Answered step by step

Verified Expert Solution

Question

1 Approved Answer

page 9 STAFF DISCUSSION OF THE RISK OF MATERIAL MISSTATEMENT DUE TO FRAUD 10. Prior to or while obtaining information to identify risks of fraud

page 9

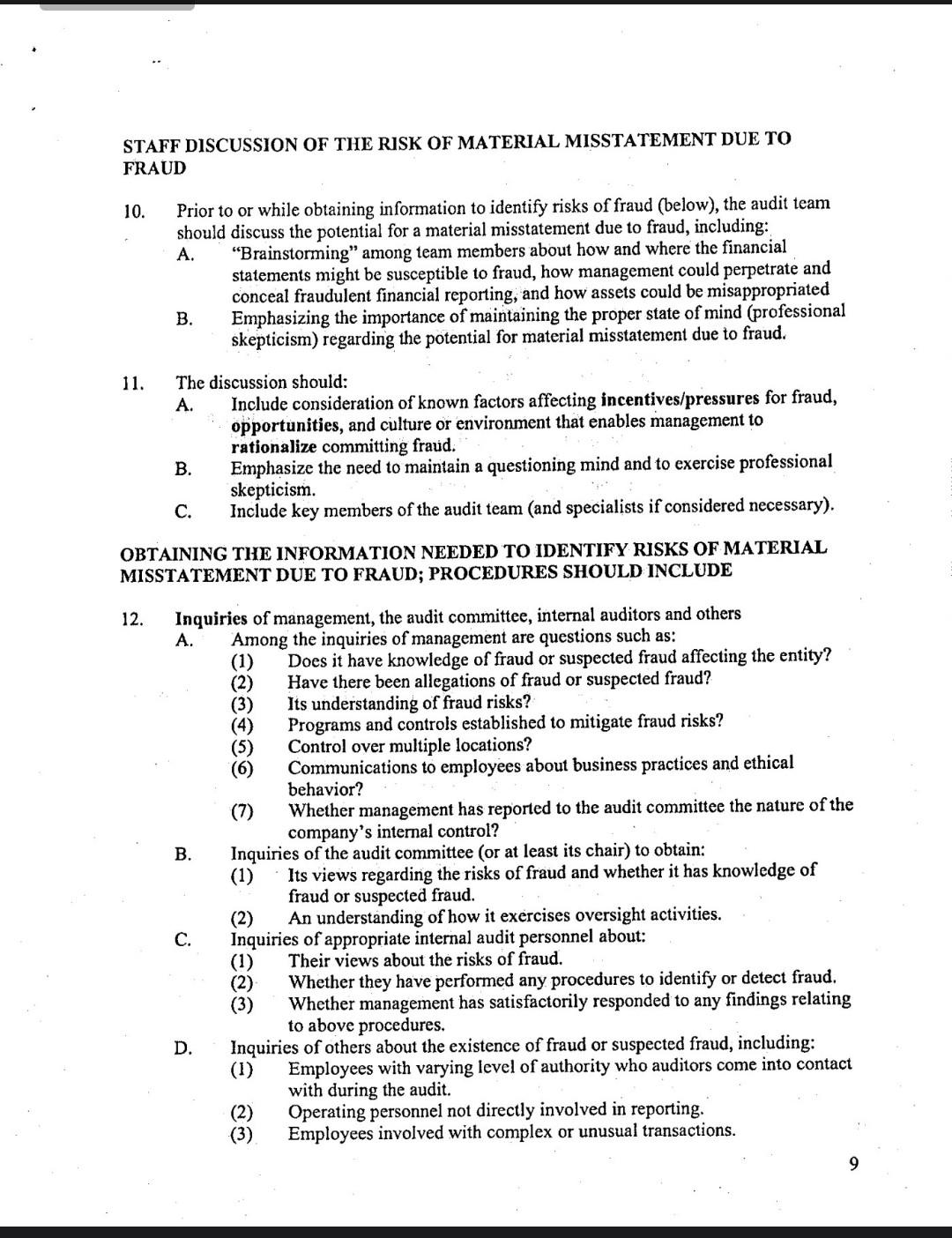

STAFF DISCUSSION OF THE RISK OF MATERIAL MISSTATEMENT DUE TO FRAUD 10. Prior to or while obtaining information to identify risks of fraud (below), the audit team should discuss the potential for a material misstatement due to fraud, including: A. "Brainstorming" among team members about how and where the financial statements might be susceptible to fraud, how management could perpetrate and conceal fraudulent financial reporting, and how assets could be misappropriated B. Emphasizing the importance of maintaining the proper state of mind (professional skepticism) regarding the potential for material misstatement due to fraud. 11. The discussion should: A. Include consideration of known factors affecting incentives/pressures for fraud, opportunities, and culture or environment that enables management to rationalize committing fraud. B. Emphasize the need to maintain a questioning mind and to exercise professional skepticism. C. Include key members of the audit team (and specialists if considered necessary). OBTAINING THE INFORMATION NEEDED TO IDENTIFY RISKS OF MATERIAL MISSTATEMENT DUE TO FRAUD; PROCEDURES SHOULD INCLUDE 12. Inquiries of management, the audit committee, internal auditors and others A. Among the inquiries of management are questions such as: (1) Does it have knowledge of fraud or suspected fraud affecting the entity? (2) Have there been allegations of fraud or suspected fraud? (3) Its understanding of fraud risks? (4) Programs and controls established to mitigate fraud risks? (5) Control over multiple locations? (6) Communications to employees about business practices and ethical behavior? (7) Whether management has reported to the audit committee the nature of the company's internal control? B. Inquiries of the audit committee (or at least its chair) to obtain: (1) Its views regarding the risks of fraud and whether it has knowledge of fraud or suspected fraud. (2) An understanding of how it exercises oversight activities. C. Inquiries of appropriate internal audit personnel about: (1) Their views about the risks of fraud. (2) Whether they have performed any procedures to identify or detect fraud. (3) Whether management has satisfactorily responded to any findings relating to above procedures. D. Inquiries of others about the existence of fraud or suspected fraud, including: (1) Employees with varying level of authority who auditors come into contact with during the audit. (2) Operating personnel not directly involved in reporting. (3) Employees involved with complex or unusual transactions. 9 STAFF DISCUSSION OF THE RISK OF MATERIAL MISSTATEMENT DUE TO FRAUD 10. Prior to or while obtaining information to identify risks of fraud (below), the audit team should discuss the potential for a material misstatement due to fraud, including: A. "Brainstorming" among team members about how and where the financial statements might be susceptible to fraud, how management could perpetrate and conceal fraudulent financial reporting, and how assets could be misappropriated B. Emphasizing the importance of maintaining the proper state of mind (professional skepticism) regarding the potential for material misstatement due to fraud. 11. The discussion should: A. Include consideration of known factors affecting incentives/pressures for fraud, opportunities, and culture or environment that enables management to rationalize committing fraud. B. Emphasize the need to maintain a questioning mind and to exercise professional skepticism. C. Include key members of the audit team (and specialists if considered necessary). OBTAINING THE INFORMATION NEEDED TO IDENTIFY RISKS OF MATERIAL MISSTATEMENT DUE TO FRAUD; PROCEDURES SHOULD INCLUDE 12. Inquiries of management, the audit committee, internal auditors and others A. Among the inquiries of management are questions such as: (1) Does it have knowledge of fraud or suspected fraud affecting the entity? (2) Have there been allegations of fraud or suspected fraud? (3) Its understanding of fraud risks? (4) Programs and controls established to mitigate fraud risks? (5) Control over multiple locations? (6) Communications to employees about business practices and ethical behavior? (7) Whether management has reported to the audit committee the nature of the company's internal control? B. Inquiries of the audit committee (or at least its chair) to obtain: (1) Its views regarding the risks of fraud and whether it has knowledge of fraud or suspected fraud. (2) An understanding of how it exercises oversight activities. C. Inquiries of appropriate internal audit personnel about: (1) Their views about the risks of fraud. (2) Whether they have performed any procedures to identify or detect fraud. (3) Whether management has satisfactorily responded to any findings relating to above procedures. D. Inquiries of others about the existence of fraud or suspected fraud, including: (1) Employees with varying level of authority who auditors come into contact with during the audit. (2) Operating personnel not directly involved in reporting. (3) Employees involved with complex or unusual transactions. 9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started