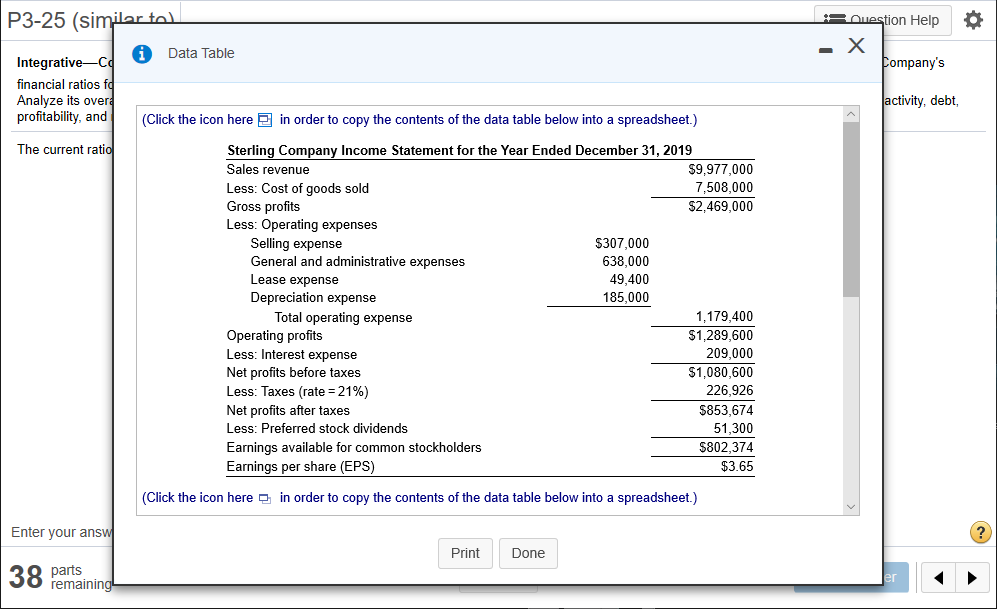

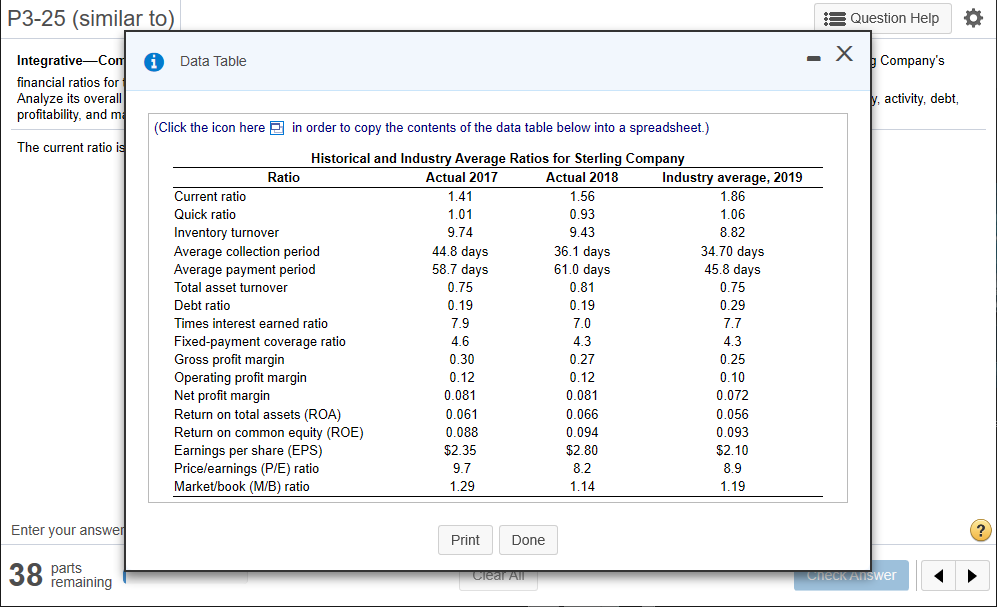

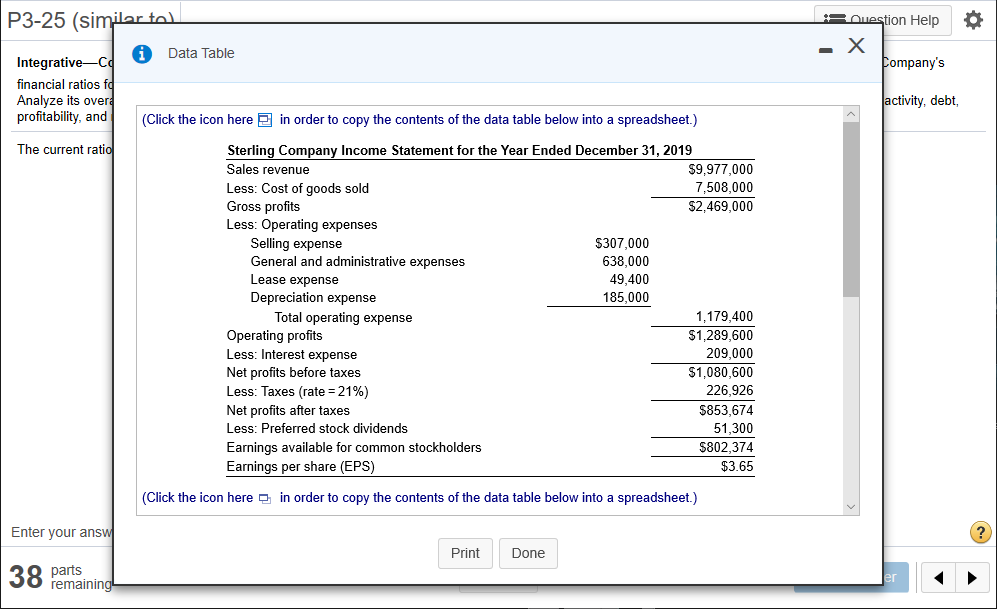

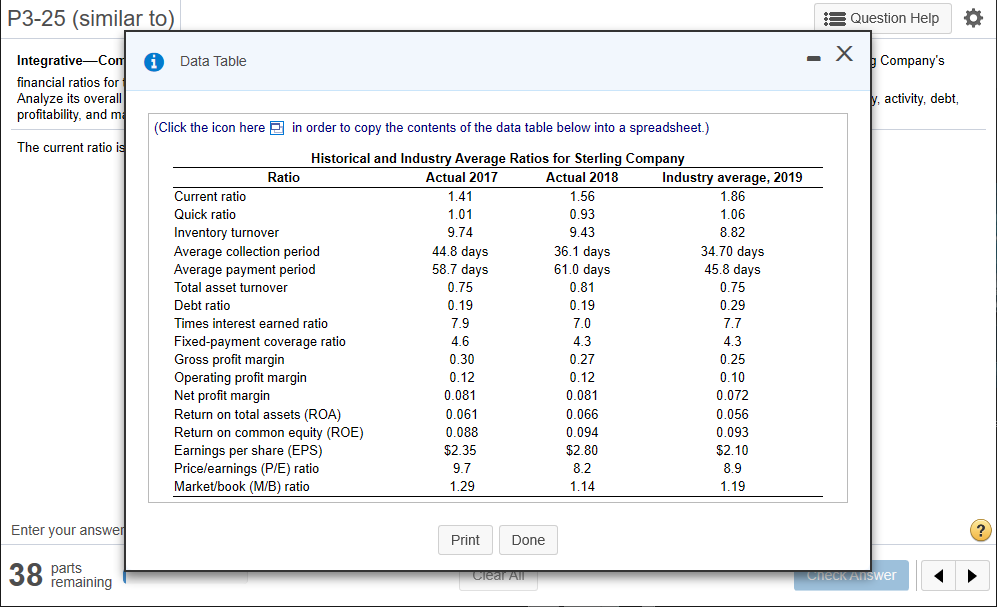

P3-25 (similar to) A Question Help Integrative Complete ratio analysis Given the following financial statements historical ratios, and industry averages calculate Sterling Company's financial ratios for the most recent year. (Assume a 365-day year.) Analyze its overall financial situation from both a cross-sectional and a time-series viewpoint. Break your analysis into evaluations of the firm's liquidity, activity, debt, profitability, and market. The current ratio is (Round to two decimal places.) Enter your answer in the answer box and then click Check Answer. 38 pemaining Clear All Check Answer P3-25 (similar toll Puestion Help i Data Table x Company's Integrative-Co financial ratios fd Analyze its over profitability, and activity, debt The current ratio (Click the icon here 2 in order to copy the contents of the data table below into a spreadsheet.) Sterling Company Income Statement for the Year Ended December 31, 2019 Sales revenue $9,977,000 Less: Cost of goods sold 7,508,000 Gross profits $2,469,000 Less: Operating expenses Selling expense $307,000 General and administrative expenses 638,000 Lease expense 49.400 Depreciation expense 185,000 Total operating expense 1,179,400 Operating profits $1,289,600 Less: Interest expense 209,000 Net profits before taxes $1,080,600 Less: Taxes (rate=21%) 226,926 Net profits after taxes $853,674 Less: Preferred stock dividends 51,300 Earnings available for common stockholders $802,374 Earnings per share (EPS) $3.65 (Click the icon here e in order to copy the contents of the data table below into a spreadsheet.) Enter your answ Print Done 38 parts remaining P3-25 (similar to) A Question Help x Data Table Company's Integrative-Con financial ratios for Analyze its overall profitability, and m y activity, debt, (Click the icon here 2 in order to copy the contents of the data table below into a spreadsheet.) The current ratio is 0.19 Historical and Industry Average Ratios for Sterling Company Ratio Actual 2017 Actual 2018 Industry average, 2019 Current ratio 1.41 1.56 1.86 Quick ratio 1.01 0.93 1.06 Inventory turnover 9.74 9.43 8.82 Average collection period 44.8 days 36.1 days 34.70 days Average payment period 58.7 days 61.0 days 45.8 days Total asset turnover 0.75 0.81 0.75 Debt ratio 0.19 0.29 Times interest earned ratio 7.9 7.0 7.7 Fixed-payment coverage ratio 4.6 4.3 4.3 Gross profit margin 0.30 0.27 0.25 Operating profit margin 0.12 0.10 Net profit margin 0.081 0.081 0.072 Return on total assets (ROA) 0.061 0.066 0.056 Return on common equity (ROE) 0.088 0.094 0.093 Earnings per share (EPS) $2.35 $2.80 $2.10 Pricelearnings (P/E) ratio 9.7 8.2 8.9 Market/book (M/B) ratio 1.29 1.14 1.19 0.12 Enter your answer ? Print Done 38 parts Clear All remaining Check Answer P3-25 (similar to) A Question Help Integrative Complete ratio analysis Given the following financial statements historical ratios, and industry averages calculate Sterling Company's financial ratios for the most recent year. (Assume a 365-day year.) Analyze its overall financial situation from both a cross-sectional and a time-series viewpoint. Break your analysis into evaluations of the firm's liquidity, activity, debt, profitability, and market. The current ratio is (Round to two decimal places.) Enter your answer in the answer box and then click Check Answer. 38 pemaining Clear All Check Answer P3-25 (similar toll Puestion Help i Data Table x Company's Integrative-Co financial ratios fd Analyze its over profitability, and activity, debt The current ratio (Click the icon here 2 in order to copy the contents of the data table below into a spreadsheet.) Sterling Company Income Statement for the Year Ended December 31, 2019 Sales revenue $9,977,000 Less: Cost of goods sold 7,508,000 Gross profits $2,469,000 Less: Operating expenses Selling expense $307,000 General and administrative expenses 638,000 Lease expense 49.400 Depreciation expense 185,000 Total operating expense 1,179,400 Operating profits $1,289,600 Less: Interest expense 209,000 Net profits before taxes $1,080,600 Less: Taxes (rate=21%) 226,926 Net profits after taxes $853,674 Less: Preferred stock dividends 51,300 Earnings available for common stockholders $802,374 Earnings per share (EPS) $3.65 (Click the icon here e in order to copy the contents of the data table below into a spreadsheet.) Enter your answ Print Done 38 parts remaining P3-25 (similar to) A Question Help x Data Table Company's Integrative-Con financial ratios for Analyze its overall profitability, and m y activity, debt, (Click the icon here 2 in order to copy the contents of the data table below into a spreadsheet.) The current ratio is 0.19 Historical and Industry Average Ratios for Sterling Company Ratio Actual 2017 Actual 2018 Industry average, 2019 Current ratio 1.41 1.56 1.86 Quick ratio 1.01 0.93 1.06 Inventory turnover 9.74 9.43 8.82 Average collection period 44.8 days 36.1 days 34.70 days Average payment period 58.7 days 61.0 days 45.8 days Total asset turnover 0.75 0.81 0.75 Debt ratio 0.19 0.29 Times interest earned ratio 7.9 7.0 7.7 Fixed-payment coverage ratio 4.6 4.3 4.3 Gross profit margin 0.30 0.27 0.25 Operating profit margin 0.12 0.10 Net profit margin 0.081 0.081 0.072 Return on total assets (ROA) 0.061 0.066 0.056 Return on common equity (ROE) 0.088 0.094 0.093 Earnings per share (EPS) $2.35 $2.80 $2.10 Pricelearnings (P/E) ratio 9.7 8.2 8.9 Market/book (M/B) ratio 1.29 1.14 1.19 0.12 Enter your answer ? Print Done 38 parts Clear All remaining Check