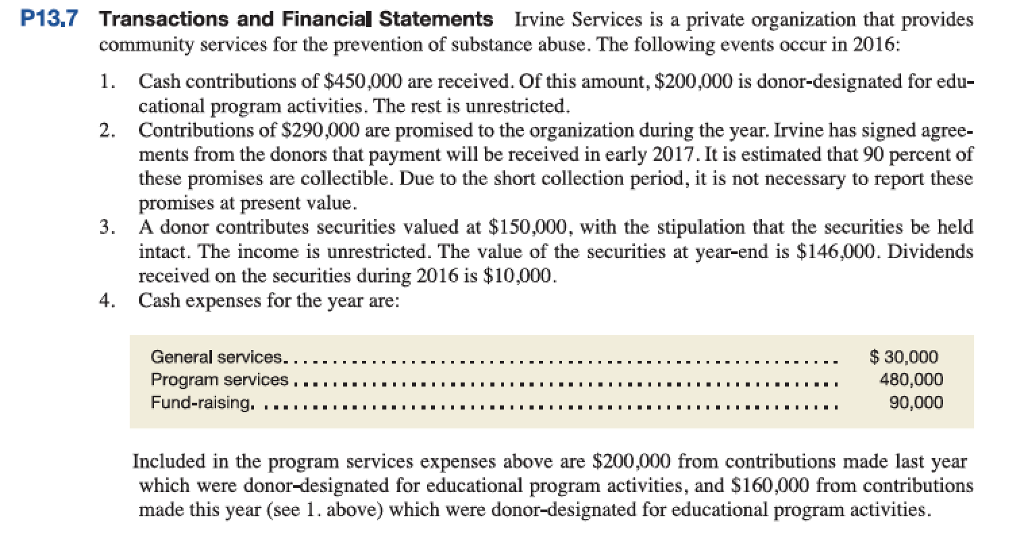

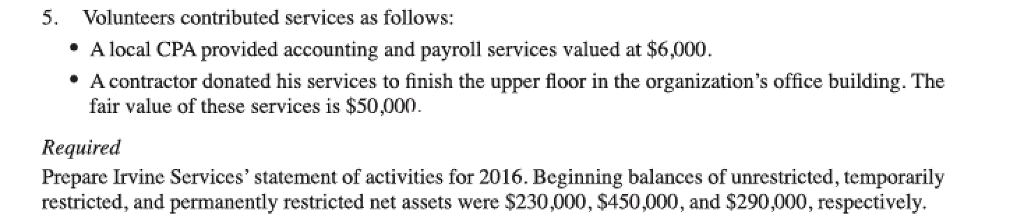

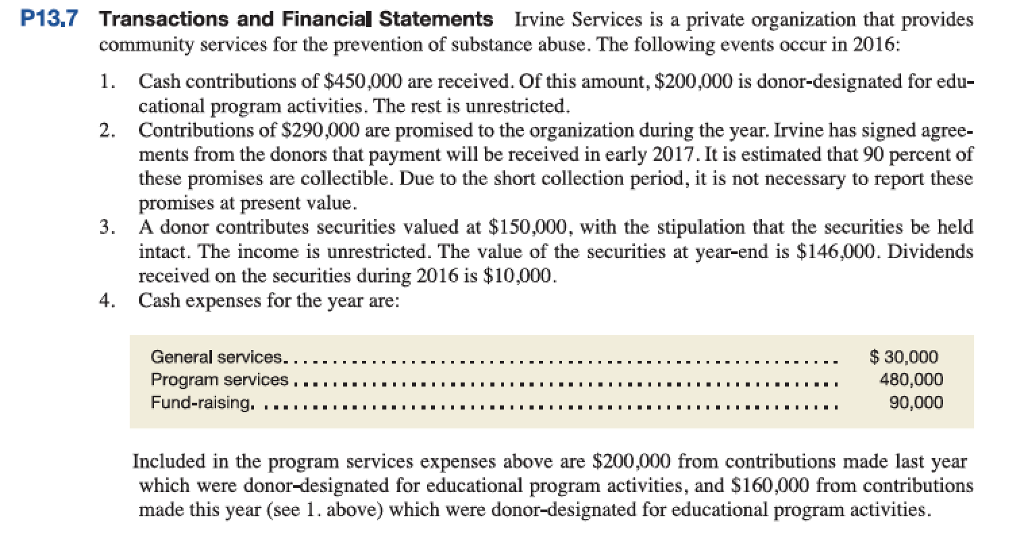

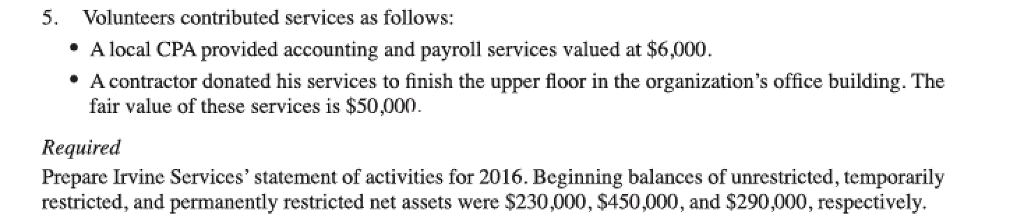

P13,7 Transactions and Financial Statements Irvine Services is a private organization that provides community services for the prevention of substance abuse. The following events occur in 2016: 1. 2. Cash contributions of $450,000 are received. Of this amount, $200,000 is donor-designated for edu- cational program activities. The rest is unrestricted Contributions of $290,000 are promised to the organization during the year. Irvine has signed agree- ments from the donors that payment will be received in early 2017. It is estimated that 90 percent of these promises are collectible. Due to the short collection period, it is not necessary to report these promises at present value. 3. A donor contributes securities valued at $150,000, with the stipulation that the securities be held intact. The income is unrestricted. The value of the securities at year-end is $146,000. Dividends received on the securities during 2016 is $10,000 Cash expenses for the year are: 4. $30,000 480,000 90,000 Included in the program services expenses above are $200,000 from contributions made last year which were donor-designated for educational program activities, and $160,000 from contributions made this year (see 1. above) which were donor-designated for educational program activities. P13,7 Transactions and Financial Statements Irvine Services is a private organization that provides community services for the prevention of substance abuse. The following events occur in 2016: 1. 2. Cash contributions of $450,000 are received. Of this amount, $200,000 is donor-designated for edu- cational program activities. The rest is unrestricted Contributions of $290,000 are promised to the organization during the year. Irvine has signed agree- ments from the donors that payment will be received in early 2017. It is estimated that 90 percent of these promises are collectible. Due to the short collection period, it is not necessary to report these promises at present value. 3. A donor contributes securities valued at $150,000, with the stipulation that the securities be held intact. The income is unrestricted. The value of the securities at year-end is $146,000. Dividends received on the securities during 2016 is $10,000 Cash expenses for the year are: 4. $30,000 480,000 90,000 Included in the program services expenses above are $200,000 from contributions made last year which were donor-designated for educational program activities, and $160,000 from contributions made this year (see 1. above) which were donor-designated for educational program activities