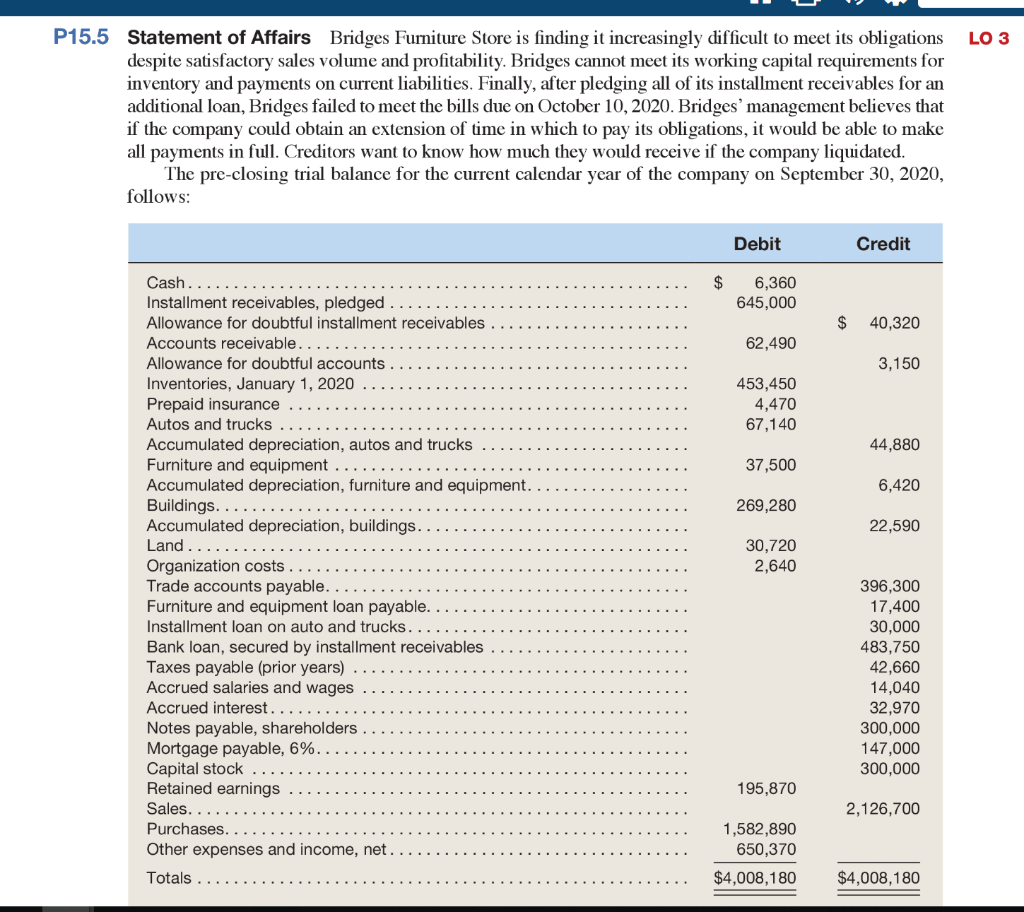

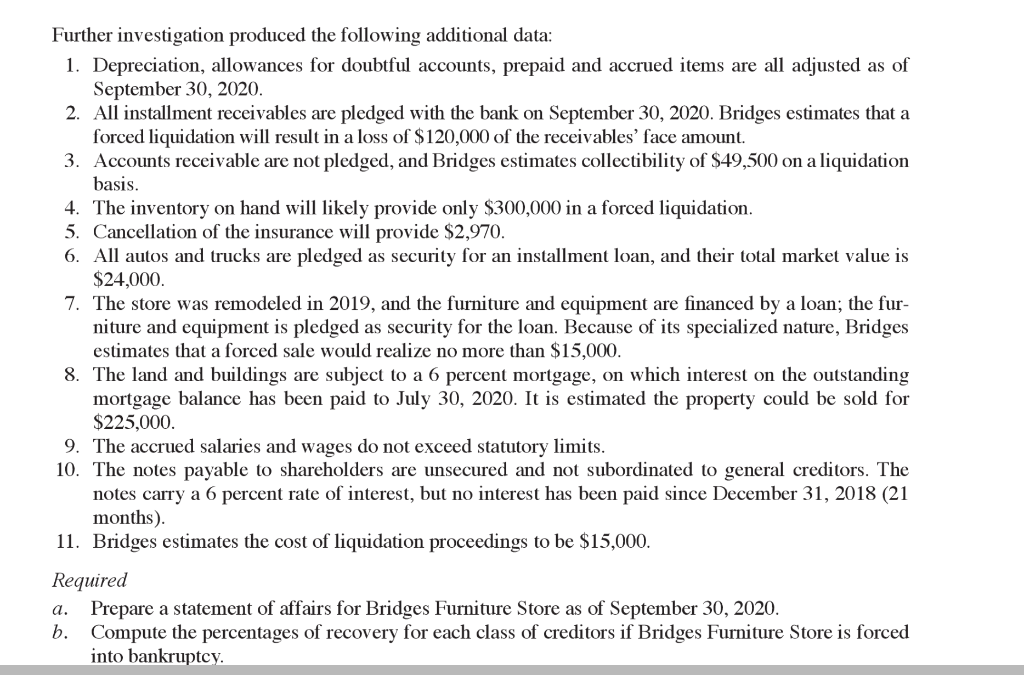

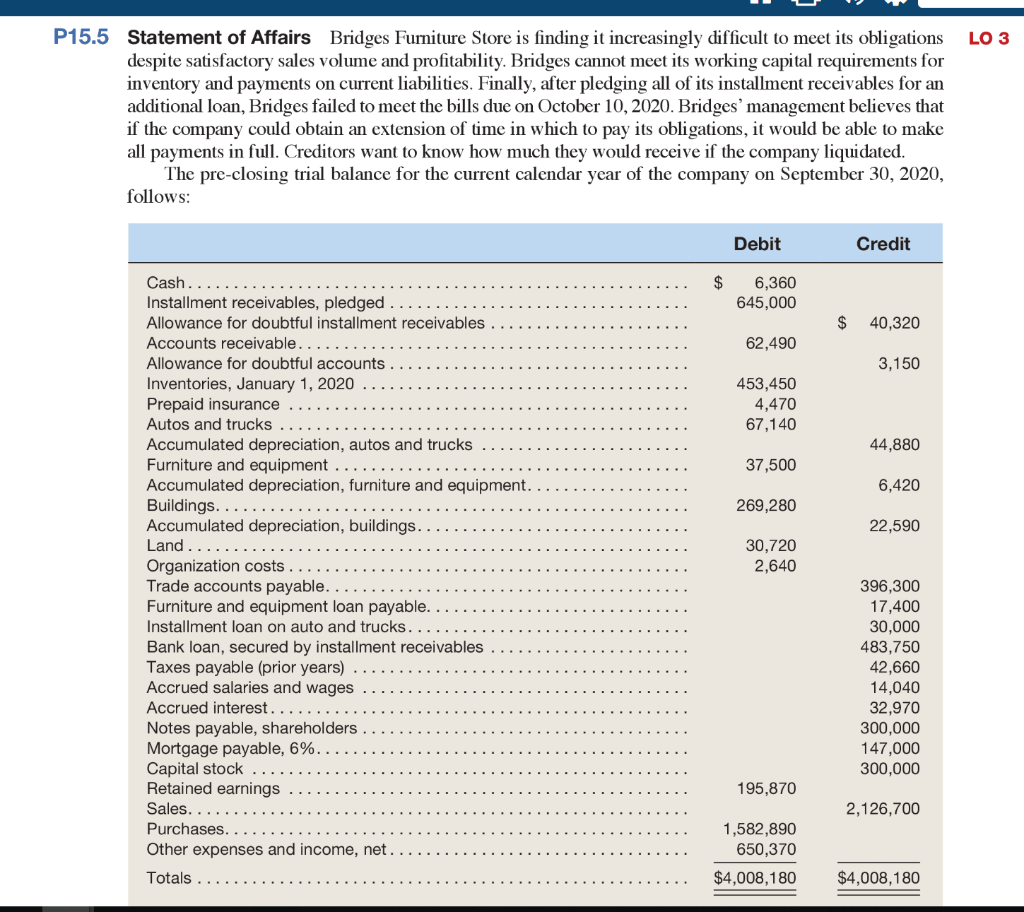

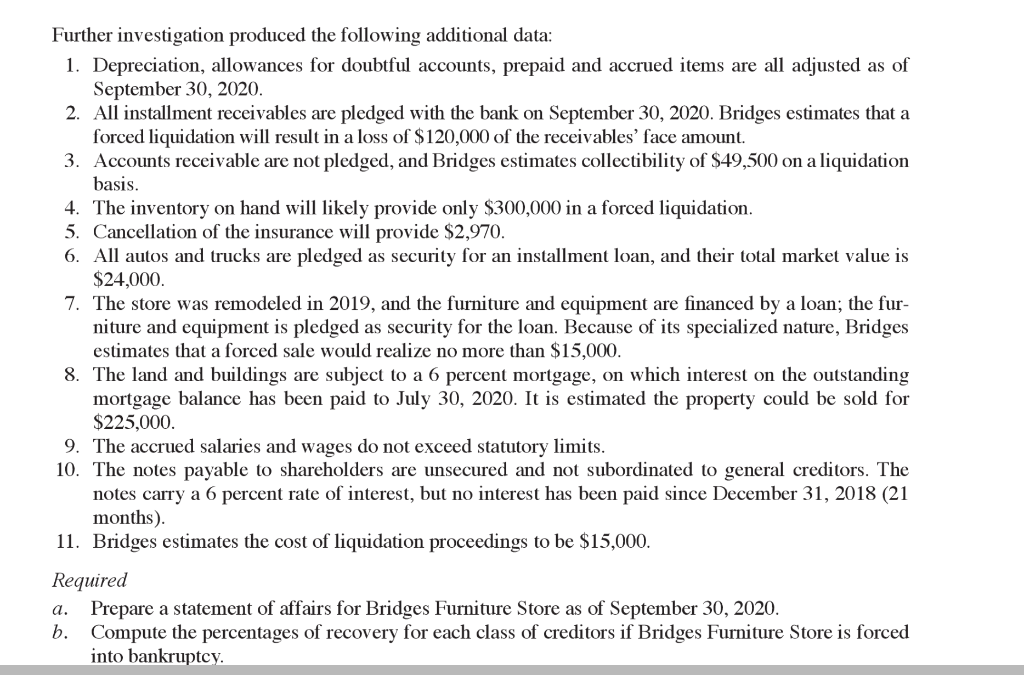

P15.5 Statement of Affairs Bridges Furniture Store is finding it increasingly difficult to meet its obligations LO 3 despite satisfactory sales volume and profitability. Bridges cannot meet its working capital requirements for inventory and payments on current liabilities. Finally, after pledging all of its installment receivables for an additional loan, Bridges failed to meet the bills due on October 10,2020. Bridges' management believes that if the company could obtain an extension of time in which to pay its obligations, it would be able to make all payments in full. Creditors want to know how much they would receive if the company liquidated The pre-closing trial balance for the current calendar year of the company on September 30, 2020, follows: Debit Credit 645,000 Allowance for doubtful installment receivables . .. _ . . . . . .. . . . . . . . . . . . $ 40,320 62,490 Allowance for doubtful accounts . . _ . _ . . . .. _ _. . . . . . _ . . ._ . . . 3,150 453,450 4,470 67,140 44,880 6,420 22,590 37,500 269,280 30,720 2,640 396,300 17,400 30,000 483,750 42,660 14,040 32,970 300,000 147,000 300,000 Furniture and equipment loan payable. .. .. . . . . . . . . . . . . . . . . . . . . . . . . Installment loan on auto and trucks. _ . . . . . . . . __ . . . .. _. . . . . .. Accrued salaries and wages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 195,870 2,126,700 650,370 Further investigation produced the following additional data: 1. Depreciation, allowances for doubtful accounts, prepaid and accrued items are all adjusted as of September 30, 2020 2. All installment receivables are pledged with the bank on September 30, 2020. Bridges estimates that a forced liquidation will result in a loss of $120,000 of the receivables' face amount. 3. Accounts receivable are not pledged, and Bridges estimates collectibility of $49,500 on a liquidation basis 4. The inventory on hand wil likely provide only $300,000 in a forced liquidation 5. Cancellation of the insurance will provide $2,970 6. All autos and trucks are pledged as security for an installment loan, and their total market value is $24,000 7. The store was remodeled in 2019, and the furniture and equipment are financed by a loan; the fur niture and equipment is pledged as security for the loan. Because of its specialized nature, Bridges estimates that a forced sale would realize no more than $15,000 8. The land and buildings are subject to a 6 percent mortgage, on which interest on the outstanding mortgage balance has been paid to July 30, 2020. It is estimated the property could be sold for $225,000 9. The accrued salaries and wages do not exceed statutory limits 10. The notes payable to shareholders are unsecured and not subordinated to general creditors. The notes carry a 6 percent rate of interest, but no interest has been paid since December 31, 2018 (21 months) 11. Bridges estimates the cost of liquidation proceedings to be $15,000 Required a. Prepare a statement of affairs for Bridges Furniture Store as of September 30, 2020 b. Compute the percentages of recovery for each class of creditors if Bridges Furniture Store is forced into bankruptc P15.5 Statement of Affairs Bridges Furniture Store is finding it increasingly difficult to meet its obligations LO 3 despite satisfactory sales volume and profitability. Bridges cannot meet its working capital requirements for inventory and payments on current liabilities. Finally, after pledging all of its installment receivables for an additional loan, Bridges failed to meet the bills due on October 10,2020. Bridges' management believes that if the company could obtain an extension of time in which to pay its obligations, it would be able to make all payments in full. Creditors want to know how much they would receive if the company liquidated The pre-closing trial balance for the current calendar year of the company on September 30, 2020, follows: Debit Credit 645,000 Allowance for doubtful installment receivables . .. _ . . . . . .. . . . . . . . . . . . $ 40,320 62,490 Allowance for doubtful accounts . . _ . _ . . . .. _ _. . . . . . _ . . ._ . . . 3,150 453,450 4,470 67,140 44,880 6,420 22,590 37,500 269,280 30,720 2,640 396,300 17,400 30,000 483,750 42,660 14,040 32,970 300,000 147,000 300,000 Furniture and equipment loan payable. .. .. . . . . . . . . . . . . . . . . . . . . . . . . Installment loan on auto and trucks. _ . . . . . . . . __ . . . .. _. . . . . .. Accrued salaries and wages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 195,870 2,126,700 650,370 Further investigation produced the following additional data: 1. Depreciation, allowances for doubtful accounts, prepaid and accrued items are all adjusted as of September 30, 2020 2. All installment receivables are pledged with the bank on September 30, 2020. Bridges estimates that a forced liquidation will result in a loss of $120,000 of the receivables' face amount. 3. Accounts receivable are not pledged, and Bridges estimates collectibility of $49,500 on a liquidation basis 4. The inventory on hand wil likely provide only $300,000 in a forced liquidation 5. Cancellation of the insurance will provide $2,970 6. All autos and trucks are pledged as security for an installment loan, and their total market value is $24,000 7. The store was remodeled in 2019, and the furniture and equipment are financed by a loan; the fur niture and equipment is pledged as security for the loan. Because of its specialized nature, Bridges estimates that a forced sale would realize no more than $15,000 8. The land and buildings are subject to a 6 percent mortgage, on which interest on the outstanding mortgage balance has been paid to July 30, 2020. It is estimated the property could be sold for $225,000 9. The accrued salaries and wages do not exceed statutory limits 10. The notes payable to shareholders are unsecured and not subordinated to general creditors. The notes carry a 6 percent rate of interest, but no interest has been paid since December 31, 2018 (21 months) 11. Bridges estimates the cost of liquidation proceedings to be $15,000 Required a. Prepare a statement of affairs for Bridges Furniture Store as of September 30, 2020 b. Compute the percentages of recovery for each class of creditors if Bridges Furniture Store is forced into bankruptc