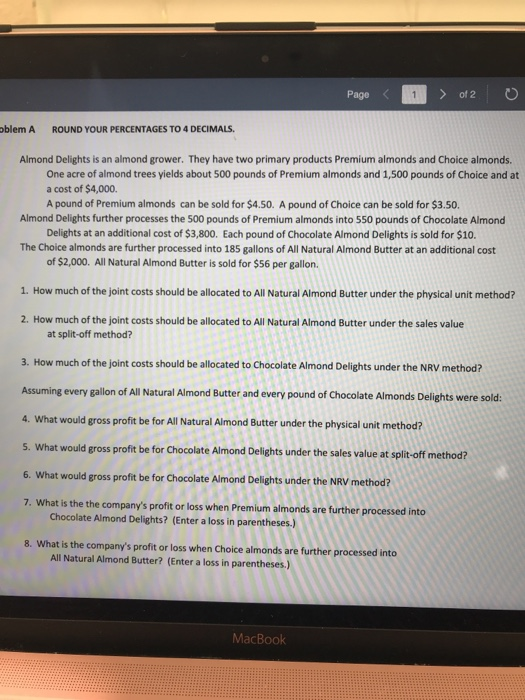

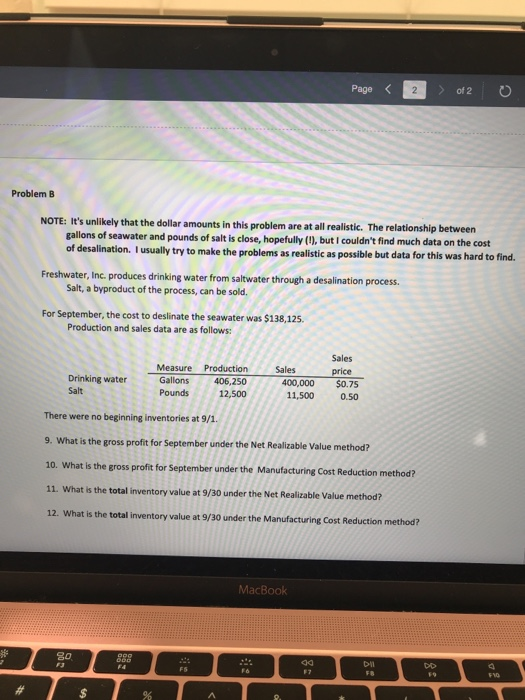

Page2 o oblem A ROUND YOUR PERCENTAGES TO 4 DECIMALS Almond Delights is an almond grower. They have two primary products Premium almonds and Choice almonds. One acre of almond trees yields about 500 pounds of Premium almonds and 1,500 pounds of Choice and at a cost of $4,000. A pound of Premium almonds can be sold for $4.50. A pound of Choice can be sold for $3.50 Almond Delights further processes the 500 pounds of Premium almonds into 550 pounds of Chocolate Almond Delights at an additional cost of $3,800. Each pound of Chocolate Almond Delights is sold for $10 The Choice almonds are further processed into 185 gallons of All Natural Almond Butter at an additional cost of $2,000. All Natural Almond Butter is sold for $56 per gallon. 1. How much of the joint costs should be allocated to All Natural Almond Butter under the physical unit method? 2. How much of the joint costs should be allocated to All Natural Almond Butter under the sales value at split-off method? 3. How much of the joint costs should be allocated to Chocolate Almond Delights under the NRV method? Assuming every gallon of All Natural Almond Butter and every pound of Chocolate Almonds Delights were sold: 4. What would gross profit be for All Natural Almond Butter under the physical unit method? ghts under the sales value at split-off method? 6. What would gross profit be for Chocolate Almond Delights under the NRV method? 7. What is the the company's profit or loss when Premium almonds are further processed into Chocolate Almond Delights? (Enter a loss in parentheses.) 8. What is the company's profit or loss when Choice almonds are further processed into All Natural Almond Butter? (Enter a loss in parentheses.) MacBook Page O of 2 Problem bB NOTE: It's unlikely that the dollar amounts in this problem are at all realistic. The relationship between gallons of seawater and pounds of salt is close, hopefully (), but I couldn't flind much data on the cost of desalination. Iusually try to make the problems as realistic as possible but data for this was hard to find. Freshwater, Inc. produces drinking water from saltwater through a desalination process. Salt, a byproduct of the process, can be sold. For September, the cost to deslinate the seawater was $138,125. Production and sales data are as follows Sales Sales Measure Production Gallons Pounds12,500 400,000 $0.75 11,500 0.50 406,250 Drinking water Salt There were no beginning inventories at 9/1 9. What is the gross profit for September under the Net Realizable Value method? 10. What is the gross profit for September under the Manufacturing Cost Reduction method? 11. What is the total inventory value at 9/30 under the Net Realizable Value method? 12. What is the total inventory value at 9/30 under the Manufacturing Cost Reduction method? MacBook