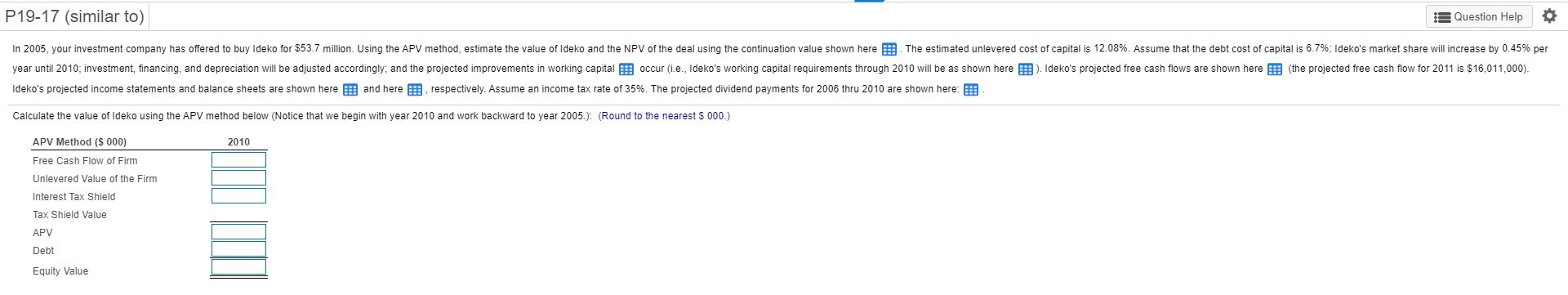

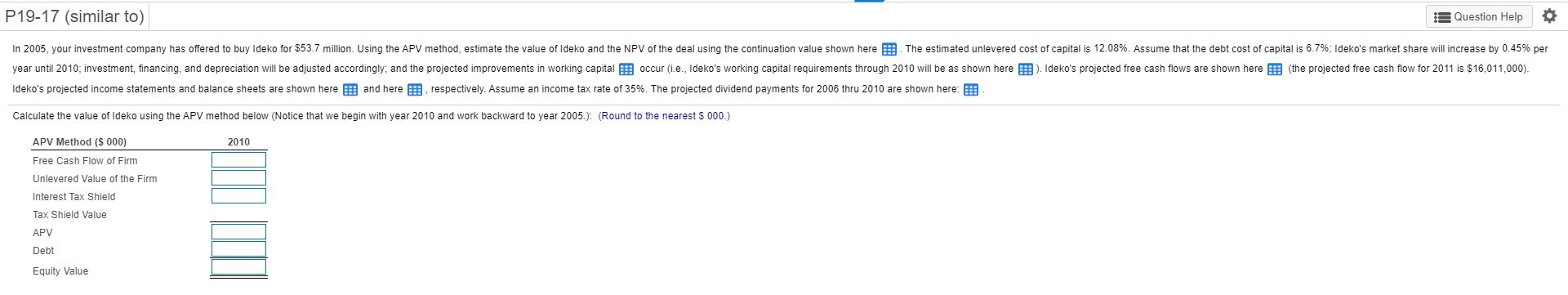

P19-17 (similar to) Question Help 0 In 2005, your investment company has offered to buy Ideko for $53.7 million. Using the APV method, estimate the value of Ideko and the NPV of the deal using the continuation value shown here 3. The estimated unlevered cost of capital is 12.08%. Assume that the debt cost of capital is 6.7%; Ideko's market share will increase by 0.45% per year until 2010; investment, financing, and depreciation will be adjusted accordingly, and the projected improvements in working capital B! occur (i.e., Ideko's working capital requirements through 2010 will be as shown here ). Ideko's projected free cash flows are shown here 3 (the projected free cash flow for 2011 is $16,011,000). Ideko's projected income statements and balance sheets are shown here and here , respectively. Assume an income tax rate of 35%. The projected dividend payments for 2006 thru 2010 are shown here: ou die me ns se sont ntre em em Calculate the value of Ideko using the APV method below (Notice that we begin with year 2010 and work backward to year 2005.): (Round to the nearest S 000.) APV Method ($ 000) 2010 Free Cash Flow of Firm Unlevered Value of the Firm Interest Tax Shield Tax Shield Value APV Debt Equity Value P19-17 (similar to) Question Help 0 In 2005, your investment company has offered to buy Ideko for $53.7 million. Using the APV method, estimate the value of Ideko and the NPV of the deal using the continuation value shown here 3. The estimated unlevered cost of capital is 12.08%. Assume that the debt cost of capital is 6.7%; Ideko's market share will increase by 0.45% per year until 2010; investment, financing, and depreciation will be adjusted accordingly, and the projected improvements in working capital B! occur (i.e., Ideko's working capital requirements through 2010 will be as shown here ). Ideko's projected free cash flows are shown here 3 (the projected free cash flow for 2011 is $16,011,000). Ideko's projected income statements and balance sheets are shown here and here , respectively. Assume an income tax rate of 35%. The projected dividend payments for 2006 thru 2010 are shown here: ou die me ns se sont ntre em em Calculate the value of Ideko using the APV method below (Notice that we begin with year 2010 and work backward to year 2005.): (Round to the nearest S 000.) APV Method ($ 000) 2010 Free Cash Flow of Firm Unlevered Value of the Firm Interest Tax Shield Tax Shield Value APV Debt Equity Value