Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P2-P1 2t 1. Consider a duopoly market, where two firms sell differentiated products, which are imperfect substitutes. The market can be modelled as a

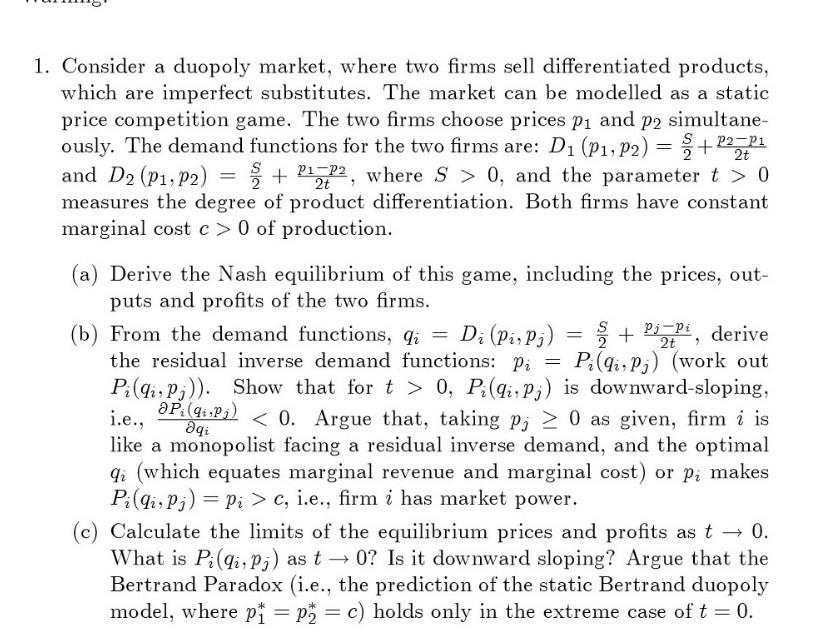

P2-P1 2t 1. Consider a duopoly market, where two firms sell differentiated products, which are imperfect substitutes. The market can be modelled as a static price competition game. The two firms choose prices p1 and p2 simultane- ously. The demand functions for the two firms are: D (P1, P2) = +21 and D2 (P1, P2) +12, where S > 0, and the parameter t > 0 measures the degree of product differentiation. Both firms have constant marginal cost c> 0 of production. = 2t (a) Derive the Nash equilibrium of this game, including the prices, out- puts and profits of the two firms. == Pj-Pi 2t (b) From the demand functions, q = Di (Pi, Pj) = +, derive the residual inverse demand functions: Pi = Pi(i,P) (work out Pi(P)). Show that for t > 0, Pi(qi,P) is downward-sloping, OP(qPj) i.e., c, i.e., firm i has market power. qi = (c) Calculate the limits of the equilibrium prices and profits as t 0. What is Pi(qi, Pi) as t0? Is it downward sloping? Argue that the Bertrand Paradox (i.e., the prediction of the static Bertrand duopoly model, where p = p2 = c) holds only in the extreme case of t = 0.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started