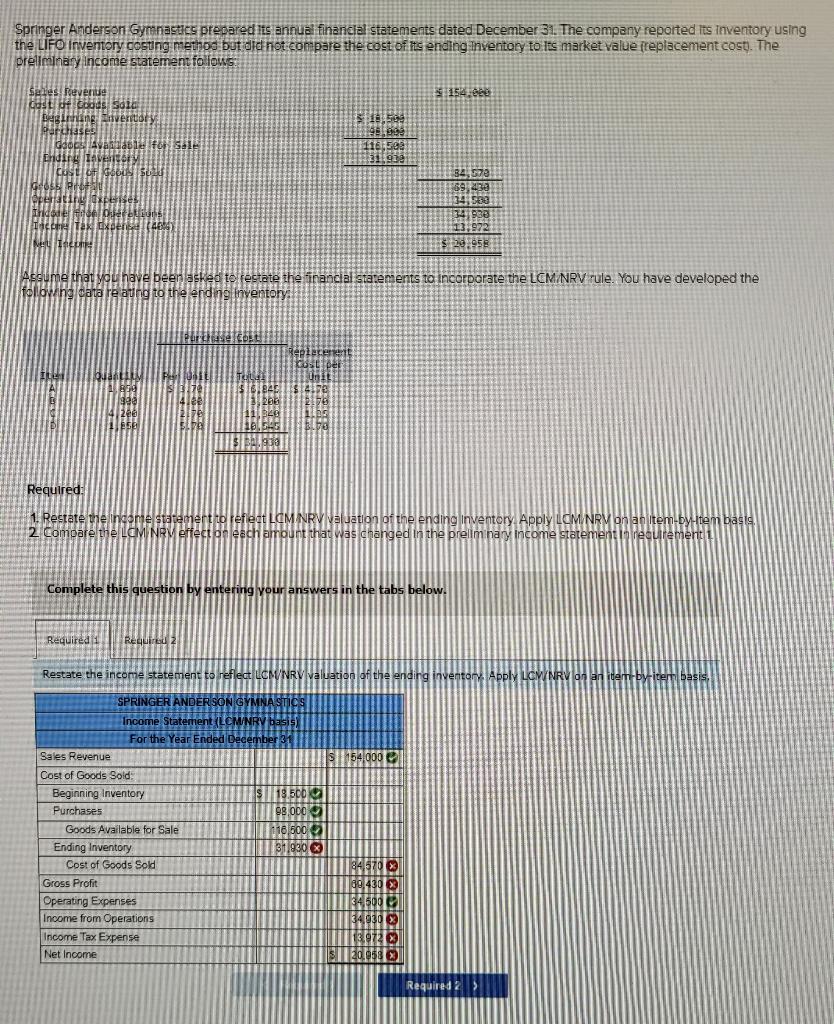

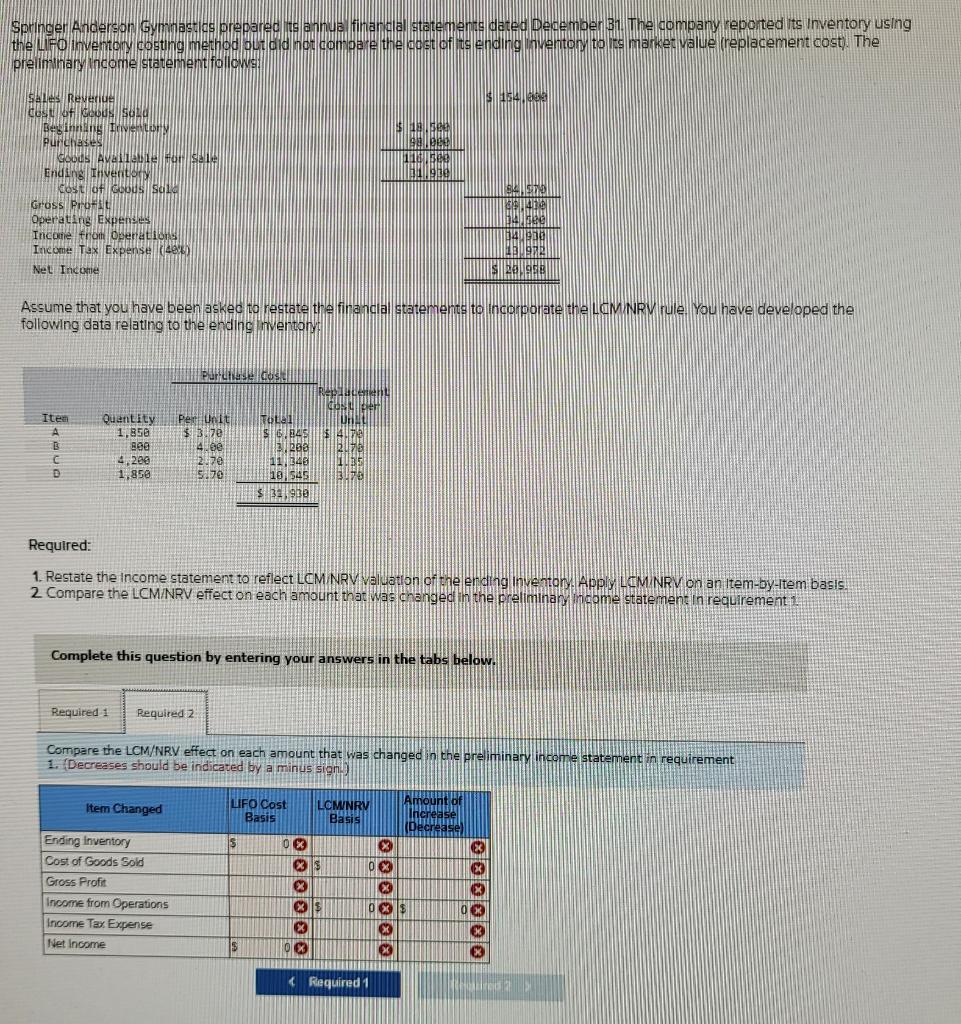

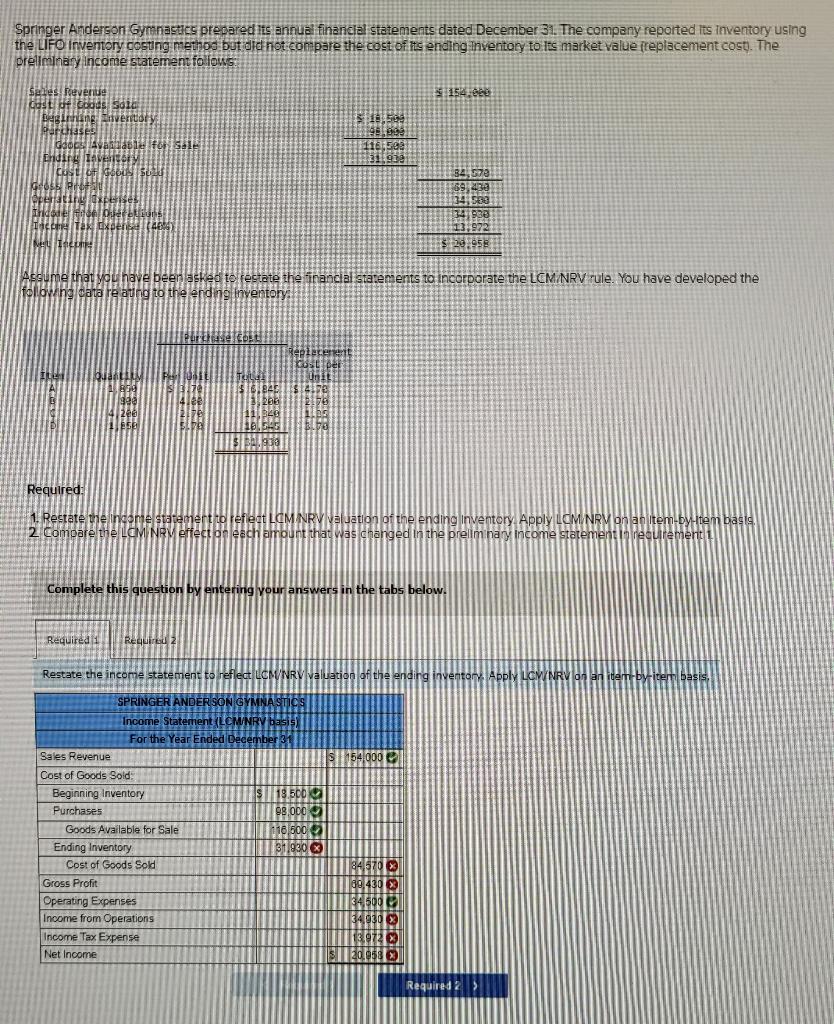

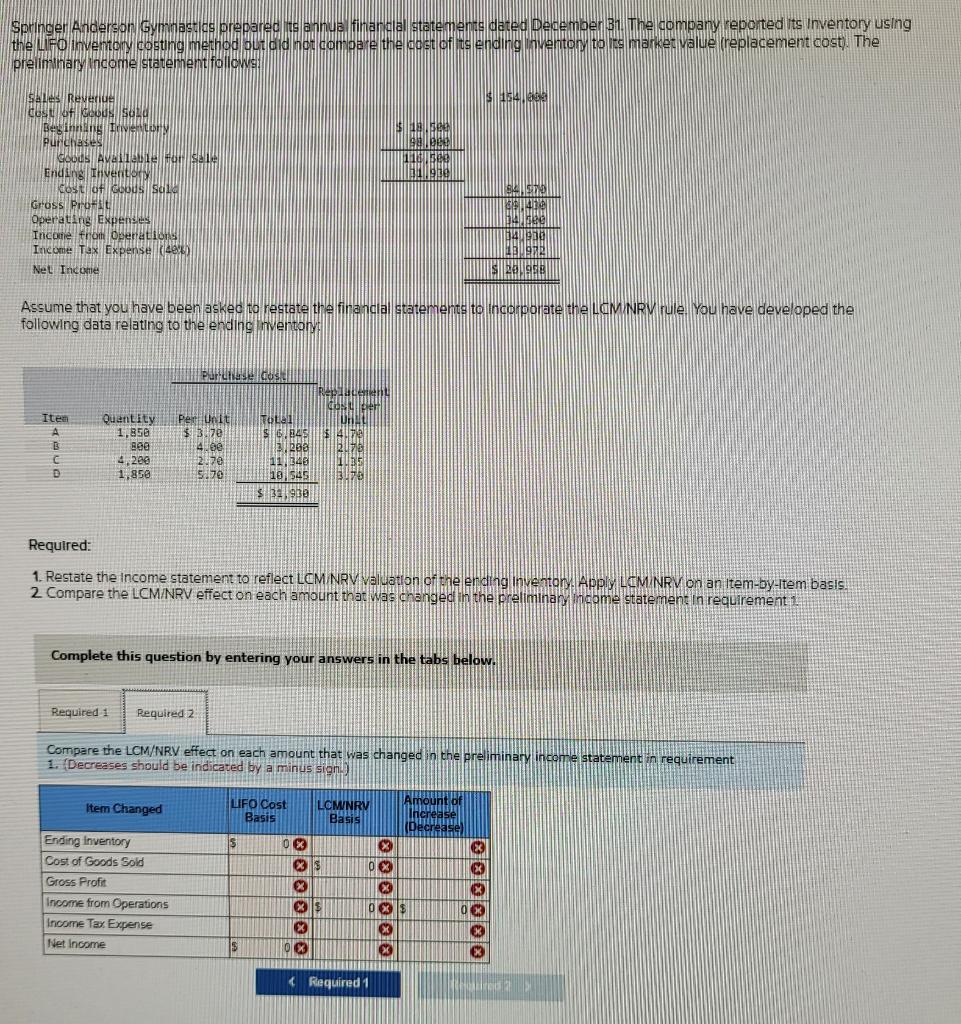

Springer Anderson Gymnastes prepared iis annual financial statements dated December 31. The company reported its inventory using the LIFO Inventory cosung method but did not compare the cost of its ending inventory to les market value freplacement cost. The preliminary Income statement follows: 154 100 Sales: Revenue Get Goods Solo Darches SETTOR Veritas Slable for sale Endine Tavetor FIT Hobbit Bull Racing 116,50 34,670 34 550 TOBATEA $29.95 formulare to the endnet sked to restate the inancial statements to incorporate the LCM/NRV rule. You have developed the 23 Required: 1. Restate the 2 compare OM NRV reflect LCM NRV Valuation of the ending inventory. Apply LCM NRM on an item-by anged in the preliminary Income statement Complete this question by in the tabs below. Required 1 Required 2 Restate the income statement SPRINGER ANDER Income Statement (LCM For the Year Ended December Sales Revenue Cost of Goods Sold Beginning Inventory S 19.500 Purchases Goods Available for Sale Ending Inventory X Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense Net Income Springer Anderson Gymnastics prepared its annual financial statemente dated December 31: The company reported its Inventory using the LIFO Inventory costing method out did not compare the cost of its ending Inventor to its market value treplacement cost. The preliminary income statement follows: 154 SALE Reverie cost of Geous SOLA Beginning the Purchases Goods AVAI11e Horse Ending Inventor cost of Geous Suid Gross Pront Operating Expenses Income from operations Income Tax Expense (480) Nel Income M 380 1993ell 1154970 ram 14889 1403 L. SBB Assume that you have been asked to restate the financial statements to incorporate the LOM NRV rule. You have developed the following data relating to the ending inventory Purunaseduse Item A TOLED Quantity 1,850 Bee 4,20 1,850 Per Unit $ 3.70 4.00 2.70 5.70 11 346 18 S4S $ 32,938 3175 Required: 1. Restate the Income statement to reflect LCM NRV Valuation of the ending inventory. Apply LCM NRV on an item-by-item basis. 2 Compare the LCM/NRV effect on each amount that was changed in the preliminary income statement in requirement 1. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compare the LCM/NRV effect on each amount that was changed in the preliminary income statement in requirement 1. Decreases should be indicated by a minus sign Amount Item Changed LIFO Cost Basis LCMNRV Basis Increi s X x 0 03 Ending inventory Cost of Goods Sold Gross Profit Income from Operations Income Tax Expense Net Income 09 0163 $3 0 x 90 15 Required 1 Springer Anderson Gymnastes prepared iis annual financial statements dated December 31. The company reported its inventory using the LIFO Inventory cosung method but did not compare the cost of its ending inventory to les market value freplacement cost. The preliminary Income statement follows: 154 100 Sales: Revenue Get Goods Solo Darches SETTOR Veritas Slable for sale Endine Tavetor FIT Hobbit Bull Racing 116,50 34,670 34 550 TOBATEA $29.95 formulare to the endnet sked to restate the inancial statements to incorporate the LCM/NRV rule. You have developed the 23 Required: 1. Restate the 2 compare OM NRV reflect LCM NRV Valuation of the ending inventory. Apply LCM NRM on an item-by anged in the preliminary Income statement Complete this question by in the tabs below. Required 1 Required 2 Restate the income statement SPRINGER ANDER Income Statement (LCM For the Year Ended December Sales Revenue Cost of Goods Sold Beginning Inventory S 19.500 Purchases Goods Available for Sale Ending Inventory X Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense Net Income Springer Anderson Gymnastics prepared its annual financial statemente dated December 31: The company reported its Inventory using the LIFO Inventory costing method out did not compare the cost of its ending Inventor to its market value treplacement cost. The preliminary income statement follows: 154 SALE Reverie cost of Geous SOLA Beginning the Purchases Goods AVAI11e Horse Ending Inventor cost of Geous Suid Gross Pront Operating Expenses Income from operations Income Tax Expense (480) Nel Income M 380 1993ell 1154970 ram 14889 1403 L. SBB Assume that you have been asked to restate the financial statements to incorporate the LOM NRV rule. You have developed the following data relating to the ending inventory Purunaseduse Item A TOLED Quantity 1,850 Bee 4,20 1,850 Per Unit $ 3.70 4.00 2.70 5.70 11 346 18 S4S $ 32,938 3175 Required: 1. Restate the Income statement to reflect LCM NRV Valuation of the ending inventory. Apply LCM NRV on an item-by-item basis. 2 Compare the LCM/NRV effect on each amount that was changed in the preliminary income statement in requirement 1. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compare the LCM/NRV effect on each amount that was changed in the preliminary income statement in requirement 1. Decreases should be indicated by a minus sign Amount Item Changed LIFO Cost Basis LCMNRV Basis Increi s X x 0 03 Ending inventory Cost of Goods Sold Gross Profit Income from Operations Income Tax Expense Net Income 09 0163 $3 0 x 90 15 Required 1