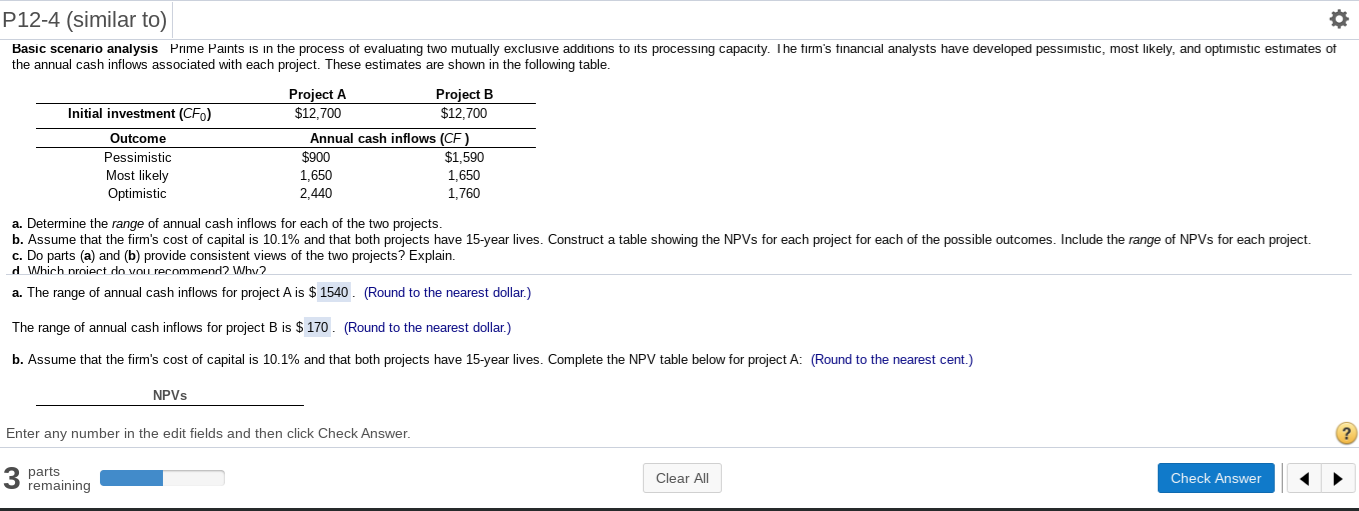

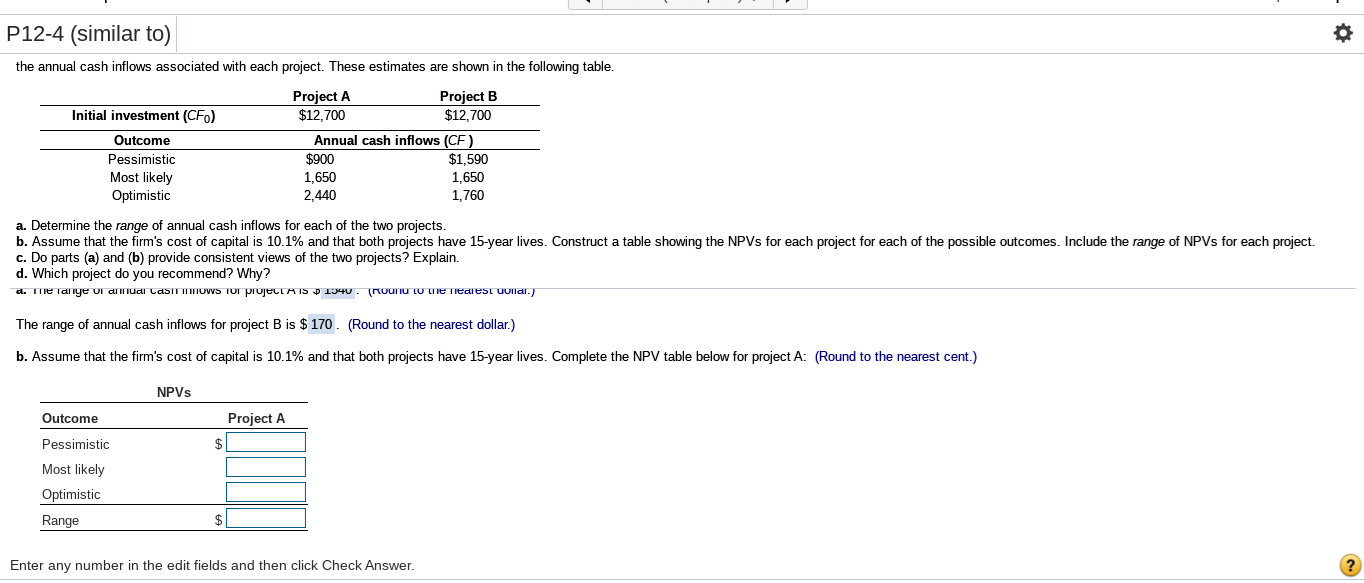

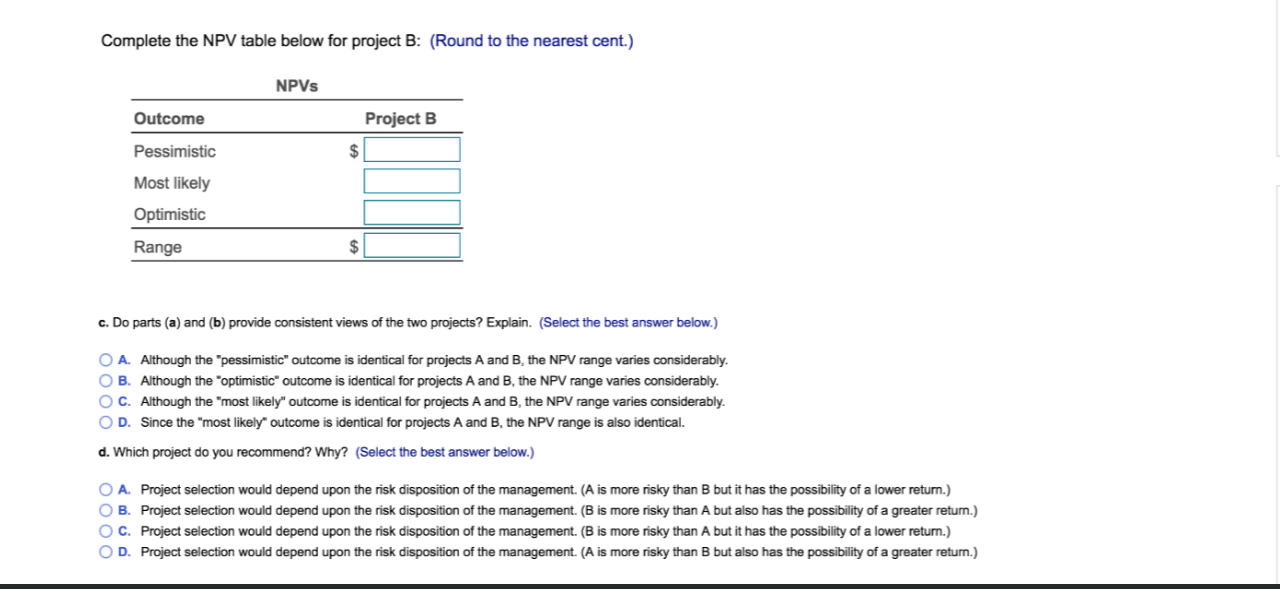

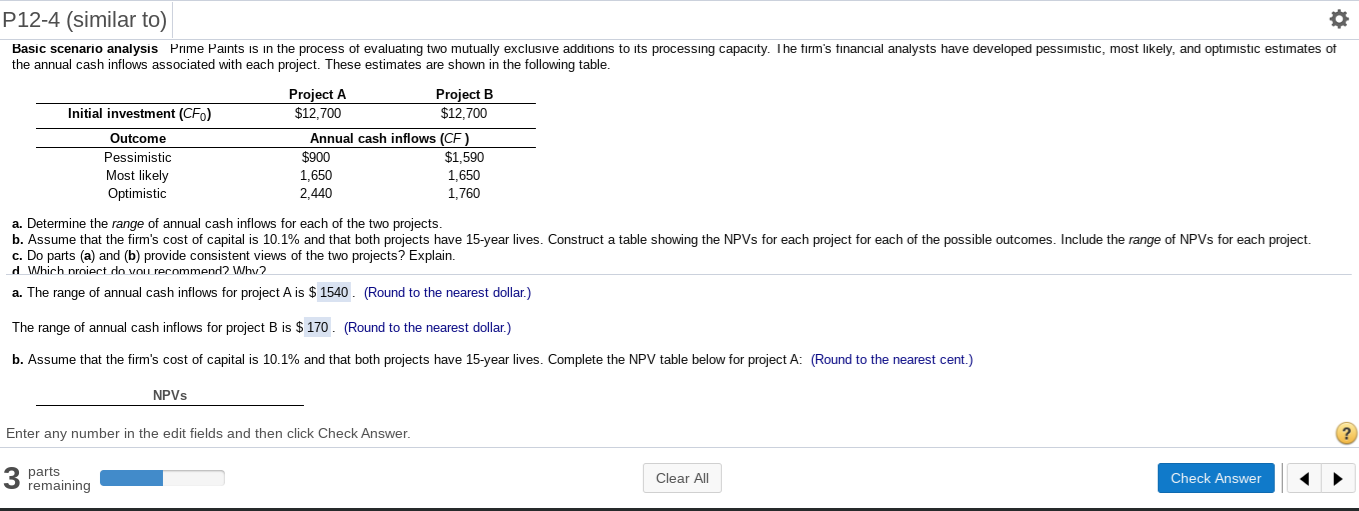

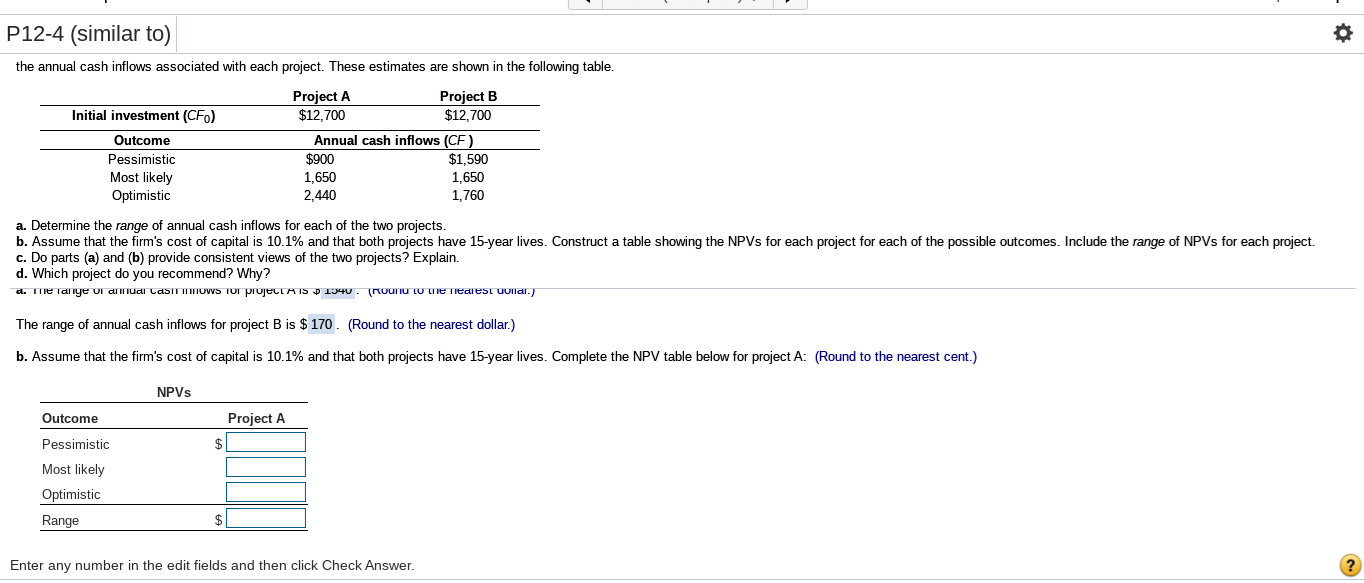

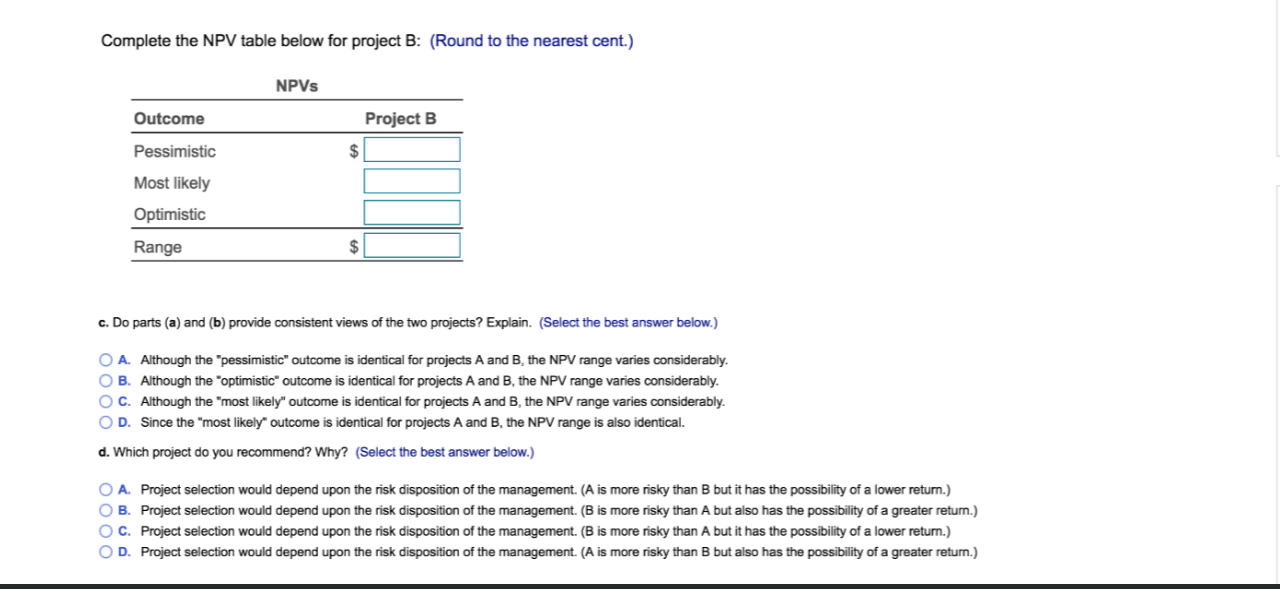

P12-4 (similar to) Basic scenario analysis Prime Paints is in the process of evaluating two mutually exclusive additions to its processing capacity. The firm's financial analysts have developed pessimistic, most likely, and optimistic estimates of the annual cash inflows associated with each project. These estimates are shown in the following table. Initial investment (CF) Outcome Pessimistic Most likely Optimistic Project A Project B $12,700 $12,700 Annual cash inflows (CF) $900 $1,590 1,650 1,650 2.440 1,760 a. Determine the range of annual cash inflows for each of the two projects. b. Assume that the firm's cost of capital is 10.1% and that both projects have 15-year lives. Construct a table showing the NPVs for each project for each of the possible outcomes. Include the range of NPVs for each project. c. Do parts (a) and (b) provide consistent views of the two projects? Explain. d Which nroiert do Vou recommend? Why? a. The range of annual cash inflows for project A is $ 1540. (Round to the nearest dollar.) The range of annual cash inflows for project B is $ 170. (Round to the nearest dollar.) b. Assume that the firm's cost of capital is 10.1% and that both projects have 15-year lives. Complete the NPV table below for project A: (Round to the nearest cent. NPVs Enter any number in the edit fields and then click Check Answer. 3 parts 3 remaining Clear All Check Answer P12-4 (similar to) the annual cash inflows associated with each project. These estimates are shown in the following table. Initial investment (CFO) Outcome Pessimistic Most likely Optimistic Project A Project B $12,700 $12,700 Annual cash inflows (CF) $900 $1,590 1,650 1,650 2,440 1,760 a. Determine the range of annual cash inflows for each of the two projects. b. Assume that the firm's cost of capital is 10.1% and that both projects have 15-year lives. Construct a table showing the NPVs for each project for each of the possible outcomes. Include the range of NPVs for each project. c. Do parts (a) and (b) provide consistent views of the two projects? Explain. d. Which project do you recommend? Why? d. The lange VI al nudi LASITI TUWS TUI prueLLAIS 1340. noun tu me Tiedest uuildi.) The range of annual cash inflows for project B is $ 170. (Round to the nearest dollar.) b. Assume that the firm's cost of capital is 10.1% and that both projects have 15-year lives. Complete the NPV table below for project A: (Round to the nearest cent.) NPVs Project A Outcome Pessimistic Most likely Optimistic Range Enter any number in the edit fields and then click Check Answer. Complete the NPV table below for project B: (Round to the nearest cent.) NPVS Outcome Project B Pessimistic Most likely Optimistic Range c. Do parts (a) and (b) provide consistent views of the two projects? Explain. (Select the best answer below.) O A. Although the "pessimistic" outcome is identical for projects A and B, the NPV range varies considerably. OB. Although the optimistic outcome is identical for projects A and B, the NPV range varies considerably. O C. Although the most likely" outcome is identical for projects A and B, the NPV range varies considerably. OD. Since the "most likely outcome is identical for projects A and B, the NPV range is also identical. d. Which project do you recommend? Why? (Select the best answer below.) O A. Project selection would depend upon the risk disposition of the management. (A is more risky than B but it has the possibility of a lower return.) O B. Project selection would depend upon the risk disposition of the management. (B is more risky than A but also has the possibility of a greater return.) OC. Project selection would depend upon the risk disposition of the management. (B is more risky than A but it has the possibility of a lower return.) OD. Project selection would depend upon the risk disposition of the management. (A is more risky than B but also has the possibility of a greater return.)