Question

Pamela Albright is the manager of the audit ofStanton Enterprises, a public company that manufactures formed steel subassemblies forother manufacturers. Albright is planning the 2011

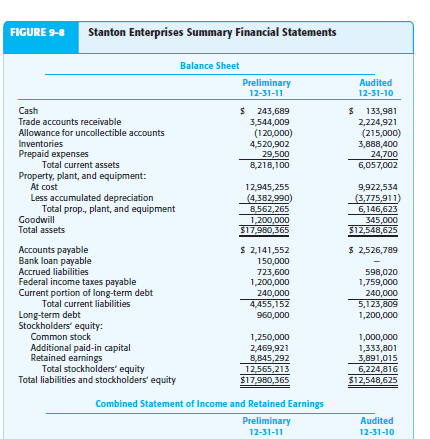

Pamela Albright is the manager of the audit ofStanton Enterprises, a public company that manufactures formed steel subassemblies forother manufacturers. Albright is planning the 2011 audit and is considering an appropriateamount for planning materiality, what tolerable misstatement should be allocated tothe financial statement accounts, and the appropriate inherent risks. Summary financial

statement information is shown in Figure 9-8. Additional relevant planning information issummarized next.

1. Stanton has been a client for 4 years, and Albrights firm has always had a good rela -tionship with the company. Management and the accounting people have alwaysbeen cooperative, honest, and positive about the audit and financial reporting. Nomaterial misstatements were found in the prior years audit. Albrights firm hasmonitored the relationship carefully, because when the audit was obtained, LeonardStanton, the CEO, had the reputation of being a high-flyer and had been throughbankruptcy at an earlier time in his career.

2. Stanton runs the company in an autocratic way, primarily because of a somewhatcontrolling personality. He believes that it is his job to make all the tough decisions.He delegates responsibility to others but is not always willing to delegate a commen -surate amount of authority.

3. The industry in which Stanton participates has been in a favorable cycle the pastfew years and that trend is continuing in the current year. Industry profits arereasonably favorable, and there are no competitive or other apparent threats on thehorizon.

4. Internal controls for Stanton are evaluated as reasonably effective for all cycles butnot unusually strong. Although Stanton supports the idea of control, Albright hasbeen disappointed that management has continually rejected Albrights recom -mendation to improve its internal audit function.

5. Stanton has a contract with its employees that if earnings before taxes, interestexpense, and pension cost exceed $7.8 million for the year, an additional contribu -ion must be made to the pension fund equal to 5% of the excess.

a. You are to play the role of Pamela Albright in the 12-31-11 audit of Stanton Enterprises.Make a preliminary judgment of materiality and allocate tolerable misstatement tofinancial statement accounts. Prepare an audit schedule showing your calculations.(Instructor option: prepare the schedule using an electronic spreadsheet.)

b. Make an acceptable audit risk decision for the current year as high, medium, or low,and support your answer.

c. Perform analytical procedures for Stanton Enterprises that will help you identifyaccounts that may require additional evidence in the current years audit. Documentthe analytical procedures you perform and your conclusions. (Instructor option: usean electronic spreadsheet to calculate analytical procedures.)

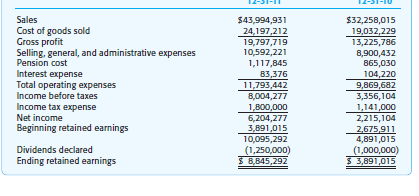

d. The evidence planning worksheet to decide tests of details of balances for Stantonsaccounts receivable is shown in Figure 9-9. Use the information in the case and yourconclusions in parts ac to complete the following rows of the evidence-planningworksheet: Acceptable audit risk, Inherent risk, and Analytical procedures. Also fill intolerable misstatement for accounts receivable at the bottom of the worksheet. Makeany assumptions you believe are reasonable and appropriate and document them.

.png)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started