Question: Question 1 (30 points) Consider the following two-factor model for the returns of three well-diversified assets (i.e., with no idiosyncratic risk): TA = 0.01-3F

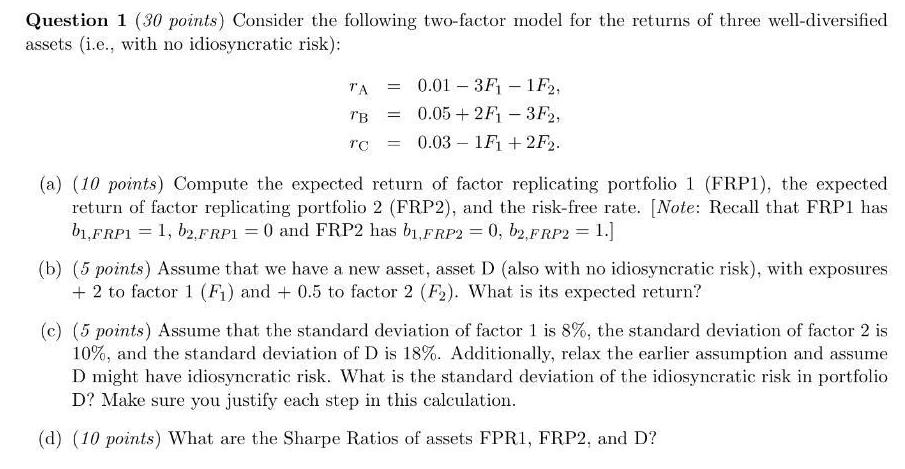

Question 1 (30 points) Consider the following two-factor model for the returns of three well-diversified assets (i.e., with no idiosyncratic risk): TA = 0.01-3F - 1F2, 0.05+2F13F2, TB = TC = 0.03 1F1+2F2. (a) (10 points) Compute the expected return of factor replicating portfolio 1 (FRP1), the expected return of factor replicating portfolio 2 (FRP2), and the risk-free rate. [Note: Recall that FRP1 has b1,FRP1 = 1, b2,FRP1 = 0 and FRP2 has b1,FRP2 = 0, b2, FRP2 = 1.] (b) (5 points) Assume that we have a new asset, asset D (also with no idiosyncratic risk), with exposures + 2 to factor 1 (F) and + 0.5 to factor 2 (F). What is its expected return? (c) (5 points) Assume that the standard deviation of factor 1 is 8%, the standard deviation of factor 2 is 10%, and the standard deviation of D is 18%. Additionally, relax the earlier assumption and assume D might have idiosyncratic risk. What is the standard deviation of the idiosyncratic risk in portfolio D? Make sure you justify each step in this calculation. (d) (10 points) What are the Sharpe Ratios of assets FPR1, FRP2, and D?

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

a The expected return of FR P 1 is 0 01 the expected return of FR P 2 is 0 05 and the risk free rat... View full answer

Get step-by-step solutions from verified subject matter experts