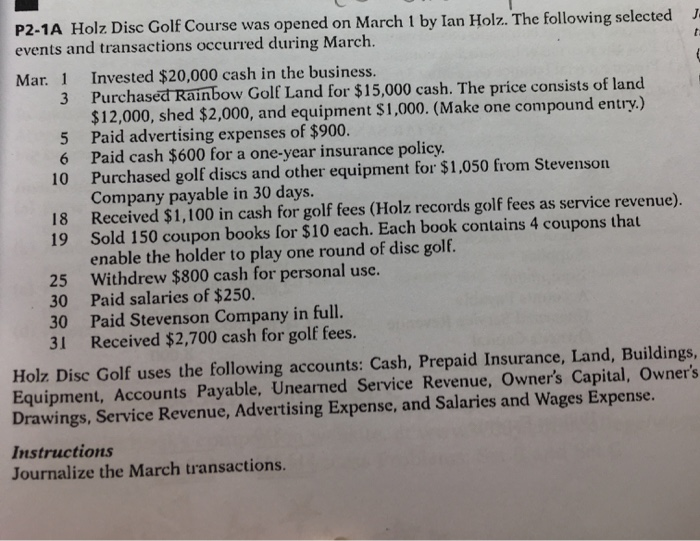

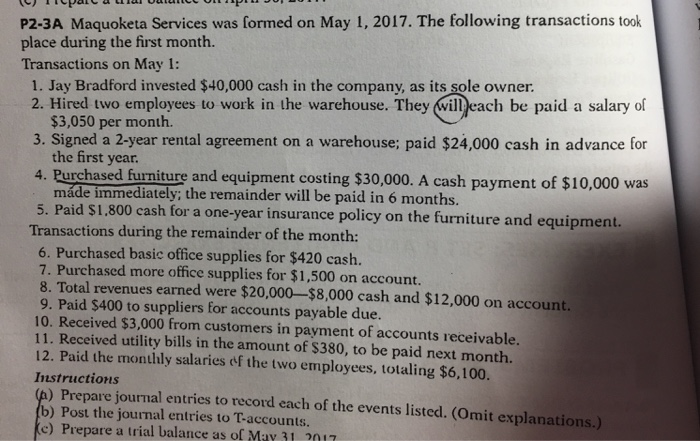

P2-1A Holz Disc Golf Course was opened on March 1 by lan Holz. The following selected events and transactions occurred during March. Mar. 1 Invested $20,000 cash in the business. 3 Purchased Rainbow Golf Land for $15,000 cash. The price consists of land $12,000, shed $2,000, and equipment $1,000. (Make one compound entry.) 5 Paid advertising expenses of $900. 6 Paid cash $600 for a one-year insurance policy. 10 Purchased golf discs and other equipment for $1,050 from Stevenson Company payable in 30 days. 18 Received $1,100 in cash for golf fees (Holz records golf fees as service revenue). 19 Sold 150 coupon books for $10 each. Each book contains 4 coupons that enable the holder to play one round of disc golf. 25 Withdrew $800 cash for personal usc. 30 Paid salaries of $250 30 Paid Stevenson Company in full. 31 Received $2,700 cash for golf fees. Holz Disc Golf uses the following accounts: Cash, Prepaid Insurance, Land, Buildings, Equipment, Accounts Payable, Unearned Service Revenue, Owner's Capital, Owner's Drawings, Service Revenue, Advertising Expense, and Salaries and Wages Expense. Instructions Journalize the March transactions. P2-3A Maquoketa Services was formed on May 1, 2017. The following transactions took place during the first month. Transactions on May 1: 1. Jay Bradford invested $40,000 cash in the company, as its sole owner 2. Hired two employees to work in the warehouse. They will each be paid a salary of $3,050 per month. 3. Signed a 2-year rental agreement on a warehouse; paid $24,000 cash in advance for the first year 4. Purchased furniture and equipment costing $30,000. A cash payment of $10,000 was mde immediately; the remainder will be paid in 6 months 5. Paid $1.800 cash for a one-year insurance policy on the furniture and equipment. Transactions during the remainder of the month: 6. Purchased basic office supplies for $420 cash. 7. Purchased more office supplies for $1,500 on account. 8. Total revenues earned were $20,000-$8,000 cash and $12,000 on account. 9. Paid $400 to suppliers for accounts payable due. 10. Received $3,000 from customers in payment of accounts receivable. 11. Received utility bills in the amount of $380, to be paid next month. 12. Paid the monthly salaries of the two employees, totaling $6,100. Instructions ) Prepare journal entries to record each of the events listed. (Omit explanations.) ) Post the journal entries to T-accounts. c) Prepare a trial balance as of May 31 017