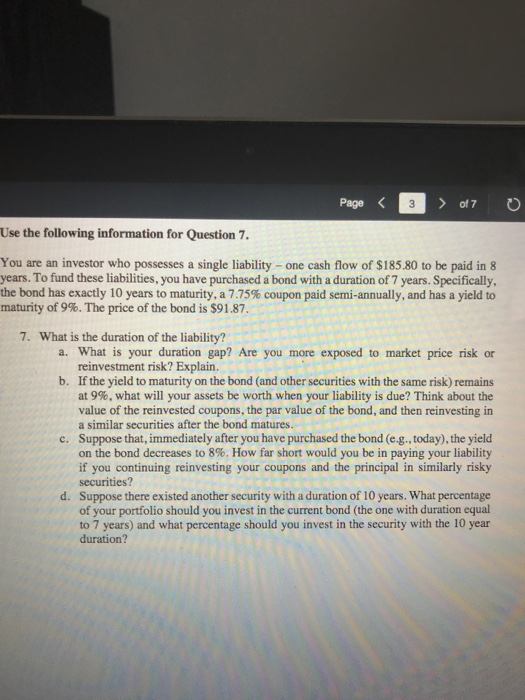

Page 017 0 Use the following information for Question 7. You are an investor who possesses a single liability - one cash flow of $185.80 to be paid in 8 years. To fund these liabilities, you have purchased a bond with a duration of 7 years. Specifically, the bond has exactly 10 years to maturity, a 7.75% coupon paid semi-annually, and has a yield to maturity of 9%. The price of the bond is $91.87. 7. What is the duration of the liability? a. What is your duration gap? Are you more exposed to market price risk or reinvestment risk? Explain. b. If the yield to maturity on the bond (and other securities with the same risk) remains at 9%, what will your assets be worth when your liability is due? Think about the value of the reinvested coupons, the par value of the bond, and then reinvesting in a similar securities after the bond matures. c. Suppose that, immediately after you have purchased the bond (e.g., today), the yield on the bond decreases to 8%. How far short would you be in paying your liability if you continuing reinvesting your coupons and the principal in similarly risky securities? d. Suppose there existed another security with a duration of 10 years. What percentage of your portfolio should you invest in the current bond (the one with duration equal to 7 years) and what percentage should you invest in the security with the 10 year duration? Page 017 0 Use the following information for Question 7. You are an investor who possesses a single liability - one cash flow of $185.80 to be paid in 8 years. To fund these liabilities, you have purchased a bond with a duration of 7 years. Specifically, the bond has exactly 10 years to maturity, a 7.75% coupon paid semi-annually, and has a yield to maturity of 9%. The price of the bond is $91.87. 7. What is the duration of the liability? a. What is your duration gap? Are you more exposed to market price risk or reinvestment risk? Explain. b. If the yield to maturity on the bond (and other securities with the same risk) remains at 9%, what will your assets be worth when your liability is due? Think about the value of the reinvested coupons, the par value of the bond, and then reinvesting in a similar securities after the bond matures. c. Suppose that, immediately after you have purchased the bond (e.g., today), the yield on the bond decreases to 8%. How far short would you be in paying your liability if you continuing reinvesting your coupons and the principal in similarly risky securities? d. Suppose there existed another security with a duration of 10 years. What percentage of your portfolio should you invest in the current bond (the one with duration equal to 7 years) and what percentage should you invest in the security with the 10 year duration