Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P4-1, P4-2 W h ile of equipment Loss on discontinued operations Administrative expenses Rent revenue Loss on write-down of inventory 75.000 240,000 40,000 60,000 Retained

P4-1, P4-2

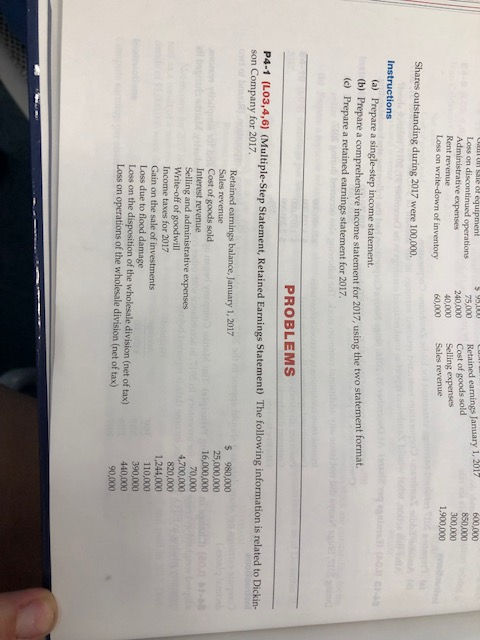

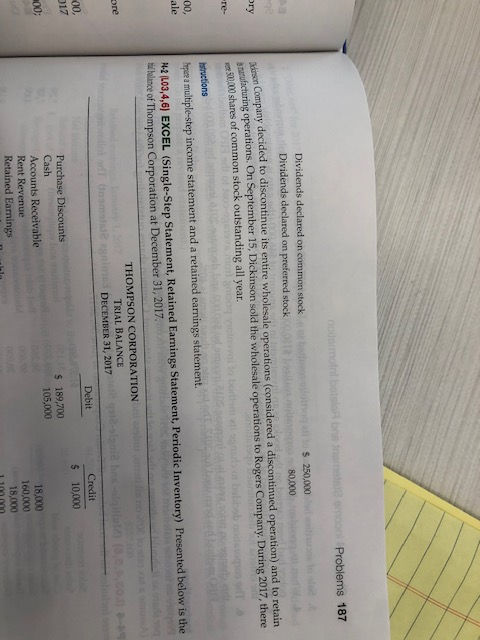

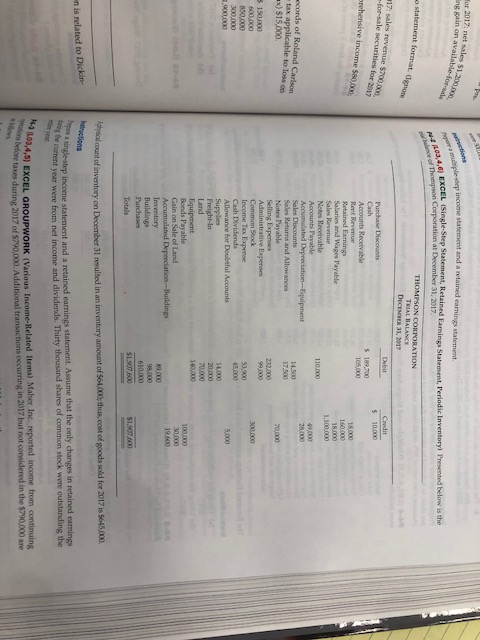

W h ile of equipment Loss on discontinued operations Administrative expenses Rent revenue Loss on write-down of inventory 75.000 240,000 40,000 60,000 Retained earnings January 1, 2017 Cost of goods sold Selling expenses Sales revenue 600.000 850,000 300,000 1,900,000 Shares outstanding during 2017 were 100,000. Instructions (a) Prepare a single-step income statement. (b) Prepare a comprehensive income statement for 2017, using the two statement format. (c) Prepare a retained earnings statement for 2017. PROBLEMS P4-1 (LO3,4,6) (Multiple-Step Statement, Retained Earnings Statement) The following information is related to Dickin son Company for 2017 Retained earnings balance, January 1, 2017 $ 980,000 Sales revenue 25,000,000 Cost of goods sold 16,000,000 Interest revenue 70.000 Selling and administrative expenses 4,700,000 Write-off of goodwill 820,000 Income taxes for 2017 1,244,000 Gain on the sale of investments 110,000 Loss due to flood damage 390,000 Loss on the disposition of the wholesale division (net of tax) 440,000 Loss on operations of the wholesale division (net of tax) 90,000 normalni bosib o Problems 187 Dividends declared on common stock bl o g $ 250,000 Dividends declared on preferred stock 80,000 Company decided to discontinue its entire wholesale operations (considered a discontinued operation) and to retain ufacturing operations. On September 15, Dickinson sold the wholesale operations to Rogers Company. During 2017, there 520.000 shares of common stock outstanding all year. 00, ale structions per a multiple-step income statement and a retained earnings statement. 12L03,4,6) EXCEL (Single-Step Statement, Retained Earnings Statement, Periodic Inventory) Presented below is the Bilince of Thompson Corporation at December 31, 2017 ore THOMPSON CORPORATION TRIAL BALANCE DECEMBER 31, 2017 Debit Credit 10,000 00 $ 017 $ 189,700 105,000 100; Purchase Discounts Cash Accounts Receivable Rent Revenue Retained Earnings 18,000 160,000 18,000 11 For 2017. net sales $1.200. ng gain on available for sal para lepincome statement and a retained earnings statement 4.6) EXCEL (Single-Step Statement, Retained Earnings Statement Periodic Inventory) Presented below is the Thompson Corporation at December 31, 2017 statement formato THOMPSON CORPORATION TRIAL BALANCE DECEMBER 31, 2017 17: sales revenue $700.00 -for-sale securities for 2017 Debit Purchase cont Cardit $ 100.000 $ 189.700 rehensive income $80,000 Accounts Receivable Rent Revenue Retained Faming Salaries and Wages Payable Sales Revenue Noors Receivable Accounts Payable Accumulated the preciation Equipment Sales Discounts Sales Returns and Allowances Notes Payable 110.000 econds of Roland Carlson -tax applicable to loss on 14,500 Ex) $15,000 70,000 300,000 150.000 600.000 8500000 300,000 1.900,000 457000 5.000 Administrative Expenses Common Stock Income Tax Expense Cash Dividends Allowance for Doubtful Accounts Supplies Freight-in Land Equipment Bonds Payable Gain on Sale of Land Accumulated Depeciation-Buildings Inventory Buildings 20,000 70,000 1401000 19.800 89,000 610,000 51 .600 Total $1.900.000 count of inventory on December 31 resulted in an inventory amount of $64,000, thus, cost of goods sold for 2017 is 5645,000 is related to Dickin ge-step income statement and a retained earnings statement. Assume that the only changes in retained earnings current year were from net income and dividends. Thirty thousand shares of common stock were outstanding the briore taxes during 1.6 EXCEL GROUPWORK (Various Income-Related Items) Maler Inc reported income from continuing one taxes during 2017 of $790,000. Additional transactions occurring in 2017 but not considered in the 570.000 areStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started