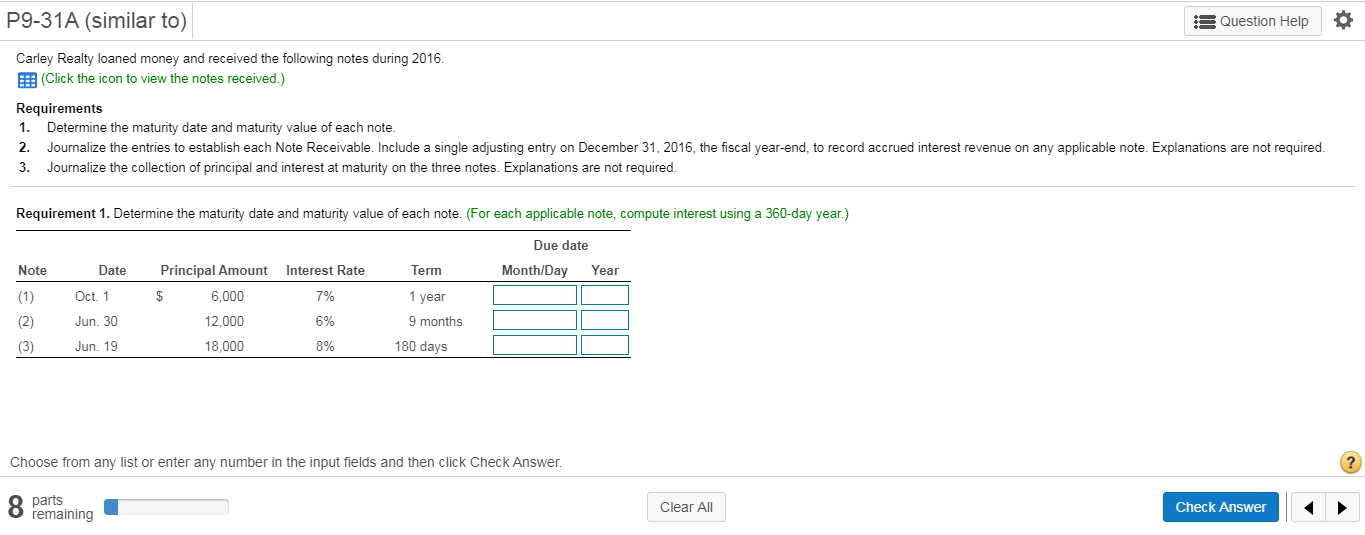

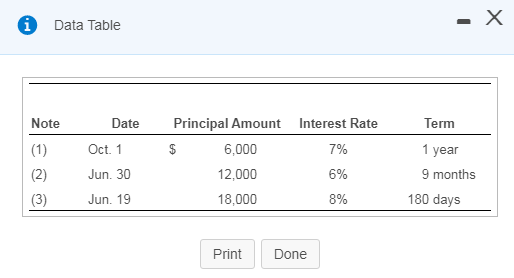

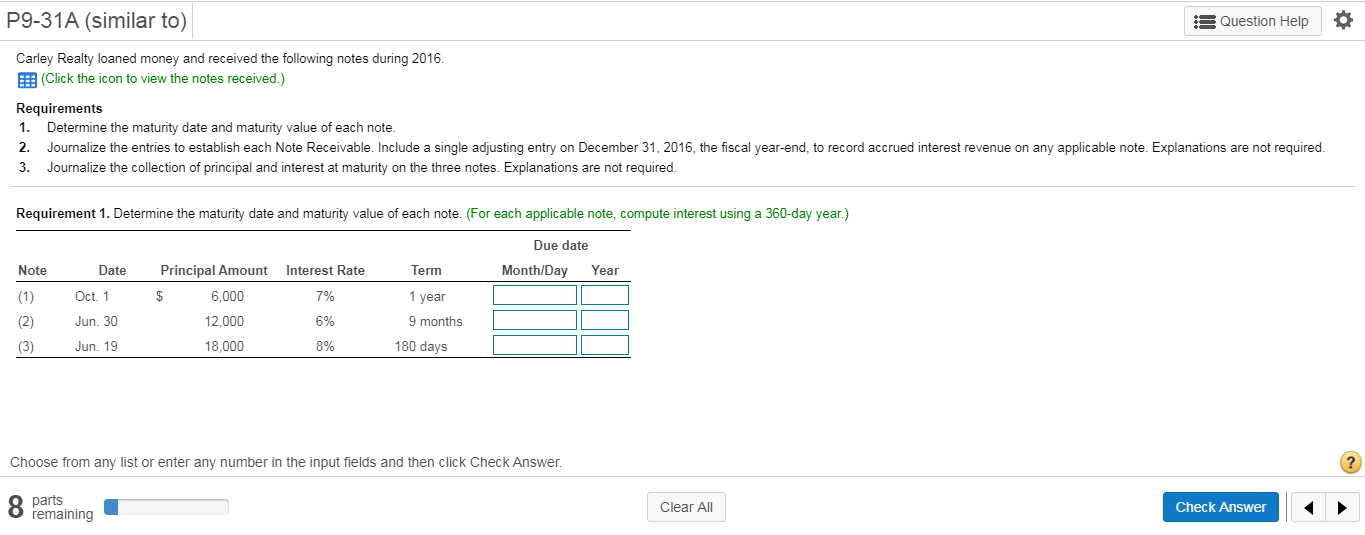

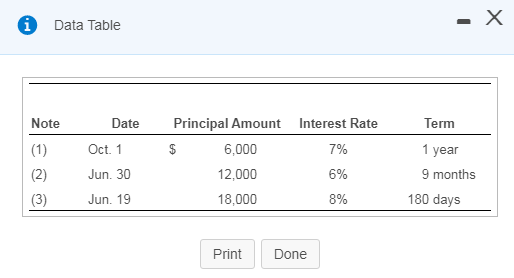

P9-31A (similar to) :3 Question Help Carley Realty loaned money and received the following notes during 2016 E: (Click the icon to view the notes received.) Requirements 1. Determine the maturity date and maturity value of each note. 2. Journalize the entries to establish each Note Receivable. Include a single adjusting entry on December 31, 2016, the fiscal year-end, to record accrued interest revenue on any applicable note. Explanations are not required. 3. Journalize the collection of principal and interest at maturity on the three notes. Explanations are not required. Requirement 1. Determine the maturity date and maturity value of each note. (For each applicable note, compute interest using a 360-day year.) Note Date Oct. 1 Jun. 30 Jun. 19 Principal Amount Interest Rate $ 6,000 7% 12,000 6% 1 8,000 8% Term 1 year C 9 months 180 days Due date Month/Day Year D (2) (3) Choose from any list or enter any number in the input fields and then click Check Answer. s parts Clear All Check Answer O remaining O X - Data Table Term Note (1) Date Oct. 1 Jun. 30 Jun. 19 Principal Amount $ 6,000 12,000 18,000 Interest Rate 7% 6% 8% 1 year 9 months 180 days Print Done P9-31A (similar to) :3 Question Help Carley Realty loaned money and received the following notes during 2016 E: (Click the icon to view the notes received.) Requirements 1. Determine the maturity date and maturity value of each note. 2. Journalize the entries to establish each Note Receivable. Include a single adjusting entry on December 31, 2016, the fiscal year-end, to record accrued interest revenue on any applicable note. Explanations are not required. 3. Journalize the collection of principal and interest at maturity on the three notes. Explanations are not required. Requirement 1. Determine the maturity date and maturity value of each note. (For each applicable note, compute interest using a 360-day year.) Note Date Oct. 1 Jun. 30 Jun. 19 Principal Amount Interest Rate $ 6,000 7% 12,000 6% 1 8,000 8% Term 1 year C 9 months 180 days Due date Month/Day Year D (2) (3) Choose from any list or enter any number in the input fields and then click Check Answer. s parts Clear All Check Answer O remaining O X - Data Table Term Note (1) Date Oct. 1 Jun. 30 Jun. 19 Principal Amount $ 6,000 12,000 18,000 Interest Rate 7% 6% 8% 1 year 9 months 180 days Print Done