Question

Palisades Creek Statement of Retained Earnings For the quarter ended March 31, 2020 585,300 430,600 135,000 880,900 Palisades Creek Balance Sheet March 31, 2020 Assets

|

| Palisades Creek Statement of Retained Earnings For the quarter ended March 31, 2020 |

| |||||||

|

| 585,300 |

| |||||||

|

|

| 430,600 |

| ||||||

|

|

| 135,000 |

| ||||||

|

|

| 880,900 |

| ||||||

|

|

|

|

| ||||||

| Palisades Creek Balance Sheet March 31, 2020 | |||||||||

| Assets | Liabilities and Stockholders' Equity | ||||||||

|

| Current Liabilities |

|

|

| |||||

| 546,406 | Accounts payable |

| 296,600 |

| |||||

|

| Salaries payable |

| 98,400 |

| |||||

| 148,900 | Unearned Revenue |

| 50,000 |

| |||||

| 652,400 | Total Current Liabilities |

| 445,000 |

| |||||

| 7,250 | Bonds Payable | 500,000 |

|

| |||||

| 9,550 | Discount on Bonds Payable | 37,194 | 462,806 |

| |||||

| 11,400 | Stockholders' Equity |

|

|

| |||||

| 1,375,906 | Common Stock, $20 par value; 1,000,000 shares authorized; 19,850 shares issued and outstanding |

| 100,000 |

| |||||

| Retained Earnings |

| 880,900 |

| ||||||

| Total Stockholders' Equity |

| 980,900 |

| ||||||

| 512,800 |

|

|

|

| |||||

|

|

|

|

|

| |||||

| 1,888,706 | Total Liabilities and Stockholder's Equity |

| 1,888,706 |

| |||||

|

|

|

|

|

| |||||

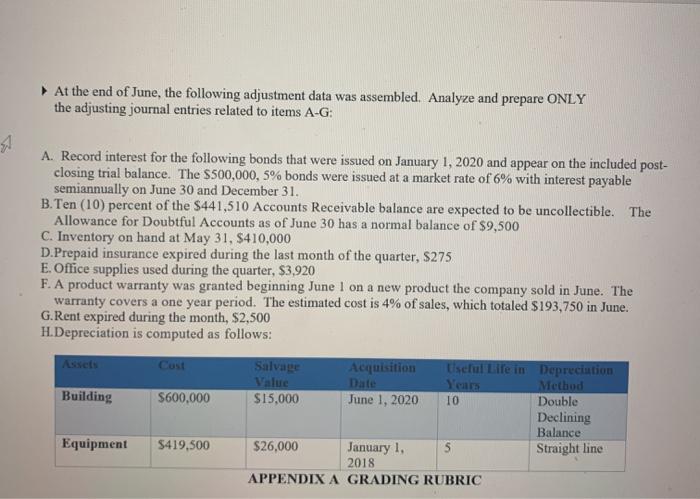

At the end of June, the following adjustment data was assembled. Analyze and prepare ONLY the adjusting journal entries related to items A-G:

- Record interest for the following bonds that were issued on January 1, 2020 and appear on the included post-closing trial balance. The $500,000, 5% bonds were issued at a market rate of 6% with interest payable semiannually on June 30 and December 31.

- Ten (10) percent of the $441,510 Accounts Receivable balance are expected to be uncollectible. The Allowance for Doubtful Accounts as of June 30 has a normal balance of $9,500

- Inventory on hand at May 31, $410,000

- Prepaid insurance expired during the last month of the quarter, $275

- Office supplies used during the quarter, $3,920

- A product warranty was granted beginning June 1 on a new product the company sold in June. The warranty covers a one year period. The estimated cost is 4% of sales, which totaled $193,750 in June.

- Rent expired during the month, $2,500

- Depreciation is computed as follows:

| Assets | Cost | Salvage Value | Acquisition Date | Useful Life in Years | Depreciation Method |

| Building | $600,000 | $15,000 | June 1, 2020 | 10 | Double Declining Balance |

| Equipment | $419,500 | $26,000 | January 1, 2018 | 5 | Straight line |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started