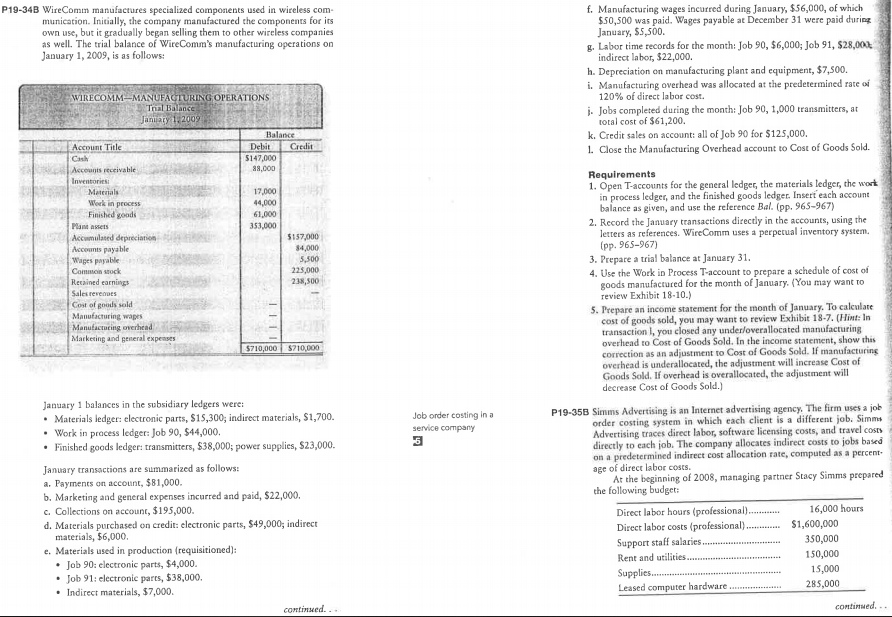

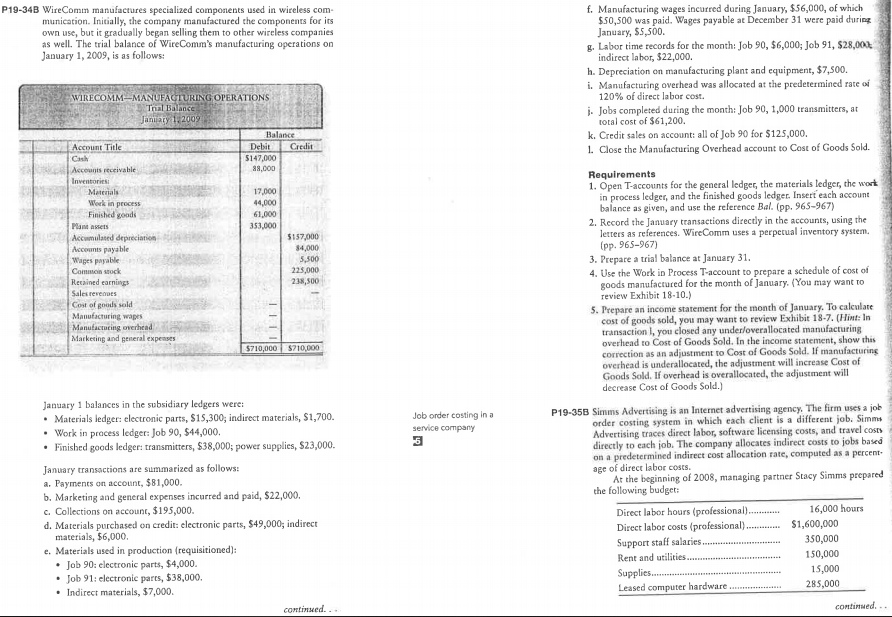

P19-34B WireComm manufactures specialized components used is wireless communication. Initially, the company manufactured the components for its own use, but it gradually began selling them to other wireless companies as well. The trial balance of WireComm's manufacturing operations on January 1, 2009, is as follows:

P19-34B WireComm manufactures specialized components used in wireless com- f. Manufacturing wages incurred during January, $56,000, of which $50,500 was paid. Wages payable at December 31 were paid during January, $5,500 munication. Initially, the company manufactured the components for its own use, but it gradually began selling them to other wireless companies as well. The trial balance of WireComm's manufacturing operations on January 1, 2009, is as follows: g. Labor time records for the month: Job 90, $6,000; Job 91, $28,000 indirect labor, $22,000. h. Depreciation on manufacturing plant and equipment, $7,500. i. Manufacturing overhead was allocated at the etrmined rate i. Jobs completed during the month: Job 90, 1,000 ansmiters, at k. Credit sales on account: all of Job 90 for $125,000. WIRECOMM MANUFAGTURIGOPERATIONS 120% of direct labor cost. total cost of $61,200. Balance L Close the Manufacturing Overhead account to Cost of Goods Sold. 5147,000 88,coo Cash Accounts receivable Requirements 1. Open T-accounts for the general ledget, the materials ledger, the work Meterials 17,000 44,000 61,000 53,000 in process ledger, and the finished goods ledger. Insert each account balance as given, and use the reference Bal. (pp. 965-967) n proces5 Finished gonds 2. Record the January transactions dizectly in the accounts, using the PMana assets letters as references. WireComm uses a perperual inventory system. (pp. 965-967) Acconts payable Wages payable Comson stock Recained earnings Sales revenues Cost of goods sold 157,000 4,000 5,500 225,000 238,500 3. Prepare a trial balance at January 31 4. Use the Work in Process T-account to prepare a schedule of cost of goods manufactured for the month of January. (You may want to review Exhibit 18-10.) 5. Prepare an income statement for the month of January. To caleulate bit 18-7. (Hnt In manufacturing cost of goods sold, you may want to review Exhi transaction I, you closed any under/overallocated overhead to Cost of Goods Sold. In the income statement, show this correction as an adjustment to Cost of Goods Sold. If manufacturing overhead is underallocated, the adjustment will increase Cost of Goods Sold. If overhead is overallocated, the adjustment will decrease Cost of Goods Sold.) $710,000 S710,000 January 1 balances in the subsidiary ledgers were: P19-35B Simms Advertising is an Internet advertising agency. The firm uses a ok Materials ledger: electronic parts, $15,300, indirect materials, $1,700. Work in pracess ledger: Job 90, $44,000 Finished goods ledger: transmitters, $38,000; power supplies, $23,000. Job order costing in a ervice company orde r costing system in which each client is a different job. Simms Advertising traces direct labor, software licensing costs, and travel costs directly to each job. The company allocates indirect costs to jobs based on a predetermined indirect cost allocation rate, computed as a percent age of direct labor costs. anuary transactions are summarized as follows: Ar the beginning of 2008, managing partner Stacy Simms prepared a. Payments on account, $81,000. b. Marketing and general expenses incurred and paid, $22,000 c. Collections on account, $195,000. d. Materials purchased on credit: electronic parts, $49,000, indirect the following budget: 16,000 hours Direct labor hours (professional Direct labor costs ( Support staff saris350,000 Rent and utilities $1,600,000 materials, 56,000. e. Materials used in production (requisitioned) .Job 90: electronic parts, $4,000. .Job 91: electronic parts, $38,000. .Indirect materials, $7,000 150,000 15,000 285,000 Leased computer hardware