Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P5.7. (Quarterly Tax Returns) Selected cumulative balances were taken from the records of a domestic corboration: Additional Data: 0 The corporation started its operations in

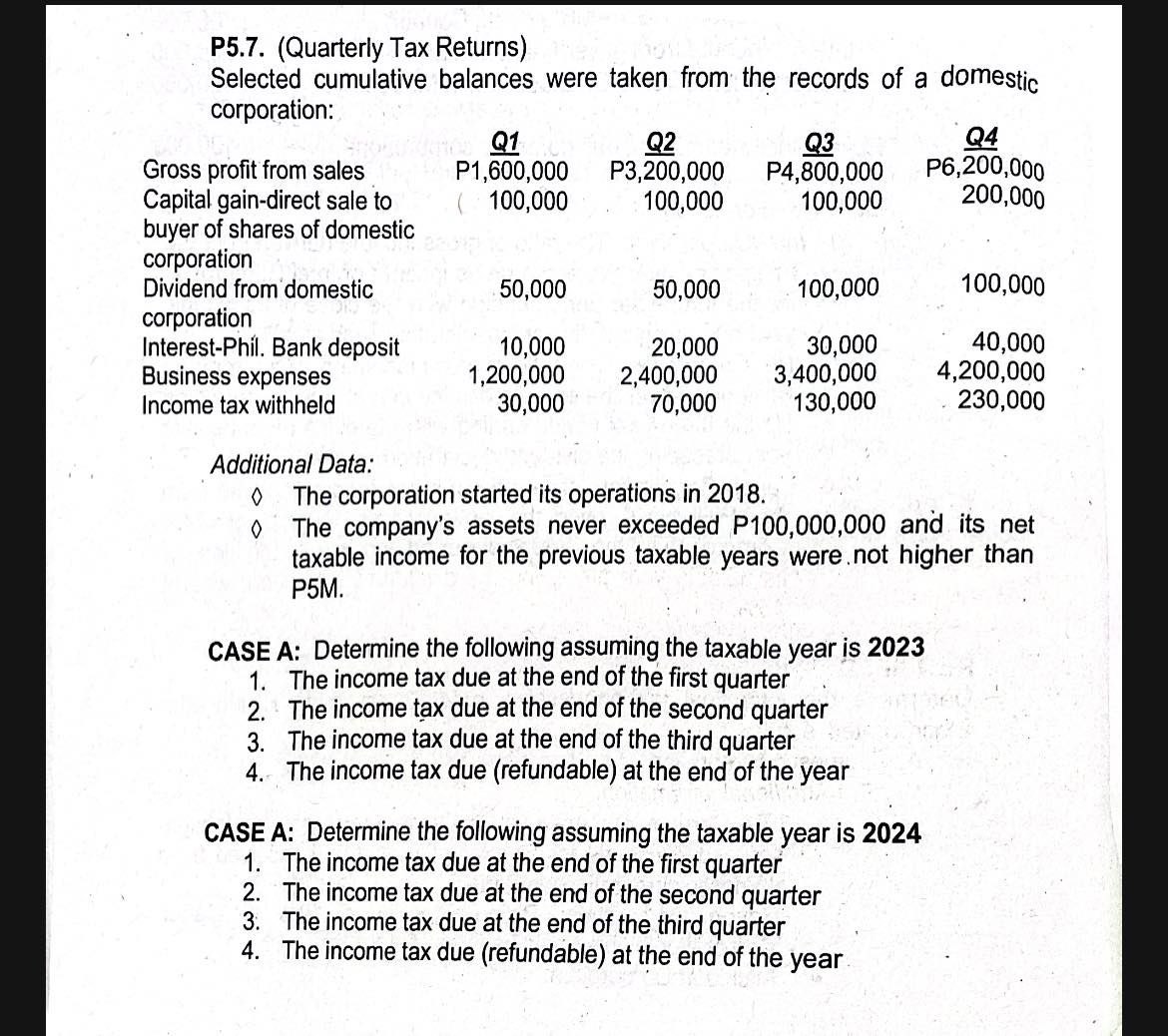

P5.7. (Quarterly Tax Returns) Selected cumulative balances were taken from the records of a domestic corboration: Additional Data: 0 The corporation started its operations in 2018. 0 The company's assets never exceeded P100,000,000 and its net taxable income for the previous taxable years were not higher than P5M. CASE A: Determine the following assuming the taxable year is 2023 1. The income tax due at the end of the first quarter 2. The income tax due at the end of the second quarter 3. The income tax due at the end of the third quarter 4. The income tax due (refundable) at the end of the year CASE A: Determine the following assuming the taxable year is 2024 1. The income tax due at the end of the first quarter 2. The income tax due at the end of the second quarter 3. The income tax due at the end of the third quarter 4. The income tax due (refundable) at the end of the year P5.7. (Quarterly Tax Returns) Selected cumulative balances were taken from the records of a domestic corboration: Additional Data: 0 The corporation started its operations in 2018. 0 The company's assets never exceeded P100,000,000 and its net taxable income for the previous taxable years were not higher than P5M. CASE A: Determine the following assuming the taxable year is 2023 1. The income tax due at the end of the first quarter 2. The income tax due at the end of the second quarter 3. The income tax due at the end of the third quarter 4. The income tax due (refundable) at the end of the year CASE A: Determine the following assuming the taxable year is 2024 1. The income tax due at the end of the first quarter 2. The income tax due at the end of the second quarter 3. The income tax due at the end of the third quarter 4. The income tax due (refundable) at the end of the year

P5.7. (Quarterly Tax Returns) Selected cumulative balances were taken from the records of a domestic corboration: Additional Data: 0 The corporation started its operations in 2018. 0 The company's assets never exceeded P100,000,000 and its net taxable income for the previous taxable years were not higher than P5M. CASE A: Determine the following assuming the taxable year is 2023 1. The income tax due at the end of the first quarter 2. The income tax due at the end of the second quarter 3. The income tax due at the end of the third quarter 4. The income tax due (refundable) at the end of the year CASE A: Determine the following assuming the taxable year is 2024 1. The income tax due at the end of the first quarter 2. The income tax due at the end of the second quarter 3. The income tax due at the end of the third quarter 4. The income tax due (refundable) at the end of the year P5.7. (Quarterly Tax Returns) Selected cumulative balances were taken from the records of a domestic corboration: Additional Data: 0 The corporation started its operations in 2018. 0 The company's assets never exceeded P100,000,000 and its net taxable income for the previous taxable years were not higher than P5M. CASE A: Determine the following assuming the taxable year is 2023 1. The income tax due at the end of the first quarter 2. The income tax due at the end of the second quarter 3. The income tax due at the end of the third quarter 4. The income tax due (refundable) at the end of the year CASE A: Determine the following assuming the taxable year is 2024 1. The income tax due at the end of the first quarter 2. The income tax due at the end of the second quarter 3. The income tax due at the end of the third quarter 4. The income tax due (refundable) at the end of the year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started