Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1-60% (Product Costing) Office Products Ltd manufactures two different multifunction printers (MFPs) for the business market. Cost estimates for the two models for the

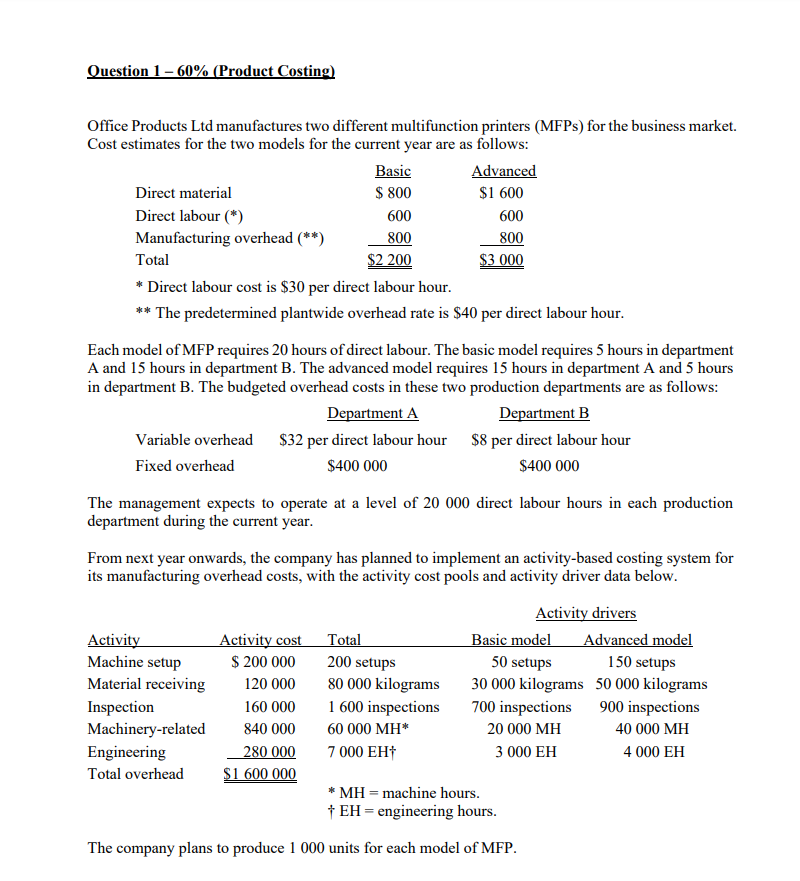

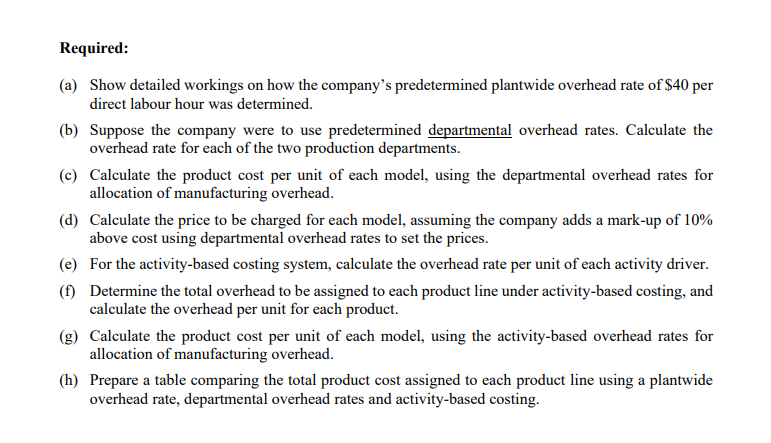

Question 1-60\\% (Product Costing) Office Products Ltd manufactures two different multifunction printers (MFPs) for the business market. Cost estimates for the two models for the current year are as follows: * Direct labour cost is \\( \\$ 30 \\) per direct labour hour. *** The predetermined plantwide overhead rate is \\( \\$ 40 \\) per direct labour hour. Each model of MFP requires 20 hours of direct labour. The basic model requires 5 hours in department A and 15 hours in department B. The advanced model requires 15 hours in department A and 5 hours in department B. The budgeted overhead costs in these two production departments are as follows: The management expects to operate at a level of 20000 direct labour hours in each production department during the current year. From next year onwards, the company has planned to implement an activity-based costing system for its manufacturing overhead costs, with the activity cost pools and activity driver data below. Antivitu Arivare The company plans to produce 1000 units for each model of MFP. (a) Show detailed workings on how the company's predetermined plantwide overhead rate of \\( \\$ 40 \\) per direct labour hour was determined. (b) Suppose the company were to use predetermined departmental overhead rates. Calculate the overhead rate for each of the two production departments. (c) Calculate the product cost per unit of each model, using the departmental overhead rates for allocation of manufacturing overhead. (d) Calculate the price to be charged for each model, assuming the company adds a mark-up of \10 above cost using departmental overhead rates to set the prices. (e) For the activity-based costing system, calculate the overhead rate per unit of each activity driver. (f) Determine the total overhead to be assigned to each product line under activity-based costing, and calculate the overhead per unit for each product. (g) Calculate the product cost per unit of each model, using the activity-based overhead rates for allocation of manufacturing overhead. (h) Prepare a table comparing the total product cost assigned to each product line using a plantwide overhead rate, departmental overhead rates and activity-based costing

Question 1-60\\% (Product Costing) Office Products Ltd manufactures two different multifunction printers (MFPs) for the business market. Cost estimates for the two models for the current year are as follows: * Direct labour cost is \\( \\$ 30 \\) per direct labour hour. *** The predetermined plantwide overhead rate is \\( \\$ 40 \\) per direct labour hour. Each model of MFP requires 20 hours of direct labour. The basic model requires 5 hours in department A and 15 hours in department B. The advanced model requires 15 hours in department A and 5 hours in department B. The budgeted overhead costs in these two production departments are as follows: The management expects to operate at a level of 20000 direct labour hours in each production department during the current year. From next year onwards, the company has planned to implement an activity-based costing system for its manufacturing overhead costs, with the activity cost pools and activity driver data below. Antivitu Arivare The company plans to produce 1000 units for each model of MFP. (a) Show detailed workings on how the company's predetermined plantwide overhead rate of \\( \\$ 40 \\) per direct labour hour was determined. (b) Suppose the company were to use predetermined departmental overhead rates. Calculate the overhead rate for each of the two production departments. (c) Calculate the product cost per unit of each model, using the departmental overhead rates for allocation of manufacturing overhead. (d) Calculate the price to be charged for each model, assuming the company adds a mark-up of \10 above cost using departmental overhead rates to set the prices. (e) For the activity-based costing system, calculate the overhead rate per unit of each activity driver. (f) Determine the total overhead to be assigned to each product line under activity-based costing, and calculate the overhead per unit for each product. (g) Calculate the product cost per unit of each model, using the activity-based overhead rates for allocation of manufacturing overhead. (h) Prepare a table comparing the total product cost assigned to each product line using a plantwide overhead rate, departmental overhead rates and activity-based costing Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started