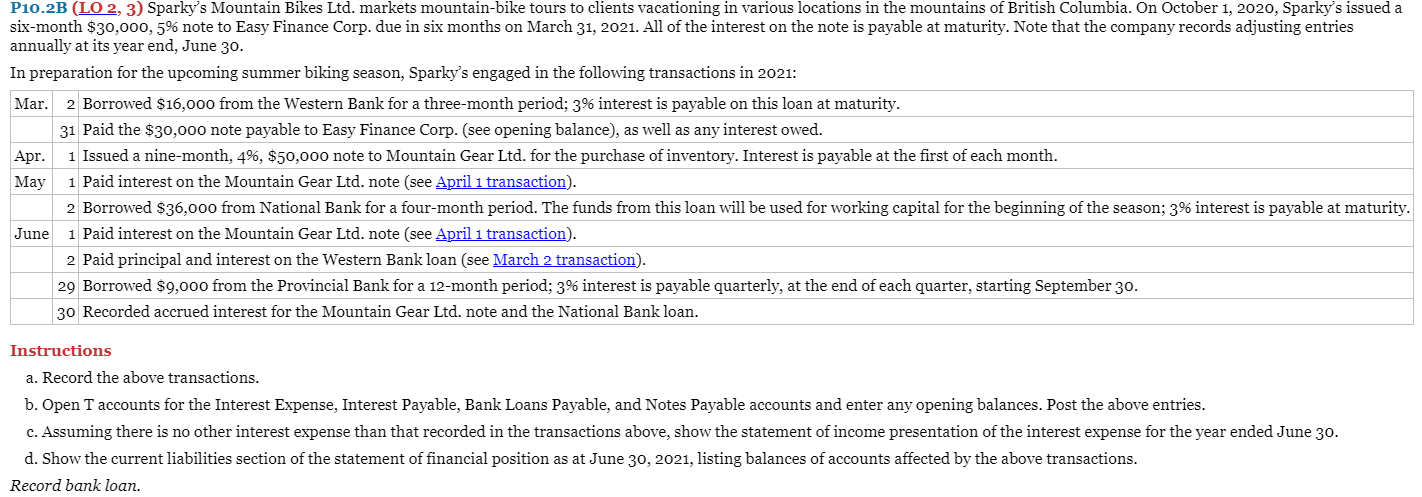

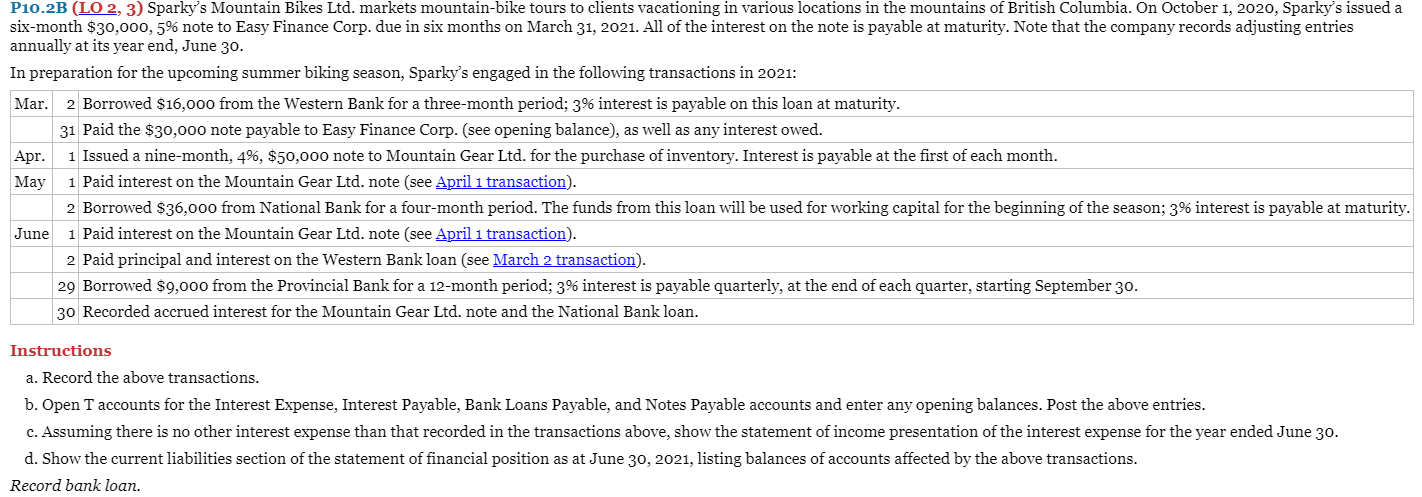

P10.2B (LO 2, 3) Sparky's Mountain Bikes Ltd. markets mountain-bike tours to clients vacationing in various locations in the mountains of British Columbia. On October 1, 2020, Sparky's issued a six-month $30,000, 5% note to Easy Finance Corp. due in six months on March 31, 2021. All of the interest on the note is payable at maturity. Note that the company records adjusting entries annually at its year end, June 30. In preparation for the upcoming summer biking season, Sparky's engaged in the following transactions in 2021: Mar. 2 Borrowed $16,000 from the Western Bank for a three-month period; 3% interest is payable on this loan at maturity. 31 Paid the $30,000 note payable to Easy Finance Corp. (see opening balance), as well as any interest owed. Apr. 1 Issued a nine-month, 4%, $50,000 note to Mountain Gear Ltd. for the purchase of inventory. Interest is payable at the first of each month. May 1 Paid interest on the Mountain Gear Ltd. note (see April 1 transaction). 2 Borrowed $36,000 from National Bank for a four-month period. The funds from this loan will be used for working capital for the beginning of the season; 3% interest is payable at maturity. June 1 Paid interest on the Mountain Gear Ltd. note (see April 1 transaction). 2 Paid principal and interest on the Western Bank loan (see March 2 transaction). 29 Borrowed $9,000 from the Provincial Bank for a 12-month period; 3% interest is payable quarterly, at the end of each quarter, starting September 30. 30 Recorded accrued interest for the Mountain Gear Ltd. note and the National Bank loan. Instructions a. Record the above transactions. b. Open T accounts for the Interest Expense, Interest Payable, Bank Loans Payable, and Notes Payable accounts and enter any opening balances. Post the above entries. c. Assuming there is no other interest expense than that recorded in the transactions above, show the statement of income presentation of the interest expense for the year ended June 30. d. Show the current liabilities section of the statement of financial position as at June 30, 2021, listing balances of accounts affected by the above transactions. Record bank loan