Answered step by step

Verified Expert Solution

Question

1 Approved Answer

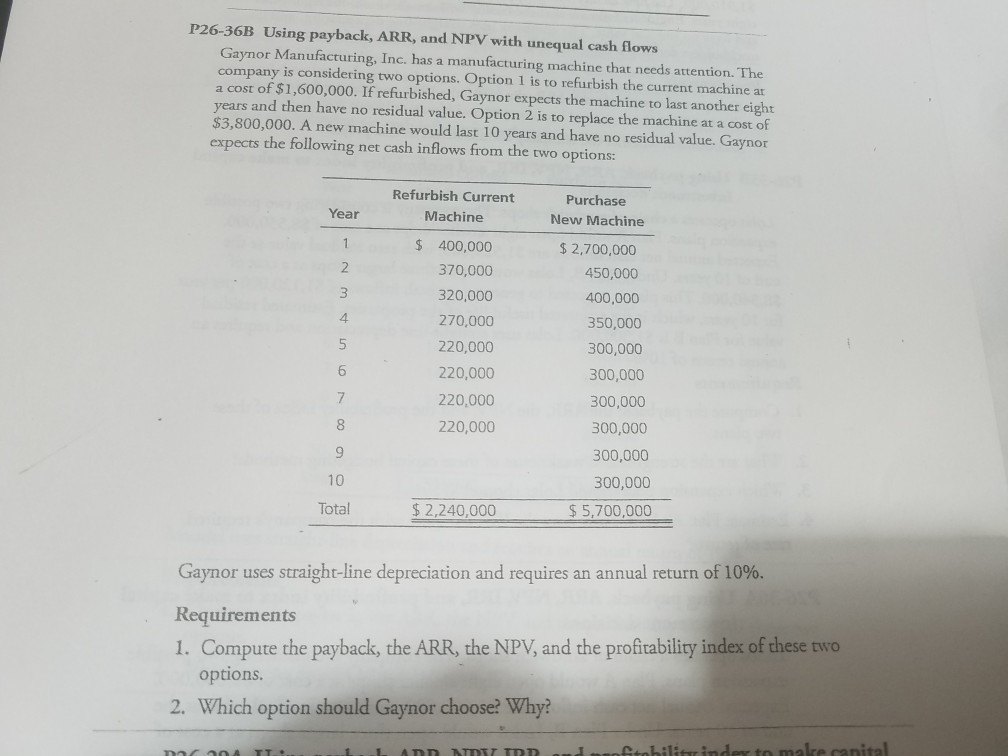

P26-36B Using payback, ARR, and NPV with unequal cash flows Gaynor Manufacturing, Inc. has a manufacturing machine that needs attention. The company is considering two

P26-36B Using payback, ARR, and NPV with unequal cash flows Gaynor Manufacturing, Inc. has a manufacturing machine that needs attention. The company is considering two options. Option 1 is to refurbish the current machine ar a cost of $1,600,000. If refurbished, Gaynor expects the machine to last another eight years and then have no residual value. Option 2 is to replace the machine at a cost of $3,800,000. A new machine would last 10 years and have no residual value. Gaynor expects the following net cash inflows from the two options: Refurbish Current Machine Purchase New Machine Year $ 400,000 370,000 320,000 270,000 220,000 220,000 220,000 220,000 $ 2,700,000 2 450,000 400,000 350,000 300,000 300,000 300,000 300,000 300,000 300,000 4 5 6 10 Total $2,240,000 $5,700,000 Gaynor uses straight-line depreciation and requires an annual return of 10%. Requirements 1. Compute the payback, the ARR, the NPV, and the profirability index of these two options 2. Which option should Gaynor choose? Why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started