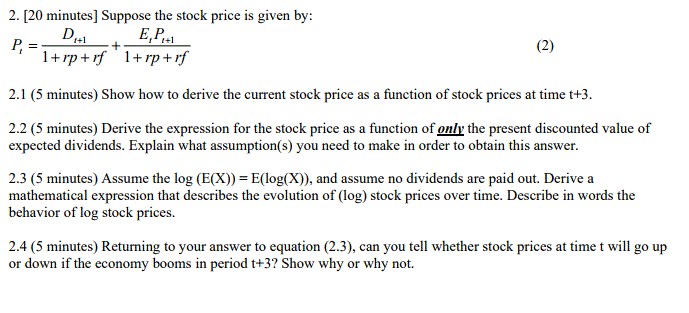

2. [20 minutes] Suppose the stock price is given by: Dr.1 2.1 (5 minutes) Show how to derive the current stock price as a function of stock prices at time t+3 2.2 (5 minutes) Derive the expression for the stock price as a function of only the present discounted value of expected dividends. Explain what assumption(s) you need to make in order to obtain this answer. 2.3 (5 minutes) Assume the log (E(X)) = E(log(X), and assume no dividends are paid out. Derive a mathematical expression that describes the evolution of (log) stock prices over time. Describe in words the behavior of log stock prices 2.4 (5 minutes) Returning to your answer to equation (2.3), can you tell whether stock prices at time t will go up or down if the economy booms in period t+3? Show why or why not 2. [20 minutes] Suppose the stock price is given by: Dr.1 2.1 (5 minutes) Show how to derive the current stock price as a function of stock prices at time t+3 2.2 (5 minutes) Derive the expression for the stock price as a function of only the present discounted value of expected dividends. Explain what assumption(s) you need to make in order to obtain this answer. 2.3 (5 minutes) Assume the log (E(X)) = E(log(X), and assume no dividends are paid out. Derive a mathematical expression that describes the evolution of (log) stock prices over time. Describe in words the behavior of log stock prices 2.4 (5 minutes) Returning to your answer to equation (2.3), can you tell whether stock prices at time t will go up or down if the economy booms in period t+3? Show why or why notStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started