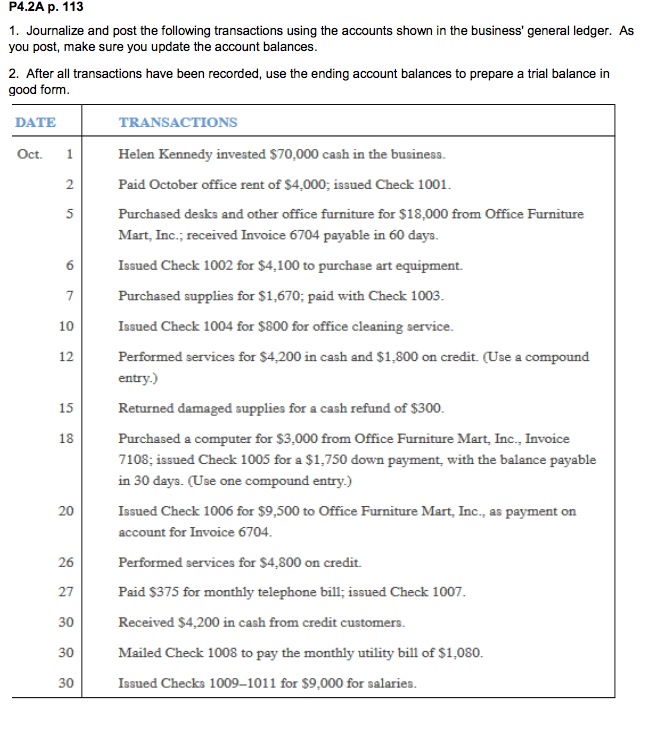

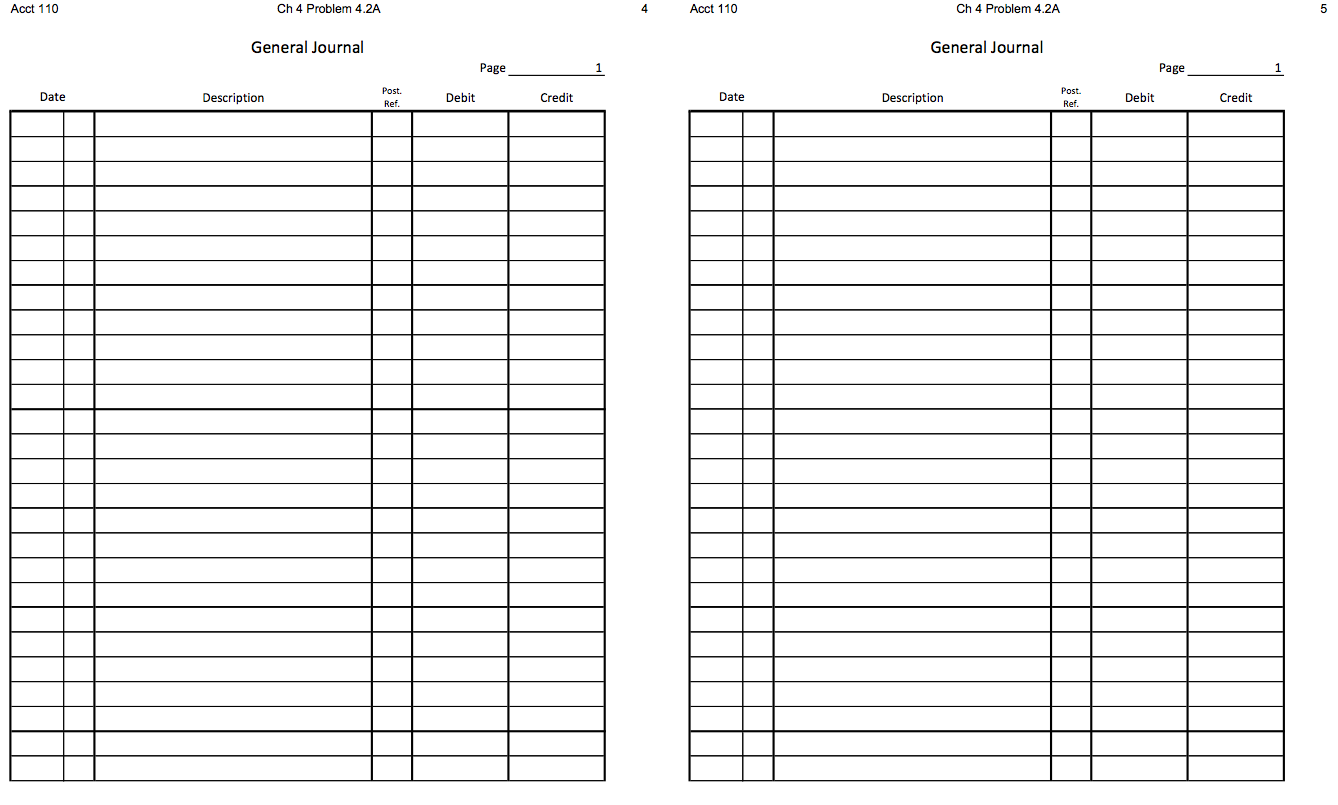

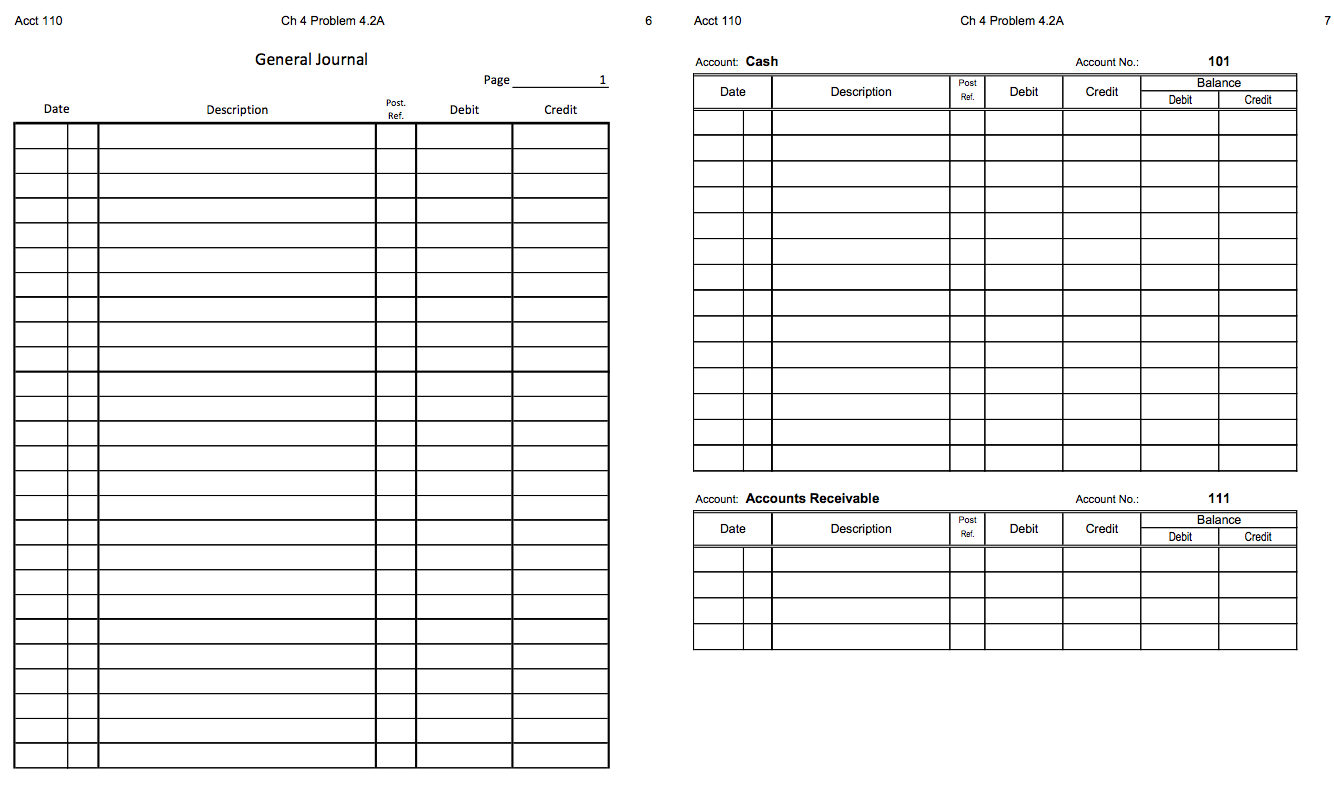

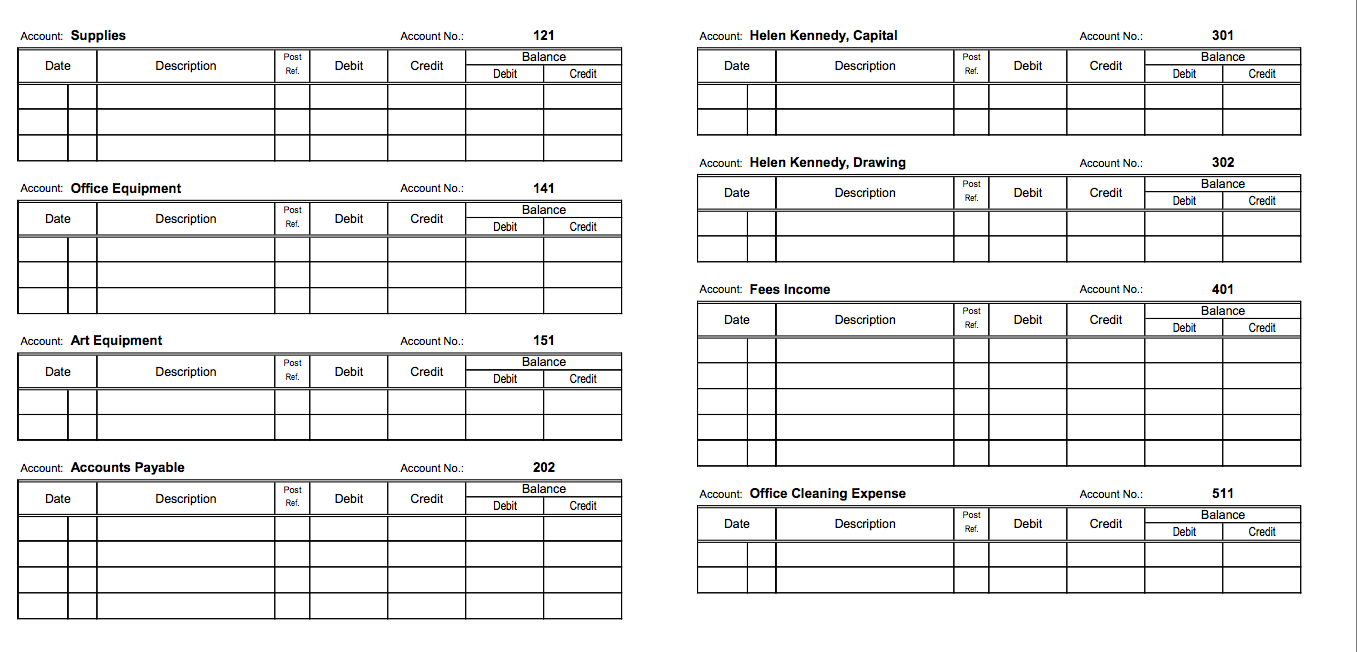

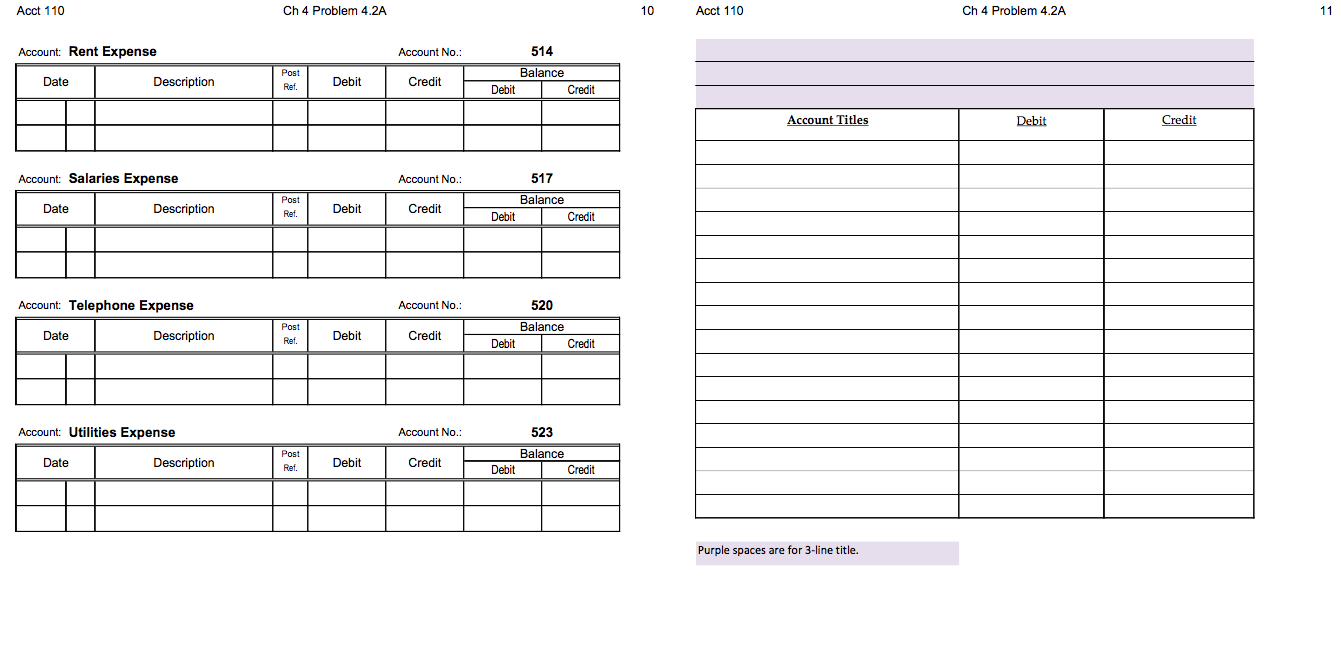

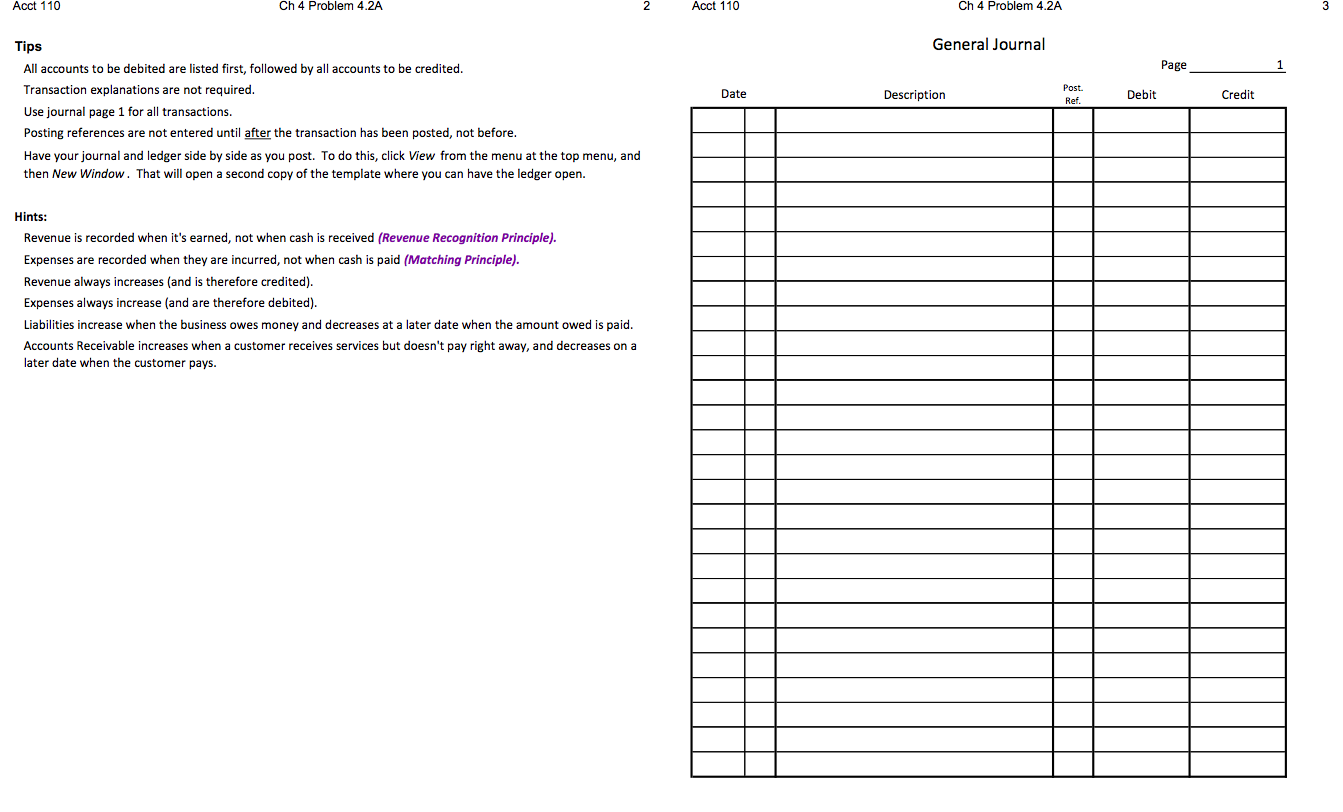

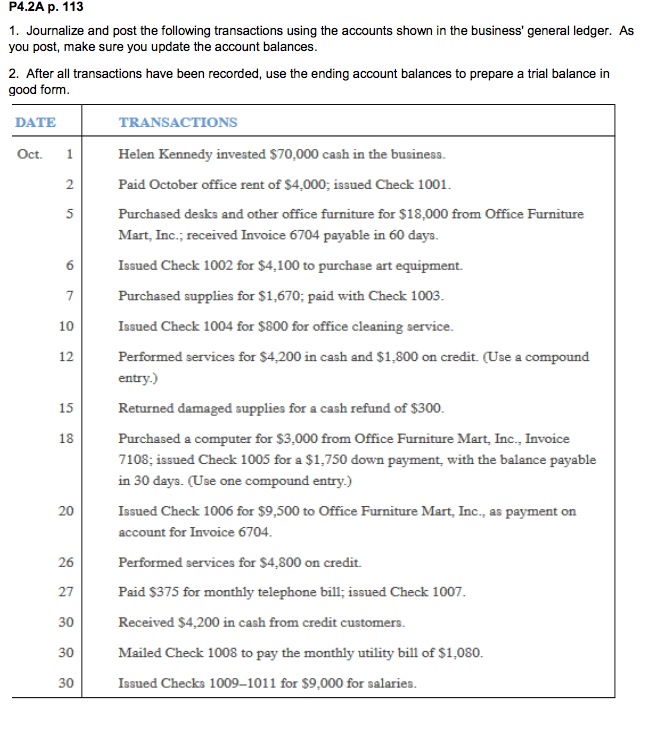

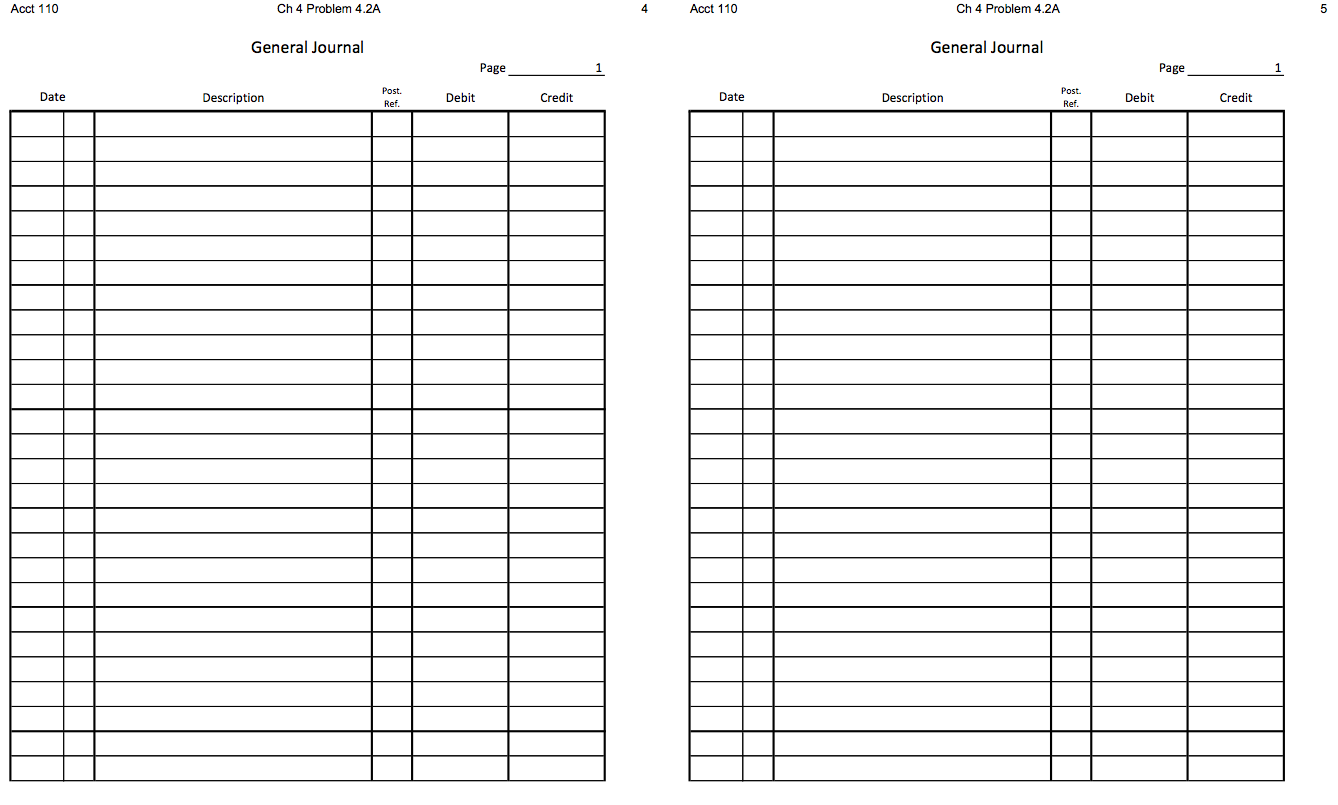

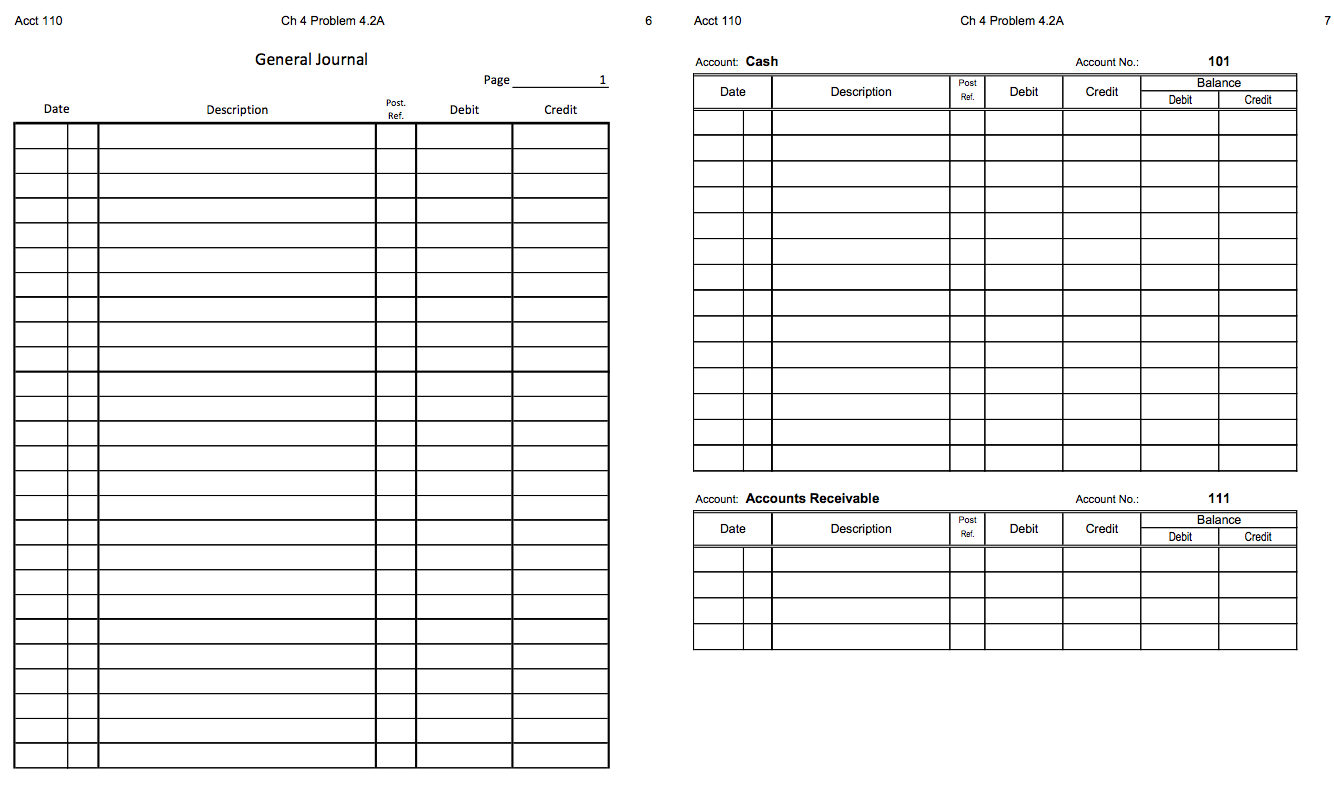

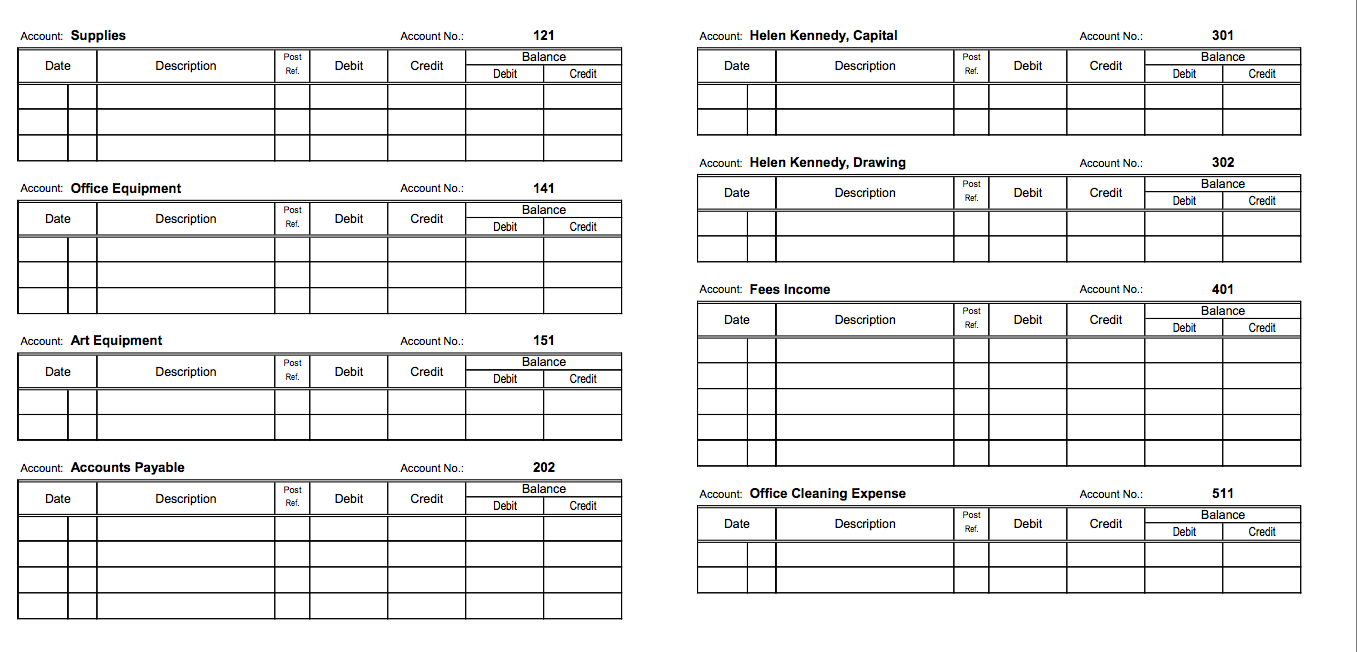

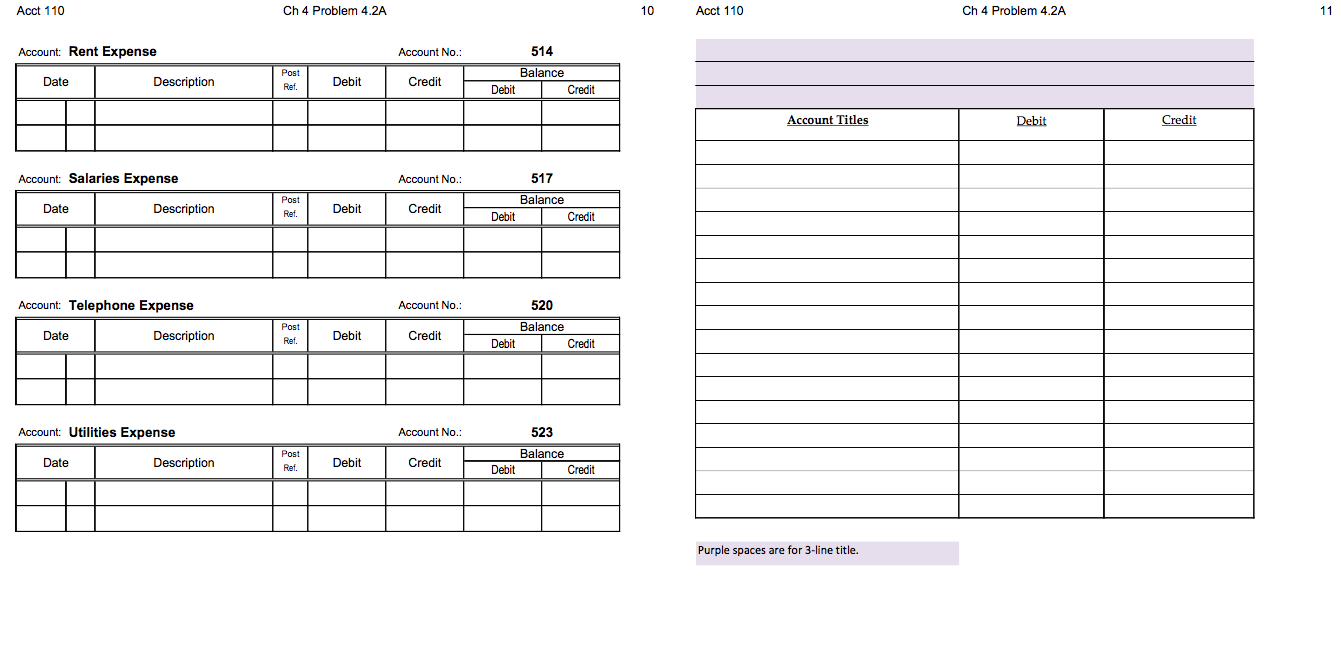

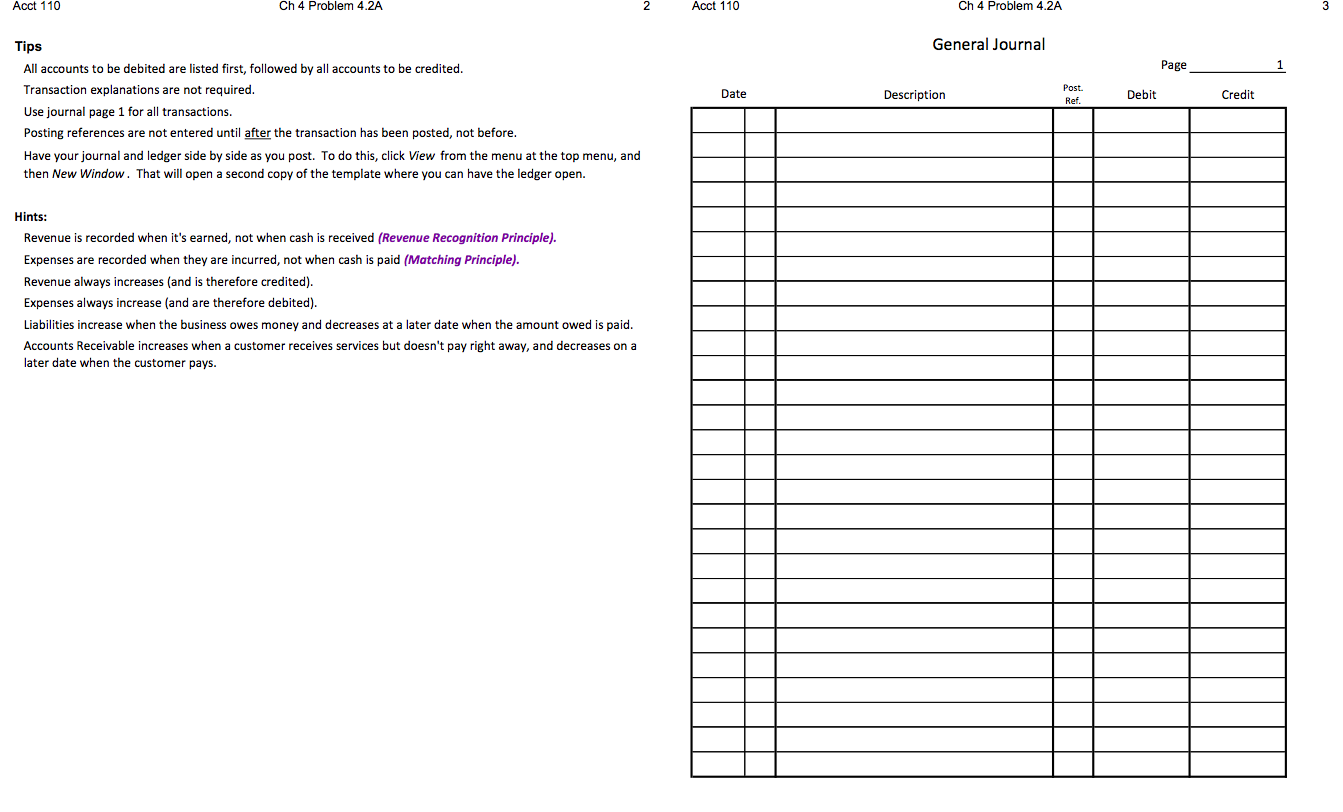

P4.2A p. 113 1. Journalize and post the following transactions using the accounts shown in the business' general ledger. As you post, make sure you update the account balances. 2. After all transactions have been recorded, use the ending account balances to prepare a trial balance in good form. DATE TRANSACTIONS Oct. 1 2 5 6 7 10 12 15 Helen Kennedy invested $70,000 cash in the business. Paid October office rent of $4.000; issued Check 1001. Purchased desks and other office furniture for $18,000 from Office Furniture Mart, Inc., received Invoice 6704 payable in 60 days. Issued Check 1002 for $4,100 to purchase art equipment Purchased supplies for $1,670; paid with Check 1003. Issued Check 1004 for $800 for office cleaning service. Performed services for $4,200 in cash and $1,800 on credit. (Use a compound entry) Returned damaged supplies for a cash refund of $300. Purchased a computer for $3,000 from Office Furniture Mart, Inc., Invoice 7108; issued Check 1005 for a $1,750 down payment with the balance payable in 30 days. (Use one compound entry) Issued Check 1006 for $9,500 to Office Furniture Mart, Inc., as payment on account for Invoice 6704. Performed services for $4.800 on credit. Paid $375 for monthly telephone bill; issued Check 1007. Received $4,200 in cash from credit customers. Mailed Check 1008 to pay the monthly utility bill of $1,080. Issued Checks 1009-1011 for $9,000 for salaries. 18 20 26 27 30 30 30 Acct 110 Ch 4 Problem 4.2A Acct 110 Acct 110 Ch 4 Problem 4.2A 5 General Journal General Journal Page Page Date Description Post. Ref Debit Credit Date Description Post Ref Debit Credit Acct 110 Ch 4 Problem 4.2A 6 Acct 110 Ch 4 Problem 4.2A General Journal Account: Cash Account No.: Page 101 Balance Debit Credit Date Post Ret. Description Debit Credit Date Description Post. Ref Debit Credit Account Accounts Receivable Account No.: 111 Date Description Post Ref Debit Credit Balance Credit Debit Account Supplies Account No.: 121 Account: Helen Kennedy, Capital Account No. 301 Date Description Post Ref. Debit Credit Balance Debit Credit Date Description Post Ref. Debit Credit Balance Credit Debit Account: Helen Kennedy, Drawing Account No.: 302 Account Office Equipment Account No. 141 Date Description Post Ref. Debit Credit Balance Credit Debit Date Description Post Ref. Debit Credit Balance Debit Credit Account: Fees Income Account No.: 401 Date Description Post Ref. Debit Credit Balance Credit Debit Account: Art Equipment Account No.: 151 Date Description Post Ref. Debit Credit Balance Credit Debit Account Accounts Payable Account No.: 202 Post Ref. Date Description Account Office Cleaning Expense Credit Balance Debit Credit 511 Debit Account No.: Date Description Post Ref. Debit Credit Balance Credit Debit Acct 110 Ch 4 Problem 4.2A 10 Acct 110 Ch 4 Problem 4.2A 11 Account Rent Expense Account No.: 514 Date Description Post Ref. Debit Credit Balance Debit Credit Account Titles Debit Credit Account: Salaries Expense Account No.: Post 517 Balance Credit Date Description Ref. Debit Credit Debit Account: Telephone Expense Account No.: 520 Date Description Post Ref. Debit Credit Balance Credit Debit Account: Utilities Expense Account No.: 523 Balance Credit Date Post Ref. Description Debit Credit Debit Purple spaces are for 3-line title Acct 110 Ch 4 Problem 4.2A Acct 110 Ch 4 Problem 4.2A General Journal Page Date Description Post. Ref. Debit Credit Tips All accounts to be debited are listed first, followed by all accounts to be credited. Transaction explanations are not required. Use journal page 1 for all transactions. Posting references are not entered until after the transaction has been posted, not before. Have your journal and ledger side by side as you post. To do this, click View from the menu at the top menu, and then New Window. That will open a second copy of the template where you can have the ledger open. Hints: Revenue is recorded when it's earned, not when cash received (Revenue Recognition Principle). Expenses are recorded when they are incurred, not when cash is paid (Matching Principle). Revenue always increases and is therefore credited). Expenses always increase (and are therefore debited). Liabilities increase when the business owes money and decreases at a later date when the amount owed is paid. Accounts Receivable increases when a customer receives services but doesn't pay right away, and decreases on a later date when the customer pays