Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P1 Liability comparisonsNerissa Smith has invested $47,000 in Northeast Productions Company. The firm has recently declared bankruptcy and has $108,000 in unpaid debts. Explain the

P1 Liability comparisonsNerissa Smith has invested $47,000 in Northeast Productions Company. The firm has recently declared bankruptcy and has $108,000 in unpaid debts. Explain the nature of Nerissas personal liability, if any, in each of the following situations

| 1. Northeast Production Company is a sole proprietorship owned by Ms. Smith. | ||||||||||

| 2. Northeast Production Company is a 5050 general partnership of Nerissa Smith and Roger Brown. | ||||||||||

| 3. Northeast Production Company is a limited partnership where Nerissa Smith is a limited partner. | ||||||||||

| 4. Northeast Production Company is a corporation. | ||||||||||

| P2 Accrual income versus cash flow for a periodThomas Book Sales, Inc., supplies textbooks to college and university bookstores. The books are shipped with a proviso that they must be paid for within 30 days. For simplicity, assume there are no returns and no bad debts (i.e., bookstores pay on time). This year, Thomas shipped and billed book titles totaling $760,000. Collections during the year totaled $690,000. The company spent $300,000 acquiring the books it shipped. | ||||||||||

| 1. Using accrual accounting and the preceding values, show the firms net profit for the past year. | ||||||||||

| 2. Using cash accounting and the preceding values, show the firms net cash flow for the past year. | ||||||||||

| 3. Explain why the accrual and cash accounting methods show different net profits. | ||||||||||

| How do the two profit figures provide different information to the financial manager? | ||||||||||

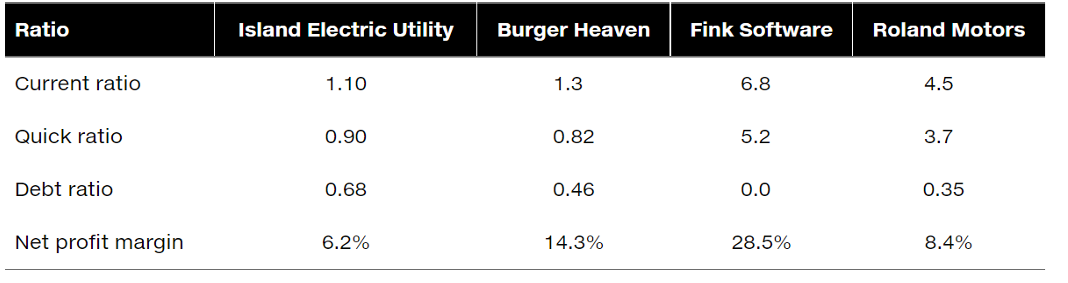

| P3 Ratio comparisons Robert Arias recently inherited a stock portfolio from his uncle. Wishing to learn more about the companies in which he is now invested, Robert performs a ratio analysis on each one and decides to compare them to one another. Some of his ratios are listed below. | ||||||||||

|

| ||||||||||

| Roberts uncle was a wise investor who assembled the portfolio with care, but Robert finds the wide | ||||||||||

| differences in these ratios confusing. Help him out. | ||||||||||

| 1. What problems might Robert encounter in comparing these companies to one another on the | ||||||||||

| basis of their ratios? | ||||||||||

| 2. Why might the current and quick ratios for the electric utility and the fast-food stock be so much | ||||||||||

| lower than the same ratios for the other companies? | ||||||||||

| 3. Why might it be all right for the electric utility to carry a large amount of debt, but not the | ||||||||||

| software company? | ||||||||||

| 4. Why wouldnt investors invest all their money in software companies instead of in less profitable | ||||||||||

| companies? (Hint: Focus on risk and return.) | ||||||||||

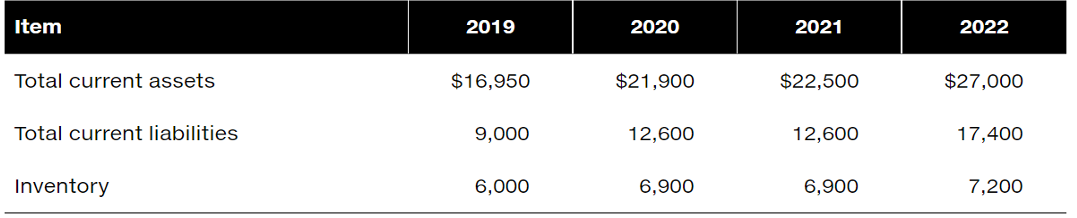

| P4 Liquidity management Bauman Companys total current assets, total current liabilities, and | ||||||||||

| inventory for each of the past four years follow: | ||||||||||

|

| ||||||||||

| 1. Calculate the firms current and quick ratios for each year. Compare the resulting time series | ||||||||||

| for these measures of liquidity. | ||||||||||

| 2. Comment on the firms liquidity over the 20192022 period. | ||||||||||

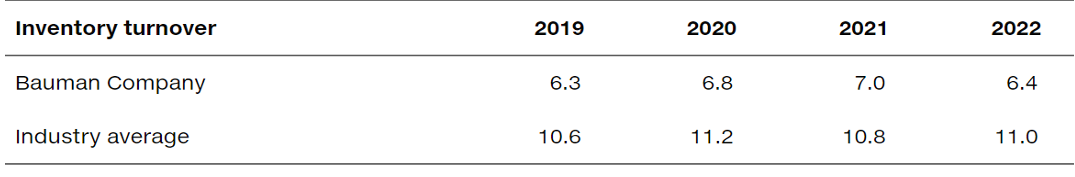

| 3. If you were told that Bauman Companys inventory turnover for each year in the 20192022 | ||||||||||

| period and the industry averages were as follows, would this information support or conflict with | ||||||||||

| your evaluation in part b? Why? | ||||||||||

|

| ||||||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started