Answered step by step

Verified Expert Solution

Question

1 Approved Answer

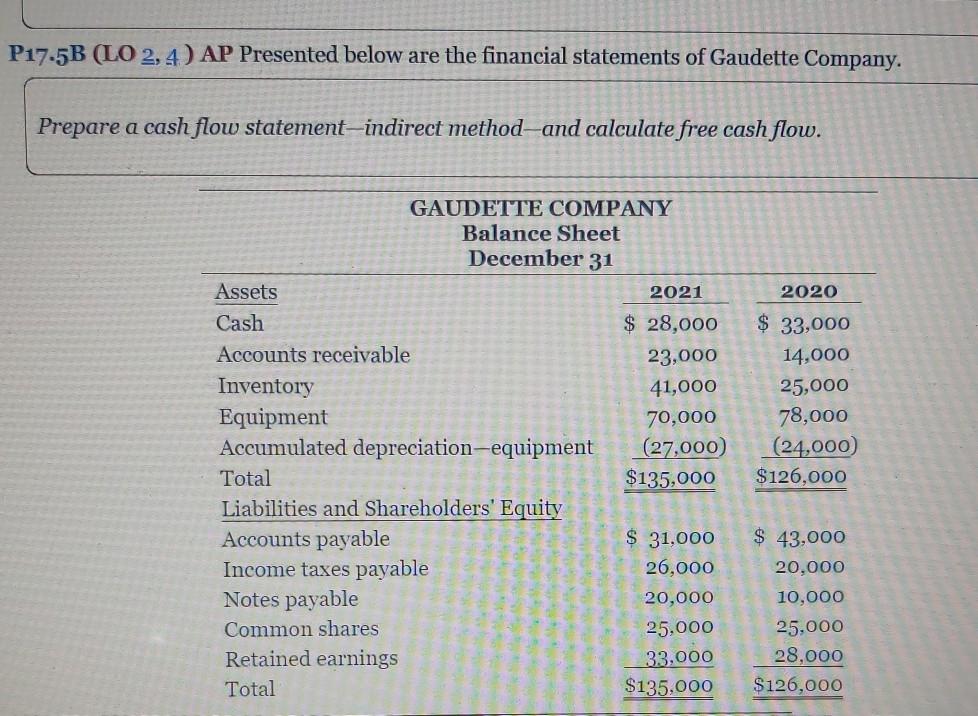

P17-5B (LO 2,4 ) AP Presented below are the financial statements of Gaudette Company. Prepare a cash flow statement-indirect method-and calculate free cash flow. 2020

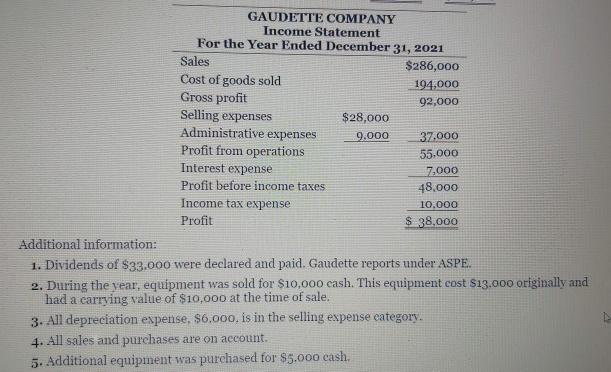

P17-5B (LO 2,4 ) AP Presented below are the financial statements of Gaudette Company. Prepare a cash flow statement-indirect method-and calculate free cash flow. 2020 GAUDETTE COMPANY Balance Sheet December 31 Assets 2021 Cash $ 28,000 Accounts receivable 23,000 Inventory 41,000 Equipment 70,000 Accumulated depreciation-equipment (27,000) Total $135,000 Liabilities and Shareholders' Equity Accounts payable $ 31.000 Income taxes payable 26.000 Notes payable 20,000 Common shares 25,000 Retained earnings 33,000 Total $135,000 $ 33,000 14,000 25,000 78,000 (24,000) $126,000 $ 43,000 20.000 10,000 25,000 28,000 $126,000 GAUDETTE COMPANY Income Statement For the Year Ended December 31, 2021 Sales $286,000 Cost of goods sold 194,000 Gross profit 92,000 Selling expenses $28,000 Administrative expenses 9.000 37,000 Profit from operations 55.000 Interest expense 7,000 Profit before income taxes 48.000 Income tax expense 10,000 Profit $ 38,000 Additional information: 1. Dividends of $33.000 were declared and paid. Gaudette reports under ASPE. 2. During the year, equipment was sold for $10,000 cash. This equipment cost $13.000 originally and had a carrying value of $10,000 at the time of sale. 3. All depreciation expense, $6,000, is in the selling expense category. 4. All sales and purchases are on account. 5. Additional equipment was purchased for $5.000 cash. Interest expense 7,000 Profit before income taxes 48.000 Income tax expense 10,000 Profit $ 38,000 Additional information: 1. Dividends of $33,000 were declared and paid. Gaudette reports under ASPE. 2. During the year, equipment was sold for $10,000 cash. This equipment cost $13,000 originally and had a carrying value of $10,000 at the time of sale. 3. All depreciation expense. $6,000, is in the selling expense category. 4. All sales and purchases are on account. 5. Additional equipment was purchased for $5,000 cash. Instructions a. Prepare a statement of cash flows using the indirect method. b. Calculate free cash flow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started