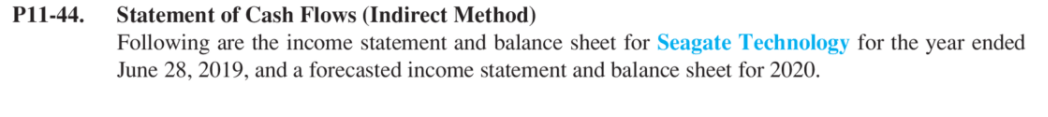

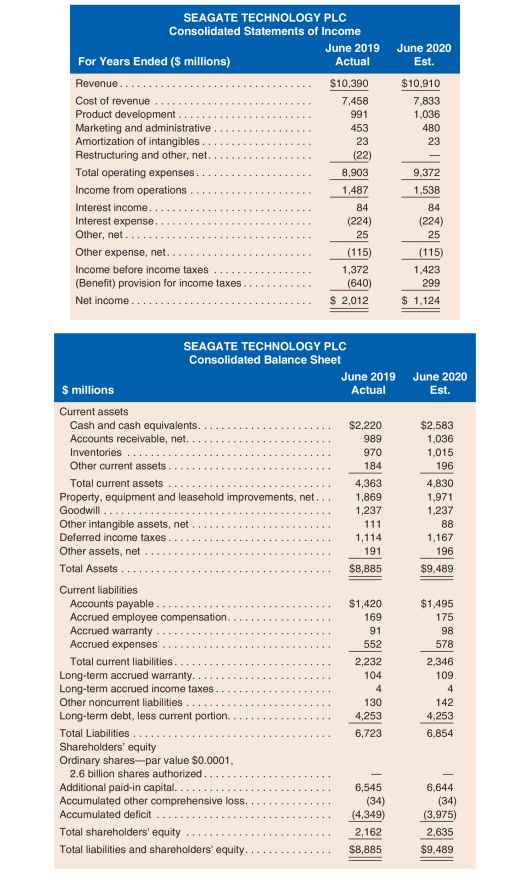

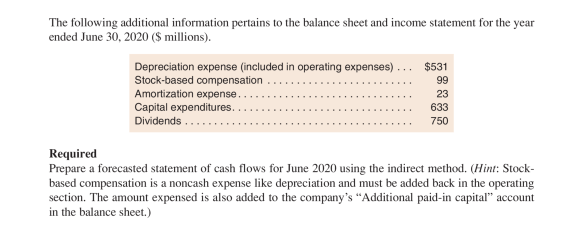

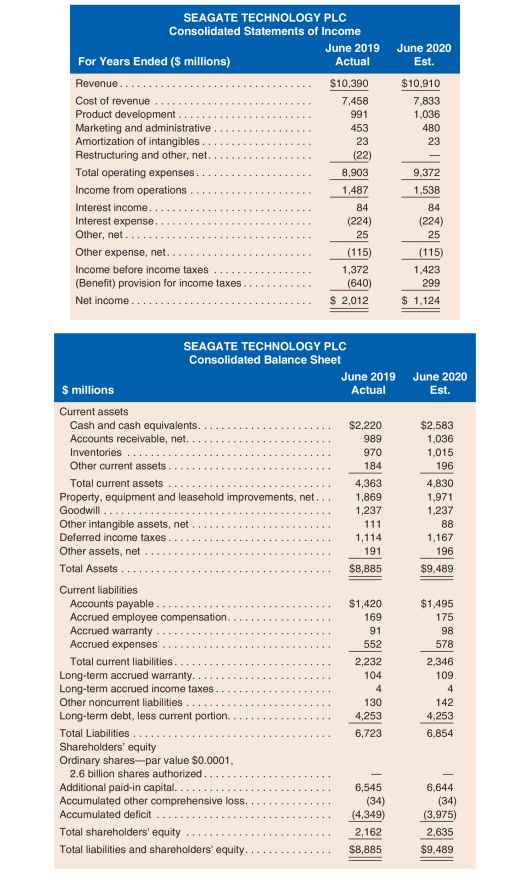

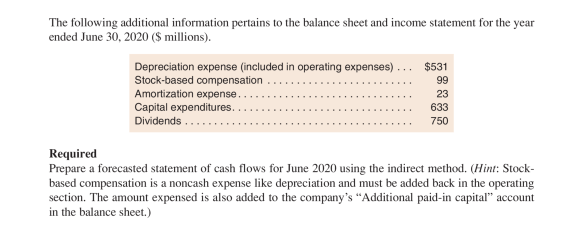

P11-44. Statement of Cash Flows (Indirect Method) Following are the income statement and balance sheet for Seagate Technology for the year ended June 28, 2019, and a forecasted income statement and balance sheet for 2020. SEAGATE TECHNOLOGY PLC Consolidated Statements of Income June 2019 June 2020 For Years Ended ($ millions) Actual Est. Revenue. $10,390 $10,910 Cost of revenue 7.458 7.833 Product development 991 1,036 Marketing and administrative 453 480 Amortization of intangibles. 23 23 Restructuring and other, net. (22) Total operating expenses.. 8,903 9,372 Income from operations 1,487 1,538 Interest income 84 84 Interest expense. (224) (224) Other, net... 25 25 Other expense, net... (115) (115) Income before income taxes 1,372 1,423 (Benefit) provision for income taxes (640) Net income.. $ 2,012 $ 1,124 0889*3499 299 June 2020 Est. $2,583 1,036 1,015 196 4,830 1,971 1.237 88 1,167 196 $9,489 SEAGATE TECHNOLOGY PLC Consolidated Balance Sheet June 2019 $ millions Actual Current assets Cash and cash equivalents. $2,220 Accounts receivable, net. 989 Inventories 970 Other current assets 184 Total current assets 4,363 Property, equipment and leasehold improvements, net... 1,869 Goodwill 1,237 Other intangible assets, net 111 Deferred income taxes. 1,114 Other assets, net 191 Total Assets $8,885 Current liabilities Accounts payable $1,420 Accrued employee compensation 169 Accrued warranty 91 Accrued expenses 552 Total current liabilities. 2,232 Long-term accrued warranty.. 104 Long-term accrued income taxes 4 Other noncurrent liabilities. 130 Long-term debt, less current portion. 4,253 Total Liabilities 6,723 Shareholders' equity Ordinary shares-par value $0.0001, 2.6 billion shares authorized.. Additional paid-in capital. 6,545 Accumulated other comprehensive loss, (34) Accumulated deficit. (4,349) Total shareholders' equity 2,162 Total liabilities shareholders' equity. $8,885 $1,495 175 98 578 2,346 109 4 142 4,253 6,854 6,644 (34) (3,975) 2,635 $9,489 The following additional information pertains to the balance sheet and income statement for the year ended June 30, 2020 ($ millions). Depreciation expense (included in operating expenses) Stock-based compensation Amortization expense. Capital expenditures. Dividends $531 99 23 633 750 Required Prepare a forecasted statement of cash flows for June 2020 using the indirect method. (Hint: Stock- based compensation is a noncash expense like depreciation and must be added back in the operating section. The amount expensed is also added to the company's Additional paid-in capital account in the balance sheet.)