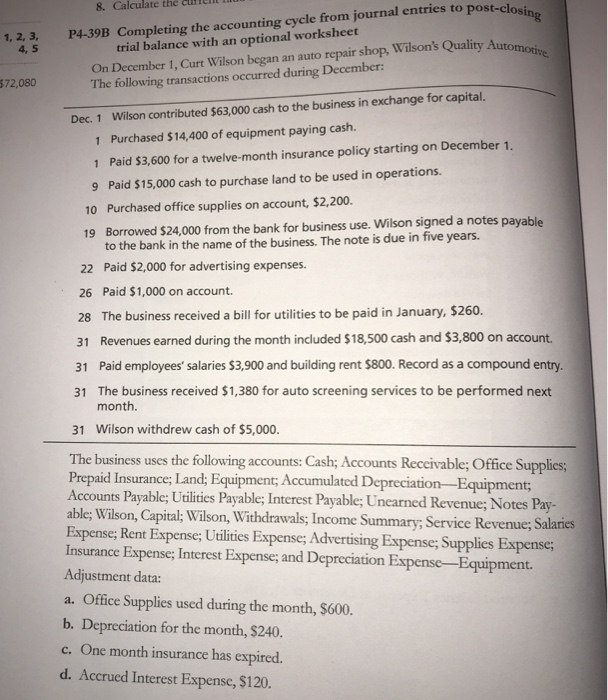

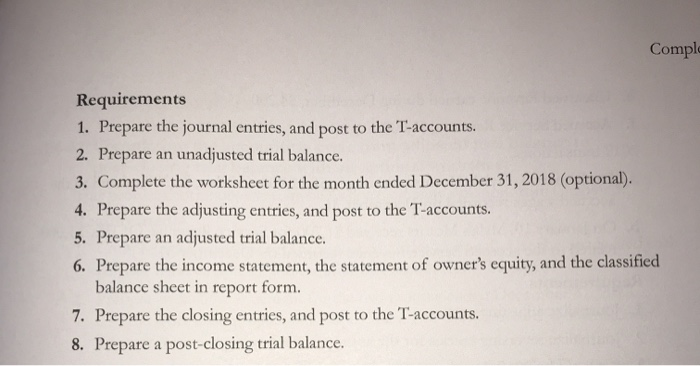

P4-39B Comple ting the accounting cycle from journal entries to post-closing optional worksheet 8. Calculate the 1, 2, 3, 4, 5 trial balance with an On December 1, Curt Wilson began an auto repair shop, Wilson's Quality Automotive. 572,080 The following transactions occurred during December: Dec. 1 Wilson contributed $63,000 cash to the business in exchange for capital. 1 Purchased $14,400 of equipment paying cash. OI 1 Paid $3,600 for a twelve-month insurance policy starting on December 1. 9 Paid $15,000 cash to purchase land to be used in operations. 10 Purchased office supplies on account, $2,200. Borrowed $24,000 from the bank for business use. Wilson signed a notes payable 19 to the bank in the name of the business. The note is due in five years. 22 Paid $2,000 for advertising expenses. 26 Paid $1,000 on account. 28 The business received a bill for utilities to be paid in January, $260. 31 Revenues earned during the month included $18,500 cash and $3,800 on account. 31 Paid employees' salaries $3,900 and building rent $800. Record as a compound entry. 31 The business received $1,380 for auto screening services to be performed next month. 31 Wilson withdrew cash of $5,000. The business uses the following accounts: Cash; Accounts Receivable; Office Supplies; Prepaid Insurance; Land; Equipment; Accumulated Depreciation -Equipment; Accounts Payable; Utilities Payable; Interest Payable; Unearned Revenue; Notes Pay able; Wilson, Capital; Wilson, Withdrawals; Income Summary; Service Revenue; Salaries Expense; Rent Expense; Utilities Expense; Advertising Expense; Supplies Expense; Insurance Expense; Interest Expense; and Depreciation Expense-Equipment. Adjustment data: a. Office Supplies used during the month, $600 b. Depreciation for the month, $240. c. One month insurance has expired. d. Accrued Interest Expense, $120. Comple Requirements 1. Prepare the journal entries, and post to the T-accounts. 2. Prepare an unadjusted trial balance. 3. Complete the worksheet for the month ended December 31, 2018 (optional). 4. Prepare the adjusting entries, and post to the T-accounts. 5. Prepare an adjusted trial balance. 6. Prepare the income statement, the statement of owner's equity, and the classified balance sheet in report form. 7. Prepare the closing entries, and post to the T-accounts. 8. Prepare a post-closing trial balance