Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pam Alnwick used to live in a province where the Harmonized Sales Tax, HST, was 14%. She recently moved to a state in the

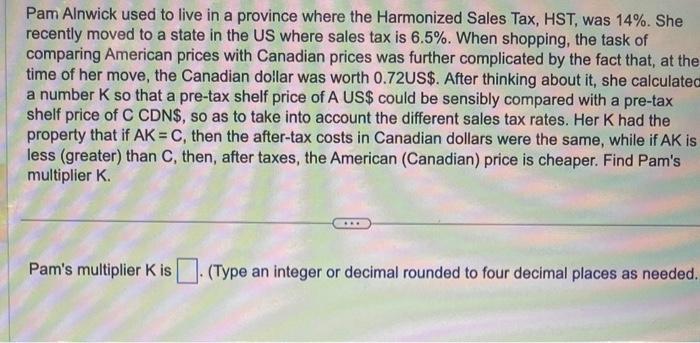

Pam Alnwick used to live in a province where the Harmonized Sales Tax, HST, was 14%. She recently moved to a state in the US where sales tax is 6.5%. When shopping, the task of comparing American prices with Canadian prices was further complicated by the fact that, at the time of her move, the Canadian dollar was worth 0.72US$. After thinking about it, she calculated a number K so that a pre-tax shelf price of A US$ could be sensibly compared with a pre-tax shelf price of C CDN$, so as to take into account the different sales tax rates. Her K had the property that if AK = C, then the after-tax costs in Canadian dollars were the same, while if AK is less (greater) than C, then, after taxes, the American (Canadian) price is cheaper. Find Pam's multiplier K. Pam's multiplier K is . (Type an integer or decimal rounded to four decimal places as needed.

Step by Step Solution

★★★★★

3.50 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started