Answered step by step

Verified Expert Solution

Question

1 Approved Answer

page numbers on bottom of page 3. On Page 36, under the section Break-Even Analysis, please calculate the breakeven point if the sales price decrease

page numbers on bottom of page

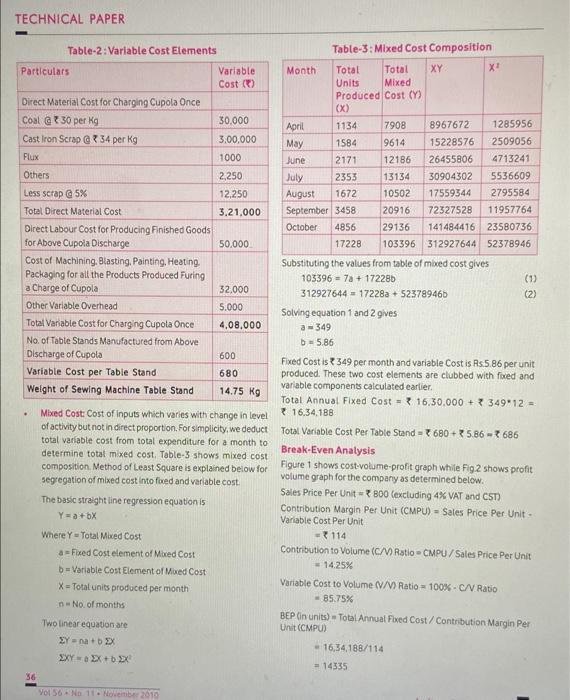

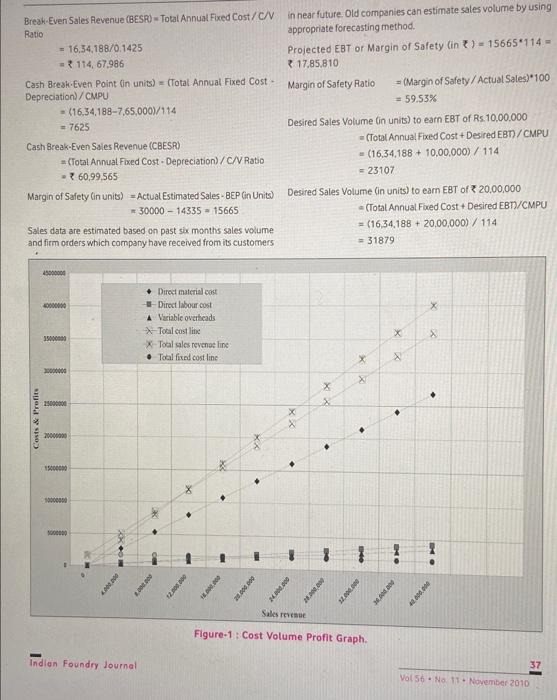

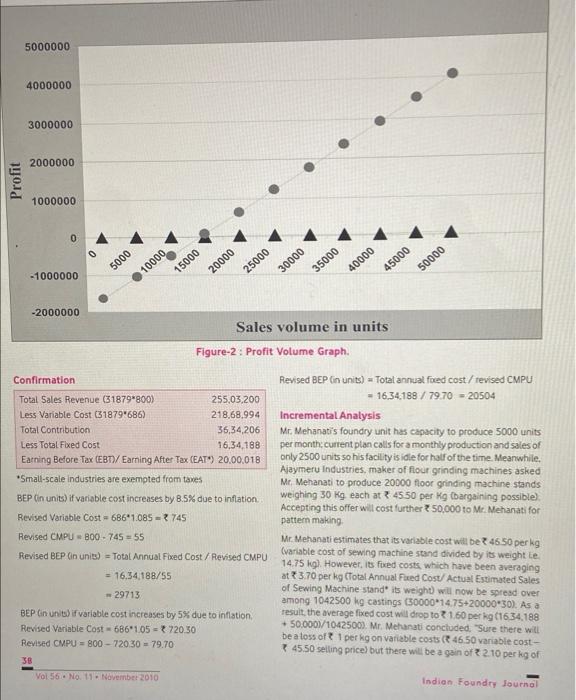

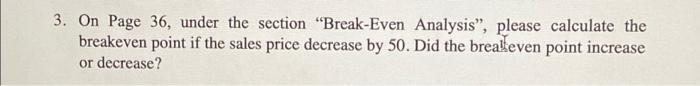

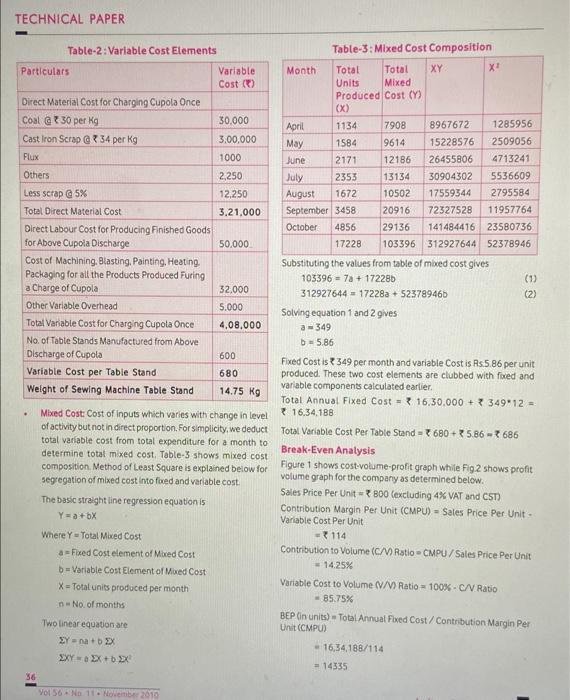

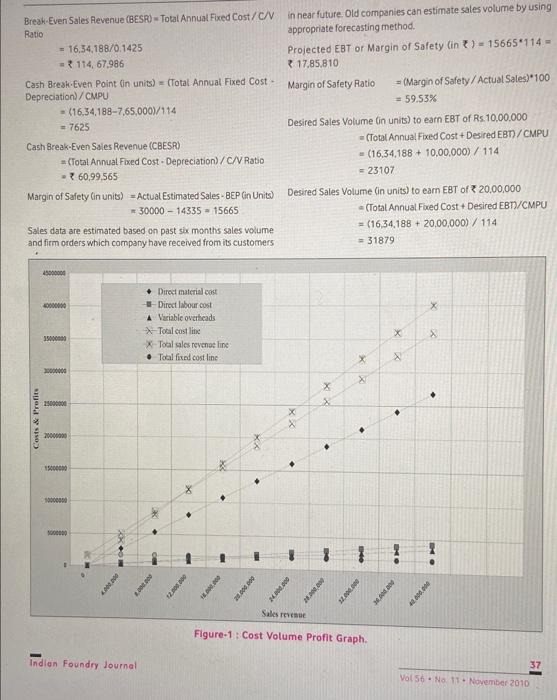

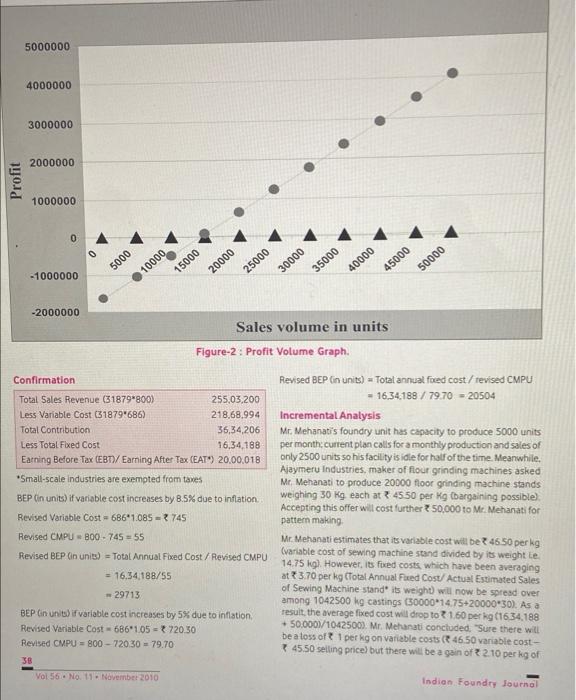

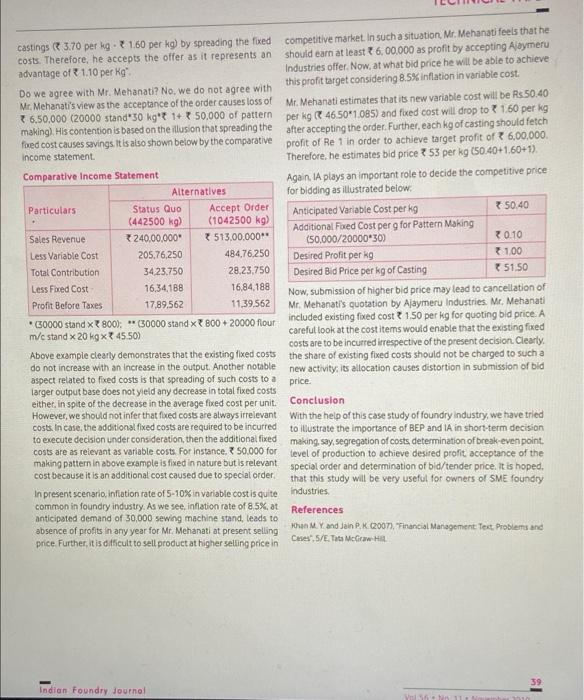

3. On Page 36, under the section "Break-Even Analysis, please calculate the breakeven point if the sales price decrease by 50. Did the brealeven point increase or decrease? TECHNICAL PAPER XY x4 Flux Table-2: Variable Cost Elements Table-3: Mixed Cost Composition Particulars Variable Month Total Total Cost ) Units Mixed Produced Cost (Y) Direct Material Cost for Charging Cupola Once (x) Coal 30 per kg 30.000 April 1134 7908 8967672 1285956 Cast Iron Scrap @34 per kg 3,00,000 May 1584 9614 15228576 2509056 1000 June 2171 12186 26455806 4713241 Others 2,250 July 2353 13134 30904302 5536609 Less scrap 5% 12,250 August 1672 10502 17559344 2795584 Total Direct Material Cost 3.21,000 September 3458 20916 72327528 11957764 Direct Labour Cost for Producing Finished Goods October 4856 29136 141484416 23580736 for Above Cupola Discharge 50.000 17228 103396 312927644 52378946 Cost of Machining. Blasting, Painting, Heating, Substituting the values from table of mixed cost gives Packaging for all the Products Produced Furing 103396 = 7a + 172280 (1) a Charge of Cupola 32.000 312927644 = 17228a + 523789461 (2) Other Variable Overhead 5.000 Solving equation 1 and 2 gives Total Vanable Cost for Charging Cupola Once 4,08,000 a 349 No. of Table Stands Manufactured from Above b = 5,86 Discharge of Cupola 600 Fixed Cost is 349 per month and variable Cost is Rs.5.86 per unit Variable Cost per Table Stand 680 produced. These two cost elements are clubbed with fixed and Weight of Sewing Machine Table Stand 14.75 kg variable components calculated earlier Total Annual Fixed Cost - ? 16,30,000 + 34912 - Mixed Cost: Cost of inputs which varies with change in level 16.34,188 of activity but not in direct proportion. For simplicity, we deduct Total Variable Cost Per Table Stand 680+25.86 -2686 total variable cost from total expenditure for a month to Break-Even Analysis determine total mixed cost. Table-3 shows mixed cost composition, Method of Least Square is explained below for Figure 1 shows cost-volume-profit graph while Fig2 shows profit segregation of mixed cost into fored and variable cost volume graph for the company as determined below. Sales Price Per Unit = 3800 (excluding 4% VAT and CST) The basic straight line regression equation is Contribution Margin Per Unit (CMPU) - Sales Price Per Unit - Y = a +bX Variable Cost Per Unit Where Y-Total Mixed Cost - 114 a Fixed Cost element of Maced Cost Contribution to Volume (c/) Ratio - CMPU / Sales Price Per Unit 14.25% b = Variable Cost Element of Med Cost Variable Cost to Volume (V/V)Ratio = 100%-CN Ratio X - Total units produced per month 85.75% n No. of months BEP Un units) - Total Annual Foxed Cost/Contribution Margin Per Two linear equation are Unit (CMPC) 2 + 16,34,188/114 - + = 14335 36 Vol 5 ND 11 November 2010 Break-Even Sales Revenue (BESR) - Total Annual Fixed Cost/C/ Ratio = 16.54,18B/0.1425 = 114,67.986 Cash Break Even Point On units) = (Total Annual Fixed Cost. Depreciation)/CMPU = (16,34,188-7,65,000//114 = 7625 in near future. Old companies can estimate sales volume by using appropriate forecasting method. Projected EBT or Margin of Safety in ) - 15665*114 - * 17,85,810 Margin of Safety Ratio =(Margin of Safety/Actual Sales)"100 = 59.53% Cash Break-Even Sales Revenue (CBESR) = (Total Annual Foxed Cost - Depreciation)/C/V Ratio - 60.99,565 Margin of Safety in units) = Actual Estimated Sales - BEP Gn Units) * 30000 - 14335 - 15665 Sales data are estima based on past six months sales volume and firm orders which company have received from its customers Desired Sales Volume (in units) to earn EBT of Rs. 10,00.000 - (Total Annual Fixed Cost + Desired EBT/CMPU - (16,34,188 + 10,00,000) / 114 = 23107 Desired Sales Volume in units) to earn EBT of 20,00,000 - (Total Annual Foxed Cost + Desired EBTI/CMPU = (16,34,188 + 20,00,000) / 114 = 31879 4500000 000000 X + Direct material cost Direct labour cost A Variable overheads -> Tocal cost line Toal sales reveno line Tocal fixed cost line X X 300000 x 0000000 X 25000001 X Costs & Profit X 20000000 19200000 X X 10000000 . 000000 8 ON A . 2. 2.000.000 ON . Sales Figure-1: Cost Volume Profit Graph, Indian Foundry Journal 37 Vol 56. Na 11. November 2010 5000000 4000000 3000000 2000000 Profit 1000000 5000 -1000000 10000 15000 20000 25000 30000 35000 40000 50000 45000 -2000000 Sales volume in units Figure-2: Profit Volume Graph. Confirmation Total Sales Revenue (31879*800) 255,03,200 Less Variable Cost (31879'686) 218.68.994 Total Contribution 36,34,206 Less Total Fixed Cost 16,34,188 Earning Before Tax (EBD/Earning After Tax (EAT) 20,00,018 *Small-scale industries are exempted from taxes BEP in units) if variable cost increases by 8.5% due to inflation Revised Variable Cost = 686*1.085 - 745 Revised CMPU B00 - 745 55 Revised BEP Un units) - Total Annual Fixed Cost / Revised CMPU = 16.34 188/55 29713 Revised BEP on units) = Total annual foed cost / revised CMPU - 16.34.188 / 79.70 = 20504 Incremental Analysis Mc Mehanati's foundry unit has capacity to produce 5000 units per month current plan calls for a monthly production and sales of only 2500 units so his facility is idle for half of the time. Meanwhile, Ajaymeru Industries, maker of four grinding machines asked Me Mehanati to produce 20000 floor grinding machine stands weighing 30 kg each at 4550 per kg bargaining possible) Accepting this offer will cost further ? 50,000 to Mr. Mehanati for pattern making Mr. Mehanati estimates that its variable cost will be 46.50 per kg (variable cost of sewing machine stand divided by its weight te 14.75 kg). However, its fixed costs, which have been averaging at 3.70 per kg (Total Annual Fed Cost/ Actual Estimated Sales of Sewing Machine stand its weight will now be spread over among 1042500 kg Castings (50000 14.75-20000*30). As a result, the average fixed cost will drop to 1.60 per kg (1634.188 + 50.000/1042500). Mr. Mehanati concluded. "Sure there will be a loss of 1 per kg on variable costs 46.50 variable cost- 45.50 selling price) but there will be a gain of 2.10 per kg of BEP in units) if variable cost increases by 5% due to inflation Revised Variable Cost 686'1,05 = 720.30 Revised CMPU 800 - 720.30 = 79.70 38 Vol 56. No. 11. November 2010 Indian Foundry Journal castings 3.70 per kg. 160 per kg) by spreading the fixed competitive market. In such a situation, Mr. Mehanat feels that he costs. Therefore, he accepts the offer as it represents an should earn at least 6,00.000 as profit by accepting Alaymeru advantage of 1.10 per kg Industries offer. Now, at what bid price he will be able to achieve this profit target considering 8.5% inflation in variable cost Do we agree with Mr. Mehanati? No, we do not agree with Mr. Mehanati's view as the acceptance of the order causes loss of Mr. Mehanati estimates that its new variable cost will be Rs.50.40 6.50,000 (20000 stand 30 kg** 1+ 50,000 of pattern per kg 46.50*1.085) and fixed cost will drop to 1,60 per kg making). His contention is based on the illusion that spreading the after accepting the order. Further, each kg of casting should fetch foed cost causes savings. It is also shown below by the comparative profit of Re 1 in order to achieve target profit of 6,00,000 income statement Therefore, he estimates bid price? 53 per kg (50.40+1.60+1). Comparative Income Statement Again I plays an important role to decide the competitive price Alternatives for bidding as illustrated below Particulars Status Quo Accept Order Anticipated Variable Cost per kg *50.40 (442500 kg) (1042500 kg) Additional Fored Cost per for Pattern Making Sales Revenue *240,00,000 513,00.000 (50,000/20000*30) 30.10 Less Variable Cost 205.76,250 484,76 250 Desired Profit per kg 100 Total Contribution 34 23.750 28,23,750 Desired Bid Price per kg of Casting * 51.50 Less Fored Cost 16,34,188 16,84,188 Now, Submission of higher bid price may lead to cancellation of Profit Before Taxes 17.89.562 1139,562 Mr. Mehanati's quotation by Ajaymeru Industries Mr. Mehanati *30000 stand x 800): (30000 stand X 800 + 20000 fiour included existing fixed cost 1.50 per kg for quoting bid price A m/c stand X 20 kgx+4550) careful look at the cost items would enable that the existing fixed costs are to be incurred irrespective of the present decision. Clearly, Above example clearly demonstrates that the existing fixed costs the share of existing fixed costs should not be charged to such a do not increase with an increase in the output . Another notable new activity is allocation causes distortion in submission of bid aspect related to fixed costs is that spreading of such costs to a price. larger output base does not yield any decrease in total fixed costs either, in spite of the decrease in the average fixed cost per unit. Conclusion However, we should not infer that fixed costs are always irrelevant with the help of this case study of foundry industry, we have tried costs. In case, the additional fixed costs are required to be incurred to illustrate the importance of BEP and IA in short-term decision to execute decision under consideration, then the additional fixed making, say, segregation of costs, determination of break-even point. costs are as relevant as variable costs. For instance, 50,000 for level of production to achieve desired profit acceptance of the making pattern in above example is fixed in nature but is relevant special order and determination of bid/tender price. It is hoped, cost because it is an additional cost caused due to special order that this study will be very useful for owners of SME foundry In present scenario, inflation rate of 5-10% in variable cost is quite Industries common in foundry industry. As we see, inflation rate of 85%, at References anticipated demand of 30,000 sewing machine stand, leads to absence of profits in any year for Mr. Mehanati at present selling Hun M.Y and Jan P.K.(2007). "Financial Management Test. Problems and price. Further, it is difficult to sell product at higher selling price in Cues", 5/8. Tata Meciww.HI 39 Indian Foundry Journal 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started