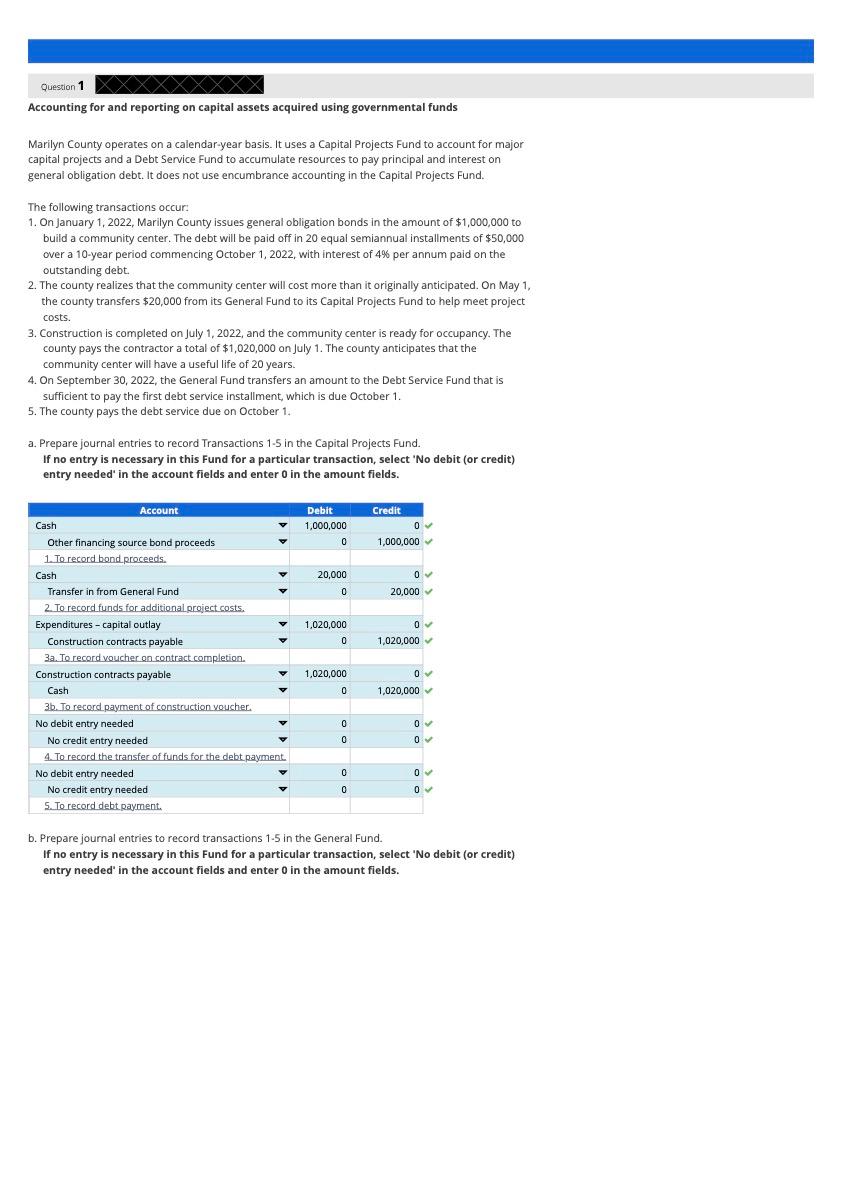

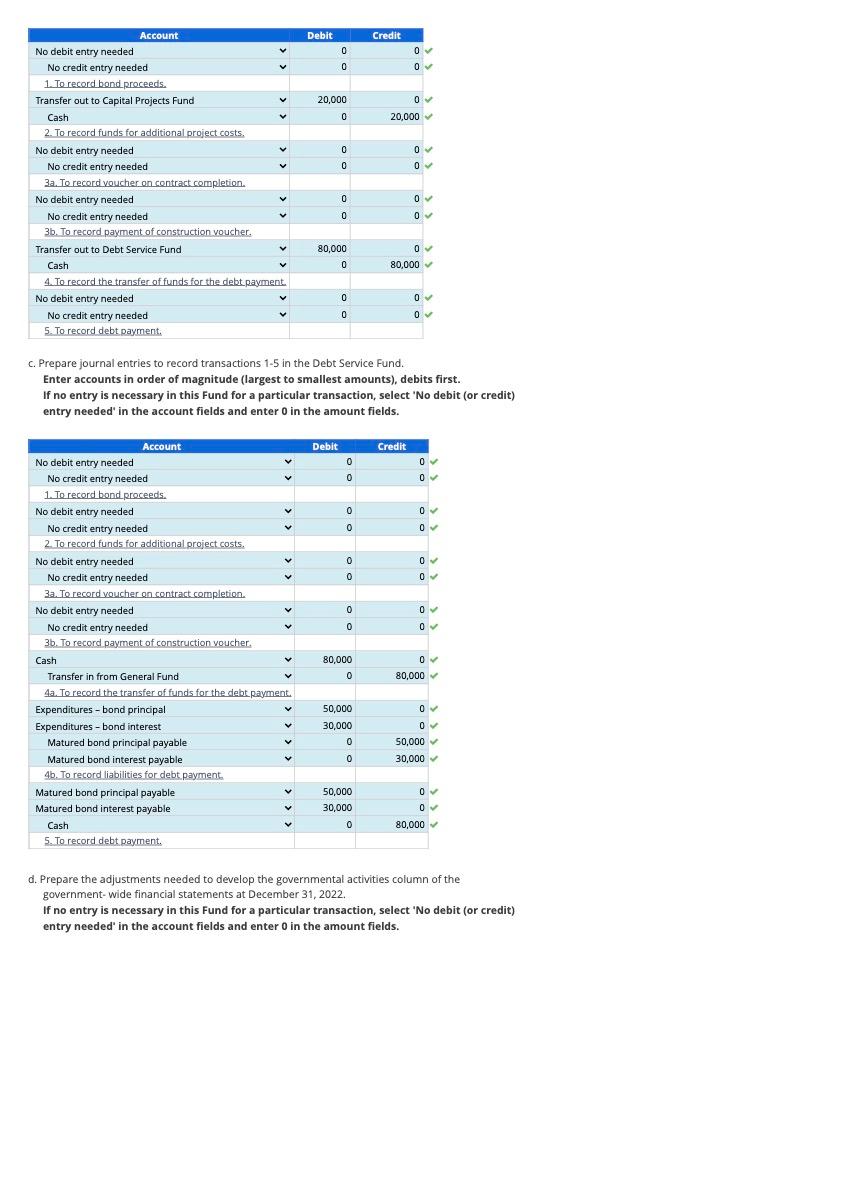

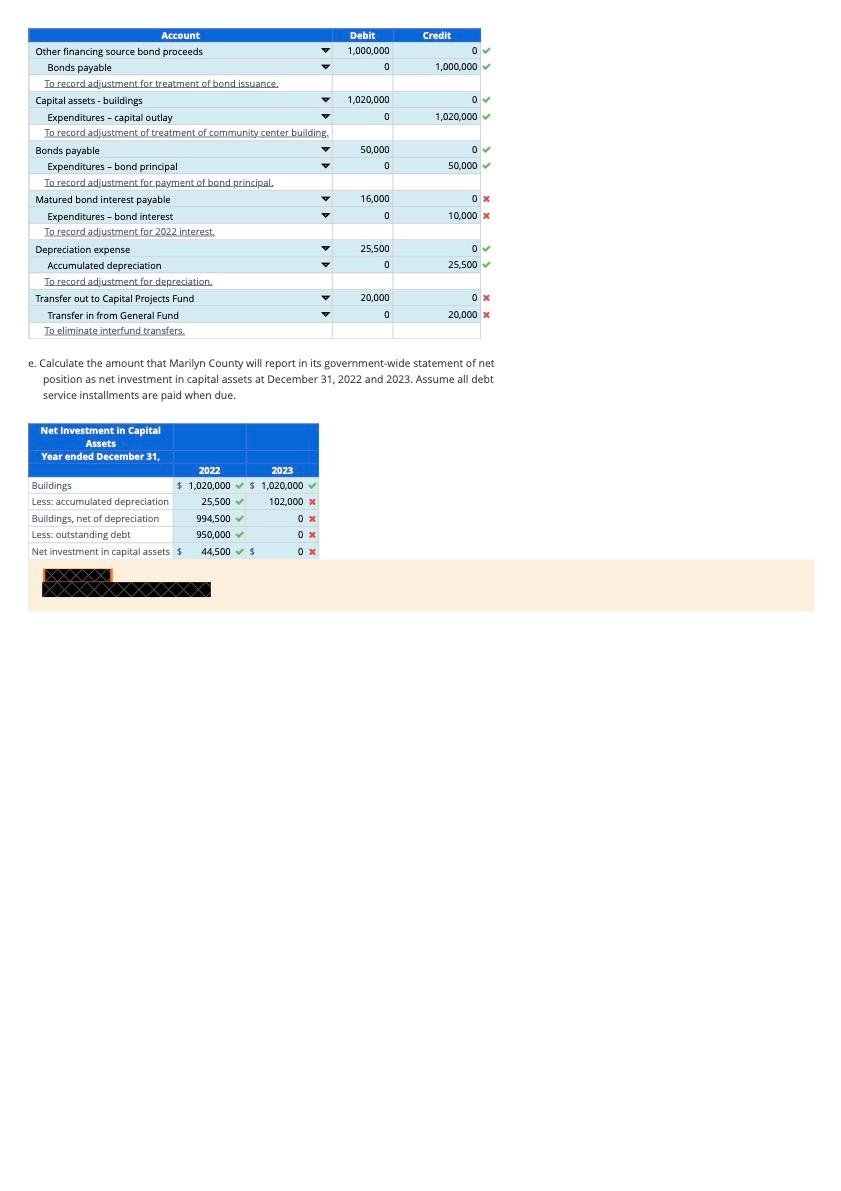

P10-42. (Accounting for and reporting on capital assets acquired using governmental funds) Marilyn County operates on a calendar-year basis. It uses a Capital Projects Fund to account for major capital projects and a Debt Service Fund to accumulate resources to pay principal and interest on general obligation debt. It does not use encumbrance accounting in the Capital Projects Fund. The following transactions occur:

1. On January 1, 2022, Marilyn County issues general obligation bonds in the amount of $1,000,000 to build a community center. The debt will be paid off in 20 equal semiannual installments of $50,000 over a 10-year period commencing October 1, 2022, with interest of 4 percent per annum paid on the outstanding debt.

2. The county realizes that the community center will cost more than it originally anticipated. On May 1, the county transfers $20,000 from its General Fund to its Capital Projects Fund to help meet project costs.

3. Construction is completed on July 1, 2022, and the community center is ready for occupancy. The county pays the contractor a total of $1,020,000 on July 1. The county anticipates that the community center will have a useful life of 20 years.

4. On September 30, 2022, the General Fund transfers an amount to the Debt Service Fund that is sufficient to pay the first debt service installment, which is due October 1.

5. The county pays the debt service due on October 1. Use the preceding information to do the following: a. Prepare journal entries to record these transactions in the Capital Projects Fund, the General Fund, and the Debt Service Fund. b. Prepare the adjustments needed to develop the governmental activities column of the government- wide financial statements at December 31, 2022. c. Calculate the amount that Marilyn County will report in its December 31, 2022, government-wide statement of net position as Net investment in capital assets. Also, assuming all debt service installments are paid when due in 2023, calculate the amount of Net investment in capital assets as of December 31, 2023.

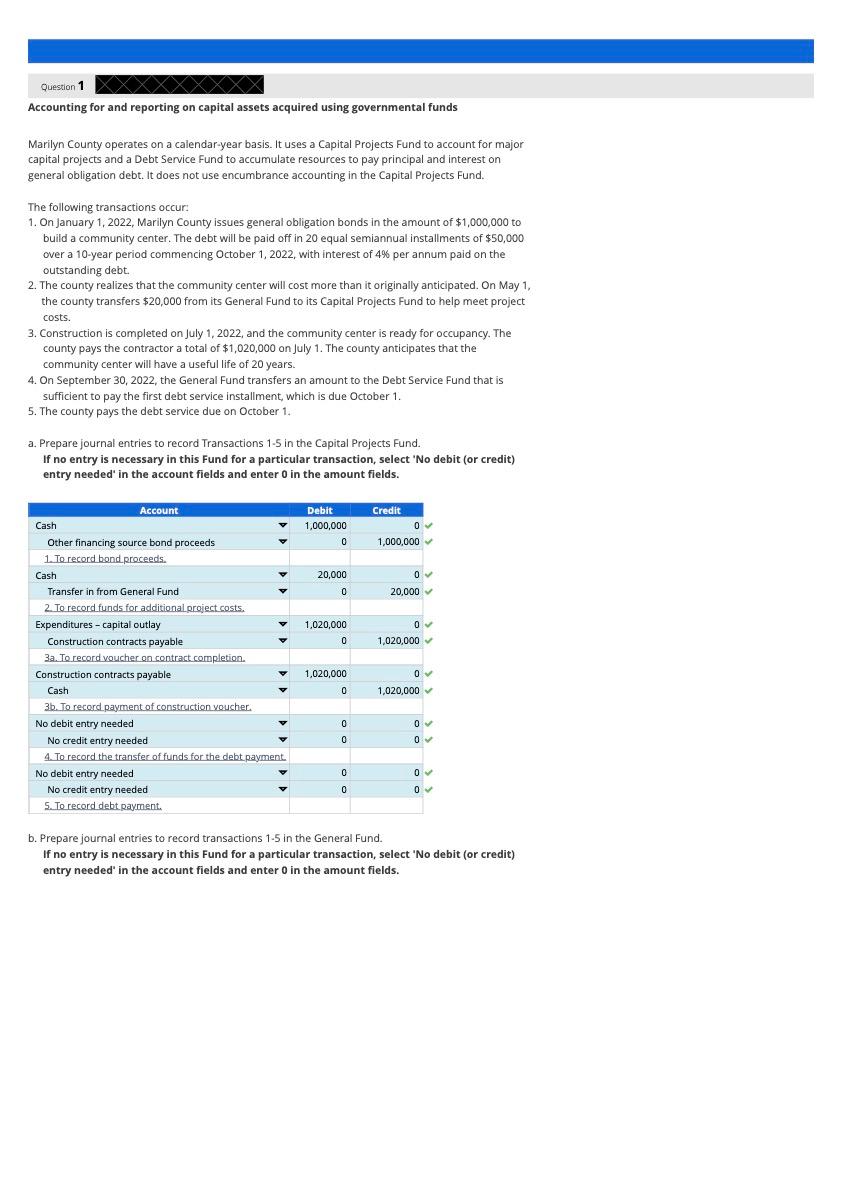

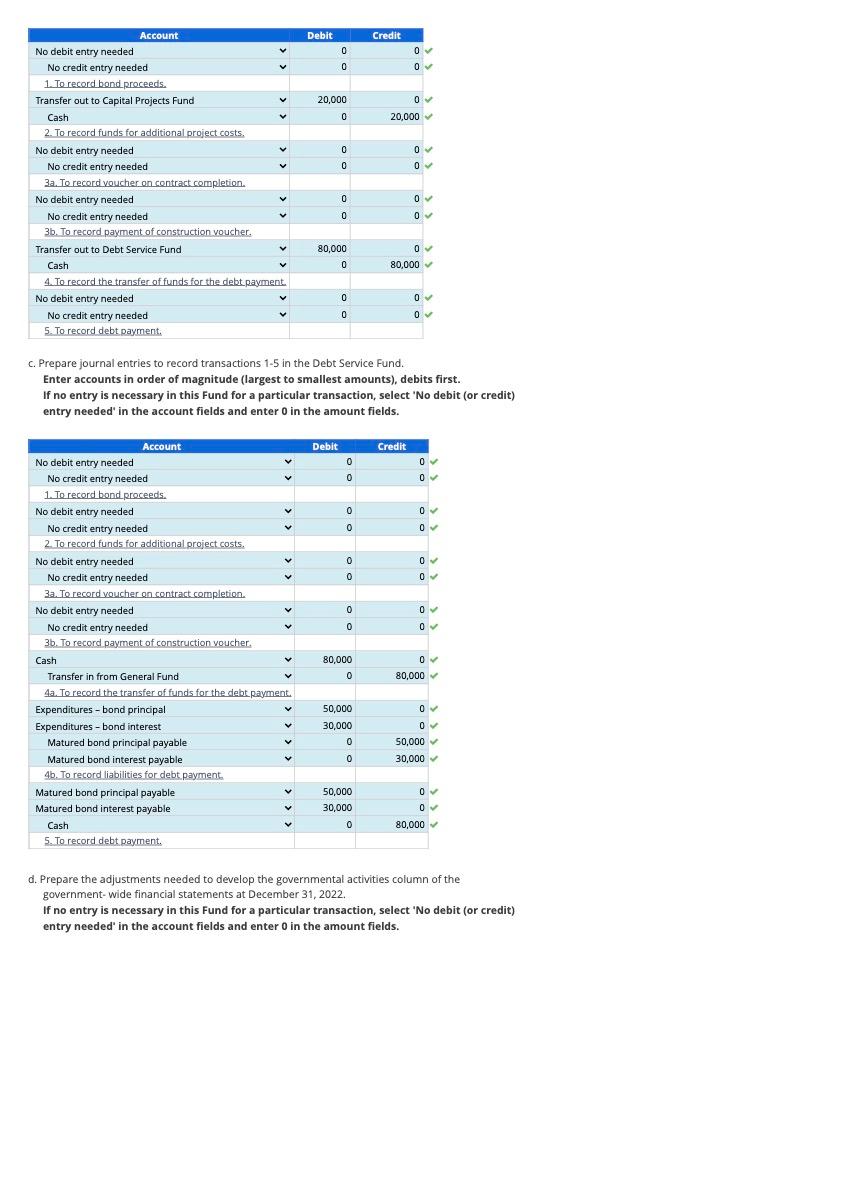

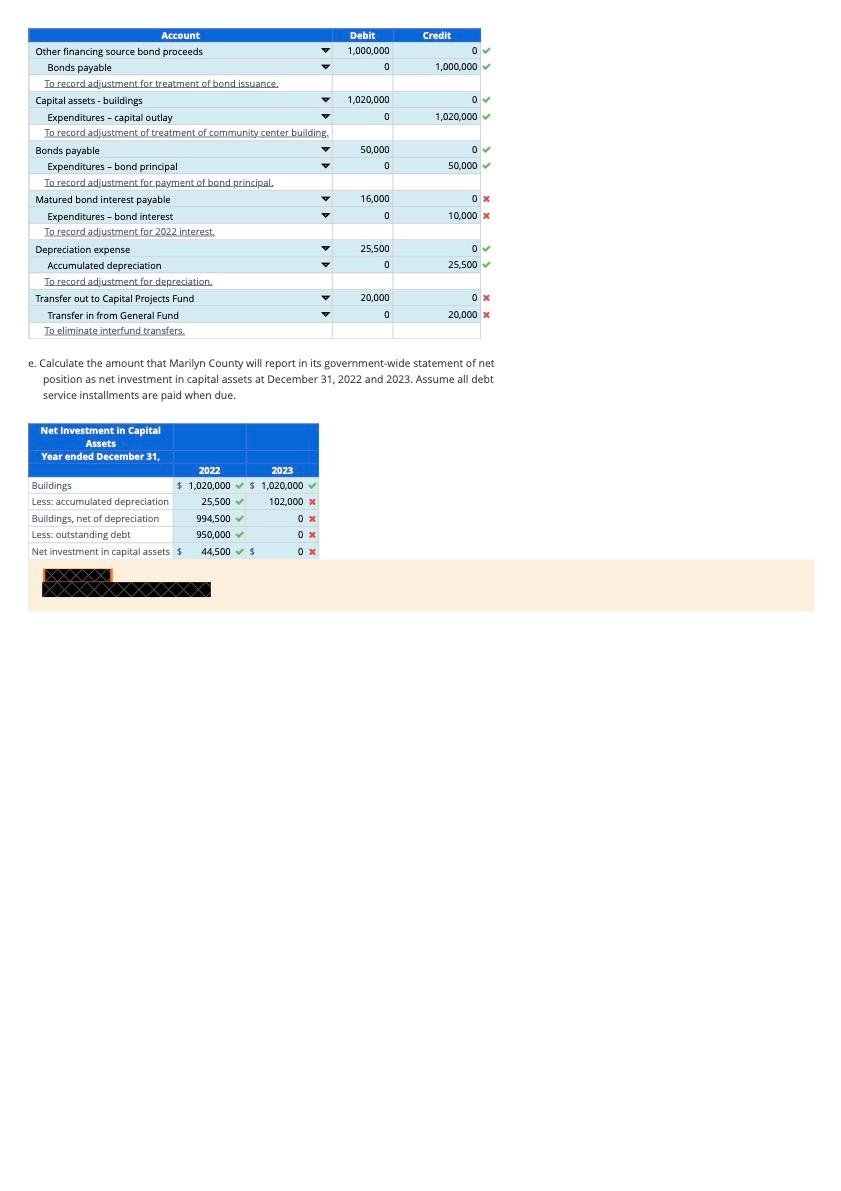

Accounting for and reporting on capital assets acquired using governmental funds Marilyn County operates on a calendar-year basis. It uses a Capital Projects Fund to account for major capital projects and a Debt Service Fund to accumulate resources to pay principal and interest on general obligation debt. It does not use encumbrance accounting in the Capital Projects Fund. The following transactions occur: 1. On January 1, 2022, Marilyn County issues general obligation bonds in the amount of $1,000,000 to build a community center. The debt will be paid off in 20 equal semiannual installments of $50,000 over a 10-year period commencing October 1,2022, with interest of 4% per annum paid on the outstanding debt. 2. The county realizes that the community center will cost more than it originally anticipated. On May 1 , the county transfers $20,000 from its General Fund to its Capital Projects Fund to help meet project costs. 3. Construction is completed on July 1,2022 , and the community center is ready for occupancy. The county pays the contractor a total of $1,020,000 on July 1 . The county anticipates that the community center will have a useful life of 20 years. 4. On September 30, 2022, the General Fund transfers an amount to the Debt Service Fund that is sufficient to pay the first debt service installment, which is due October 1 . 5. The county pays the debt service due on October 1. a. Prepare journal entries to record Transactions 1-5 in the Capital Projects Fund. If no entry is necessary in this Fund for a particular transaction, select 'No debit (or credit) entry needed' in the account fields and enter 0 in the amount fields. b. Prepare journal entries to record transactions 1.5 in the General Fund. If no entry is necessary in this Fund for a particular transaction, select 'No debit (or credit) entry needed' in the account fields and enter 0 in the amount fields. c. Prepare journal entries to record transactions 1-5 in the Debt Service Fund. Enter accounts in order of magnitude (largest to smallest amounts), debits first. If no entry is necessary in this Fund for a particular transaction, select 'No debit (or credit) entry needed' in the account fields and enter 0 in the amount fields. d. Prepare the adjustments needed to develop the governmental activities column of the government- wide financial statements at December 31, 2022. If no entry is necessary in this Fund for a particular transaction, select 'No debit (or credit) entry needed' in the account fields and enter 0 in the amount fields. e. Calculate the amount that Marilyn County will report in its government-wide statement of net position as net investment in capital assets at December 31, 2022 and 2023. Assume all debt service installments are paid when due. Accounting for and reporting on capital assets acquired using governmental funds Marilyn County operates on a calendar-year basis. It uses a Capital Projects Fund to account for major capital projects and a Debt Service Fund to accumulate resources to pay principal and interest on general obligation debt. It does not use encumbrance accounting in the Capital Projects Fund. The following transactions occur: 1. On January 1, 2022, Marilyn County issues general obligation bonds in the amount of $1,000,000 to build a community center. The debt will be paid off in 20 equal semiannual installments of $50,000 over a 10-year period commencing October 1,2022, with interest of 4% per annum paid on the outstanding debt. 2. The county realizes that the community center will cost more than it originally anticipated. On May 1 , the county transfers $20,000 from its General Fund to its Capital Projects Fund to help meet project costs. 3. Construction is completed on July 1,2022 , and the community center is ready for occupancy. The county pays the contractor a total of $1,020,000 on July 1 . The county anticipates that the community center will have a useful life of 20 years. 4. On September 30, 2022, the General Fund transfers an amount to the Debt Service Fund that is sufficient to pay the first debt service installment, which is due October 1 . 5. The county pays the debt service due on October 1. a. Prepare journal entries to record Transactions 1-5 in the Capital Projects Fund. If no entry is necessary in this Fund for a particular transaction, select 'No debit (or credit) entry needed' in the account fields and enter 0 in the amount fields. b. Prepare journal entries to record transactions 1.5 in the General Fund. If no entry is necessary in this Fund for a particular transaction, select 'No debit (or credit) entry needed' in the account fields and enter 0 in the amount fields. c. Prepare journal entries to record transactions 1-5 in the Debt Service Fund. Enter accounts in order of magnitude (largest to smallest amounts), debits first. If no entry is necessary in this Fund for a particular transaction, select 'No debit (or credit) entry needed' in the account fields and enter 0 in the amount fields. d. Prepare the adjustments needed to develop the governmental activities column of the government- wide financial statements at December 31, 2022. If no entry is necessary in this Fund for a particular transaction, select 'No debit (or credit) entry needed' in the account fields and enter 0 in the amount fields. e. Calculate the amount that Marilyn County will report in its government-wide statement of net position as net investment in capital assets at December 31, 2022 and 2023. Assume all debt service installments are paid when due