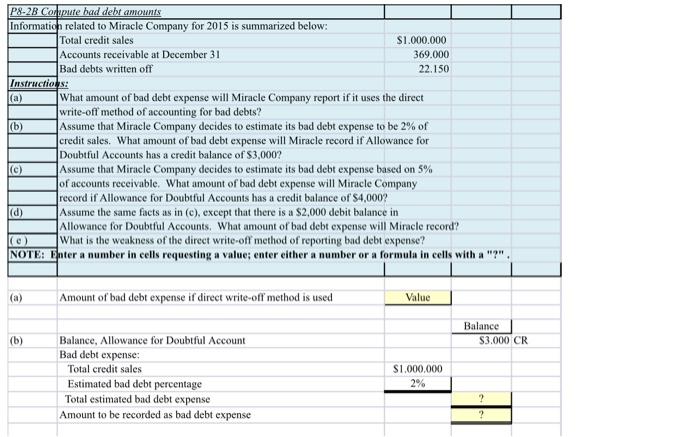

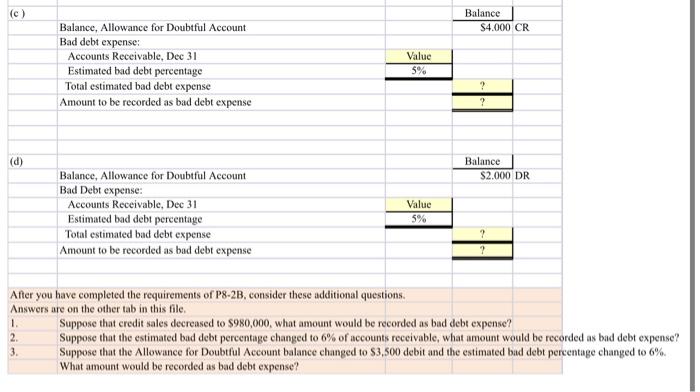

P8-2B Compute bad deht amounts Information related to Miracle Company for 2015 is summarized below: Total credit sales S1.000.000 Accounts receivable at December 31 369.000 Bad debts written of 22.150 Instructions: (a) What amount of bad debt expense will Miracle Company report if it uses the direct write-off ' method of accounting for bad debts? (b) Assume that Miracle Company decides to estimate its bad debt expense to be 2% of credit sales. What amount of bad debt expense will Miracle record if Allowance for Doubtful Accounts has a credit balance of $3,000? (e) Assume that Miracle Company decides to estimate its bad debt expense based on 5% of accounts receivable. What amount of bad debt expense will Miracle Company record if Allowance for Doubtful Accounts has a credit balance of $4,000? (d) Assume the same facts as in (c), except that there is a $2,000 debit balance in Allowance for Doubtful Accounts. What amount of bad debt expense will Miracle record? (0) What is the weakness of the direct write-off method of reporting bad debt expense? NOTE: Enter a number in cells requesting a value: enter either a number or a formula in cells with a "?", (a) Amount of bad debt expense if direct write-off' method is used Value Balance $3.000 CR (b) $1.000.000 Balance, Allowance for Doubtful Account Bad debt expense: Total credit sales Estimated bad debt percentage Total estimated bad debt expense Amount to be recorded as bad debt expense 470 (c) Balance $4.000 CR Balance, Allowance for Doubtful Account Bad debt expense: Accounts Receivable, Dec 31 Estimated bad debt percentage Total estimated bad debt expense Amount to be recorded as bad debt expense Value 5% ? ? (d) Balance $2.000 DR Balance, Allowance for Doubtful Account Bad Debt expense: Accounts Receivable, Dec 31 Estimated bad debt percentage Total estimated bad debt expense Amount to be recorded as bad debt expense Value 5% 1. 2. 3. After you have completed the requirements of P8-2B, consider these additional questions. Answers are on the other tab in this file Suppose that credit sales decreased to $980,000, what amount would be recorded as bad debt expense? Suppose that the estimated bad debt percentage changed to 6% of accounts receivable, what amount would be recorded as bad debt expense? Suppose that the Allowance for Doubtful Account balance changed to $3,500 debit and the estimated bad debt percentage changed to 6% What amount would be recorded as bad debt expense