Answered step by step

Verified Expert Solution

Question

1 Approved Answer

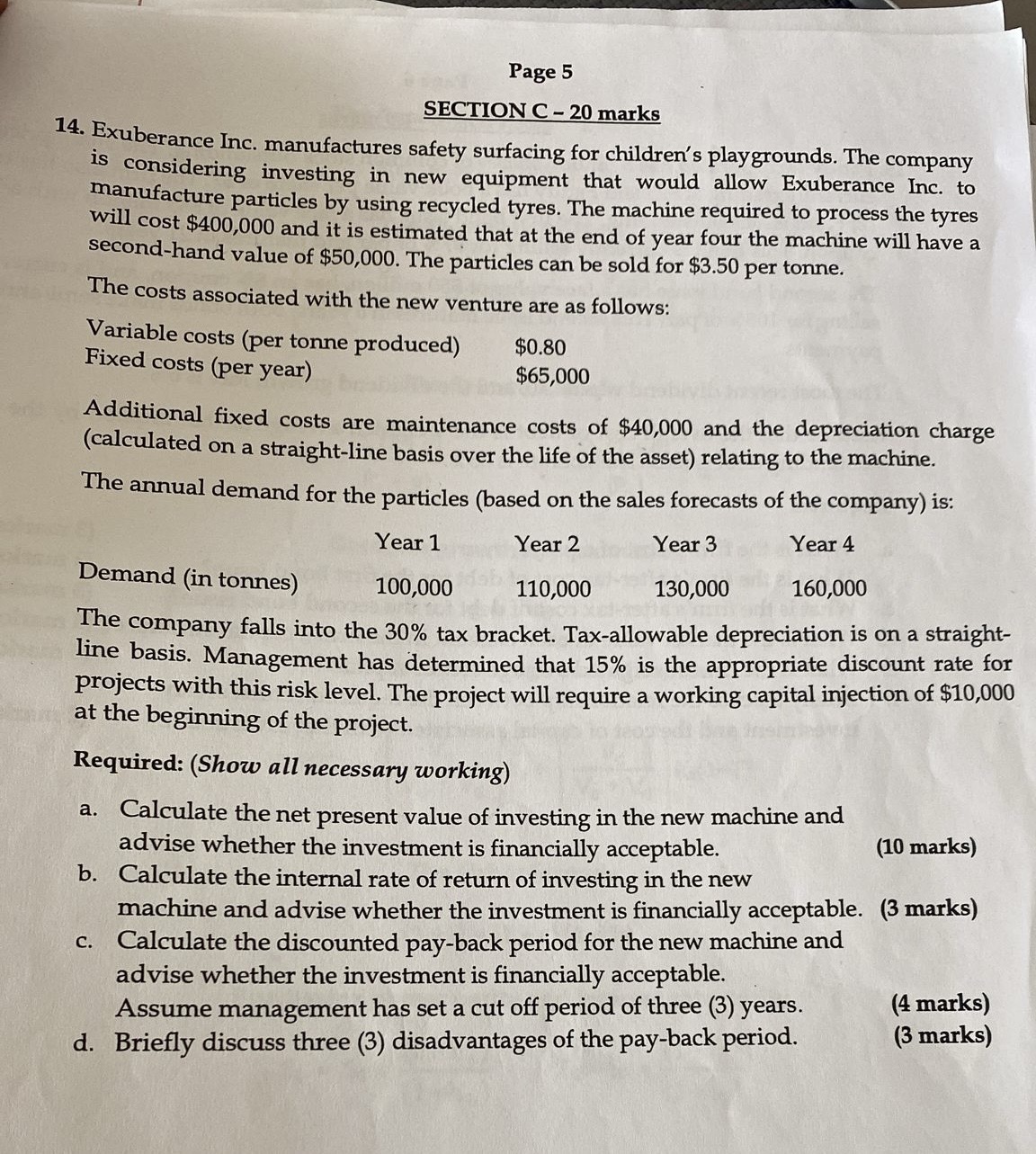

Page 5 SECTION C - 2 0 marks Exuberance Inc. manufactures safety surfacing for children's playgrounds. The company is considering investing in new equipment that

Page

SECTION C marks

Exuberance Inc. manufactures safety surfacing for children's playgrounds. The company

is considering investing in new equipment that would allow Exuberance Inc. to

manufacture particles by using recycled tyres. The machine required to process the tyres

will cost $ and it is estimated that at the end of year four the machine will have a

secondhand value of $ The particles can be sold for $ per tonne.

The costs associated with the new venture are as follows:

Variable costs per tonne produced$

Fixed costs per year $

Additional fixed costs are maintenance costs of $ and the depreciation charge

calculated on a straightline basis over the life of the asset relating to the machine.

The annual demand for the particles based on the sales forecasts of the company is:

The company falls into the tax bracket. Taxallowable depreciation is on a straight

line basis. Management has determined that is the appropriate discount rate for

projects with this risk level. The project will require a working capital injection of $

at the beginning of the project.

Required: Show all necessary working

a Calculate the net present value of investing in the new machine and

advise whether the investment is financially acceptable.

b Calculate the internal rate of return of investing in the new

machine and advise whether the investment is financially acceptable.

marks

c Calculate the discounted payback period for the new machine and

advise whether the investment is financially acceptable.

Assume management has set a cut off period of three years.

d Briefly discuss three disadvantages of the payback period.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started