Answered step by step

Verified Expert Solution

Question

1 Approved Answer

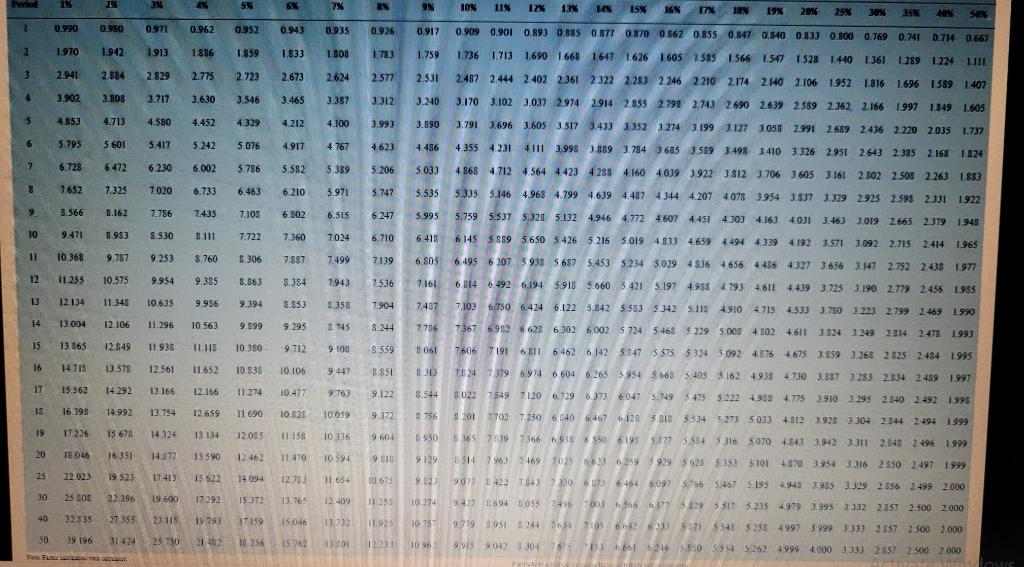

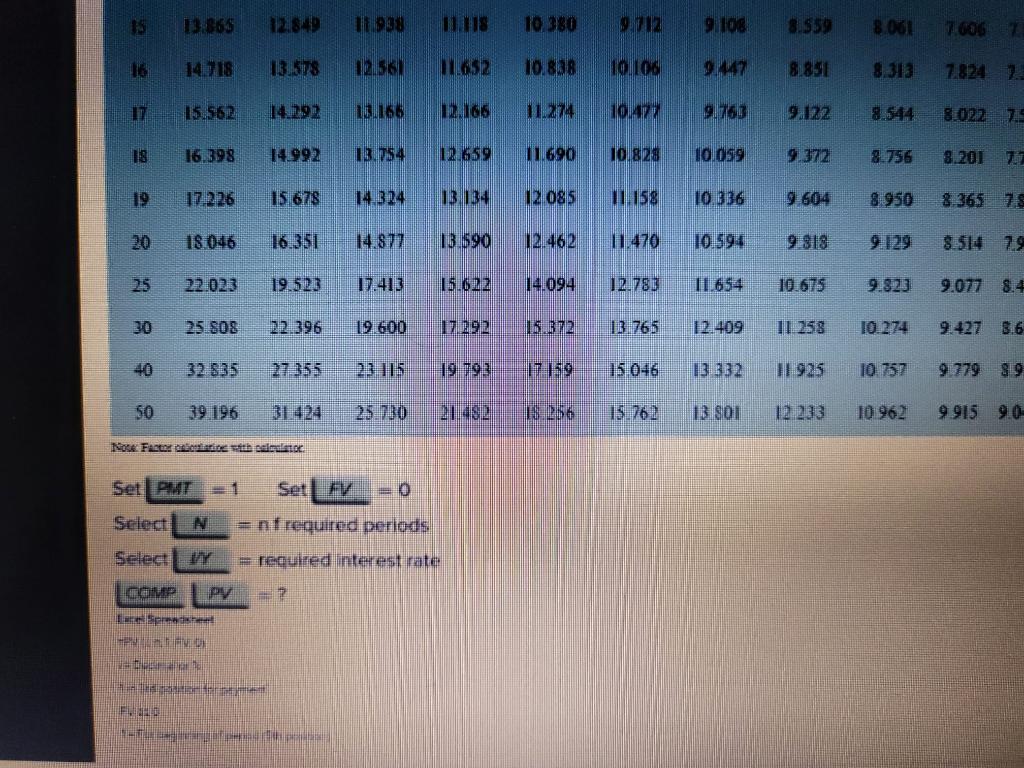

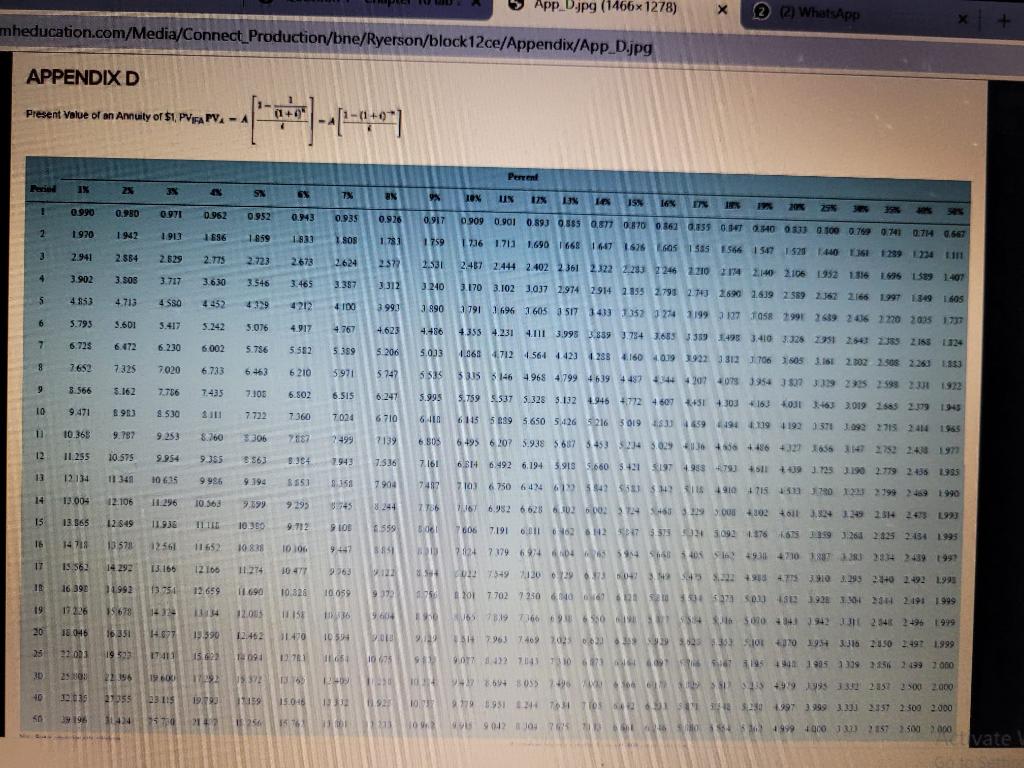

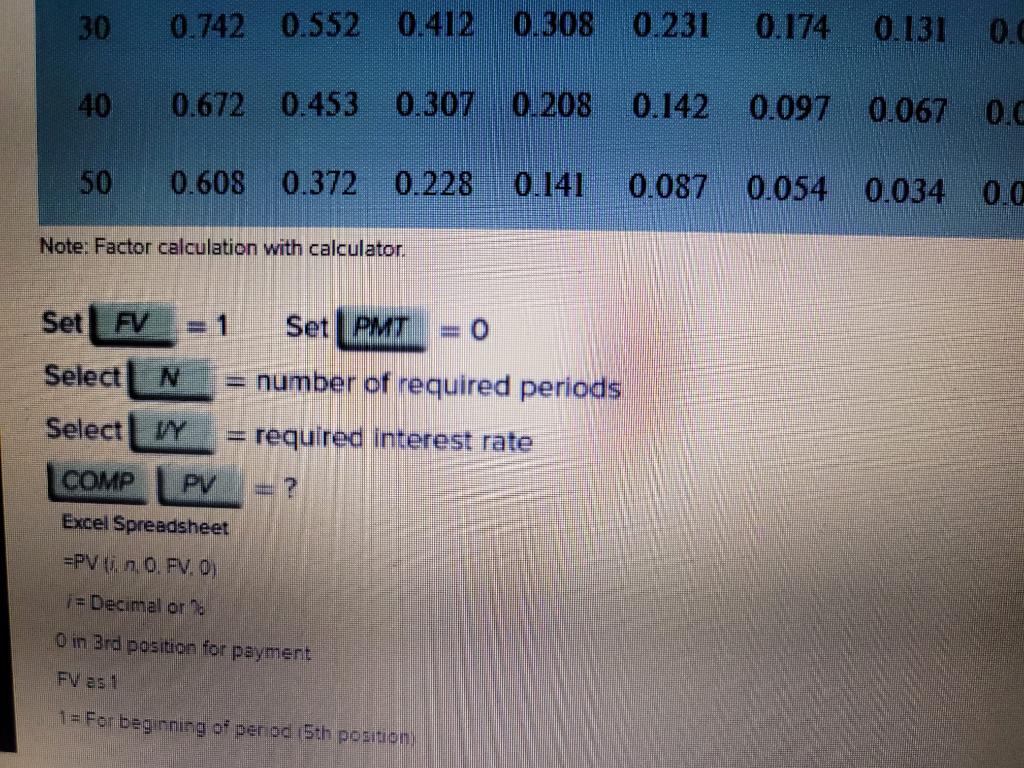

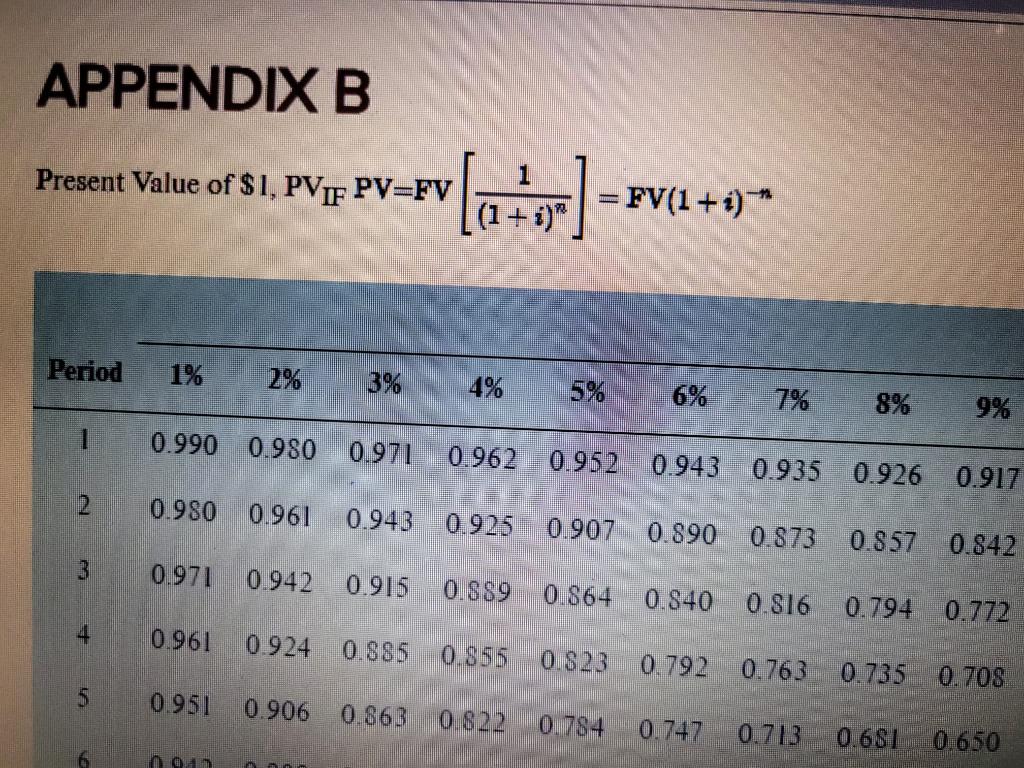

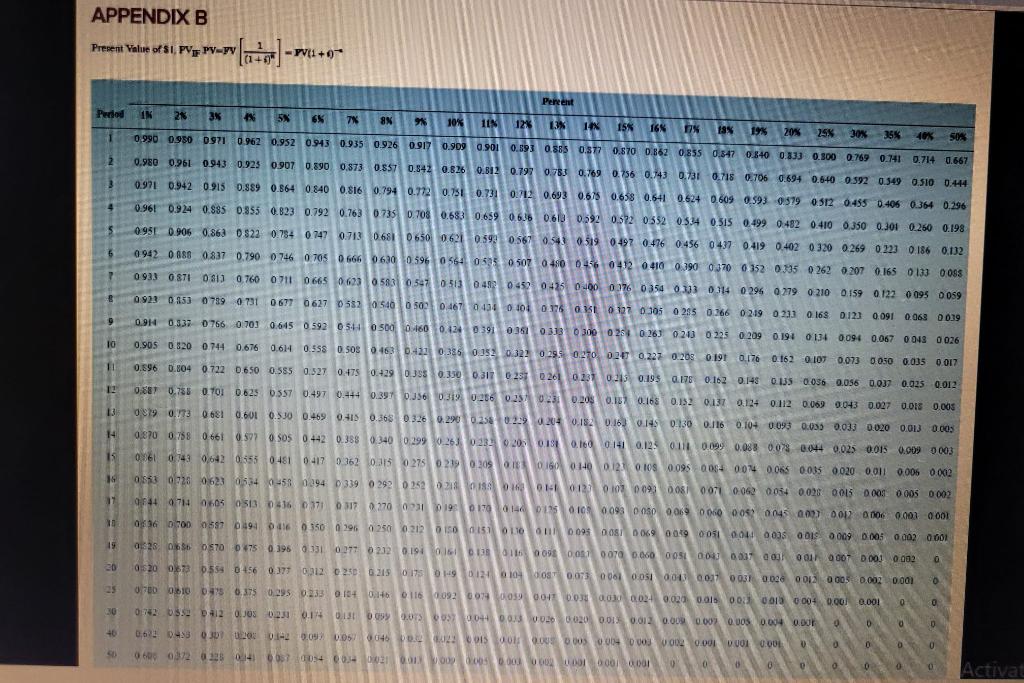

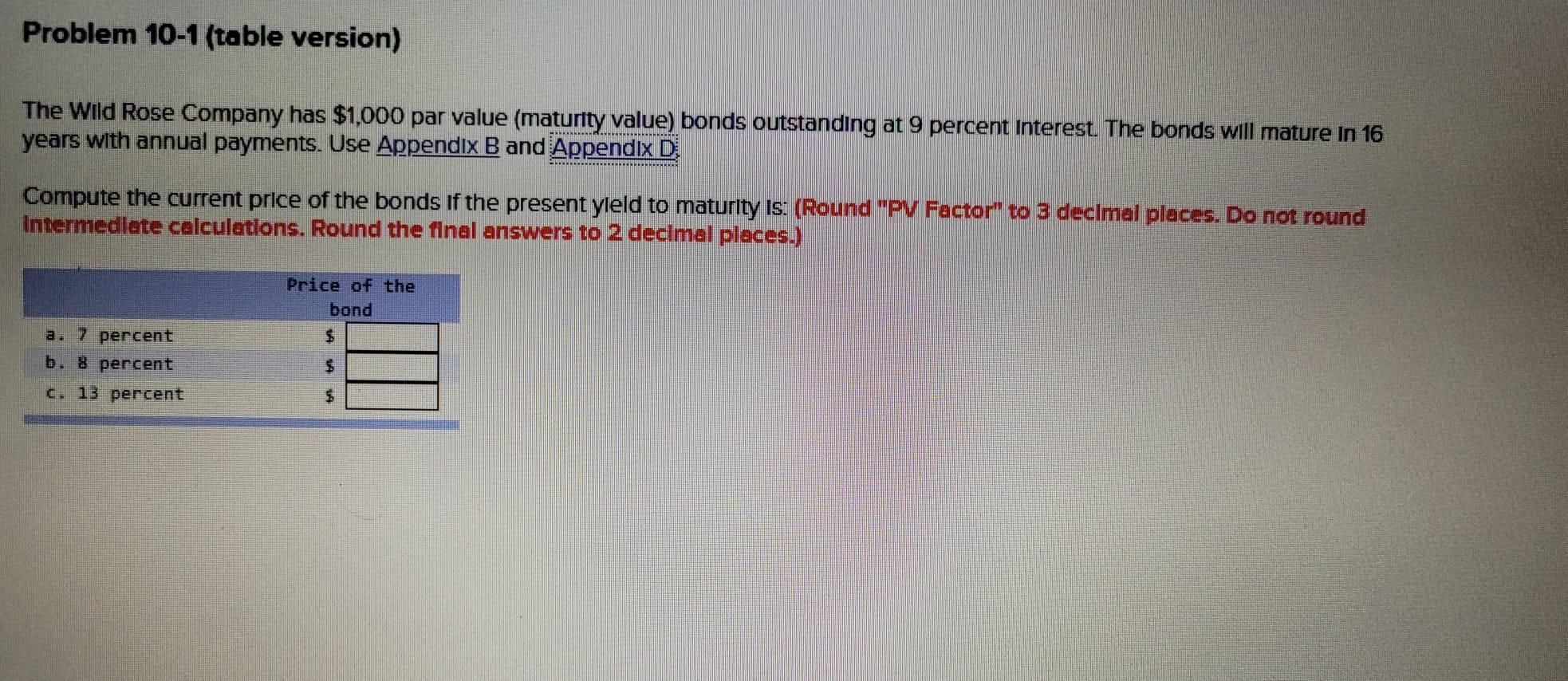

P1VIFAPV=A[i1(1+i)k1]A[i1(1+0)] Note: Factor calculation with calculator. PVIFPV=FV[(1+i)n1]=FV(1+i)n PVFPV=FV[(1+i)n1]=FV(1+0) The Wild Rose Company has $1,000 par value (maturity value) bonds outstanding at 9 percent Interest. The

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started