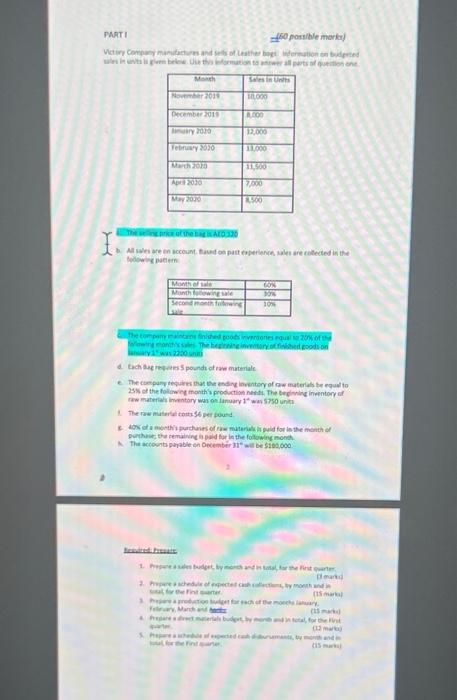

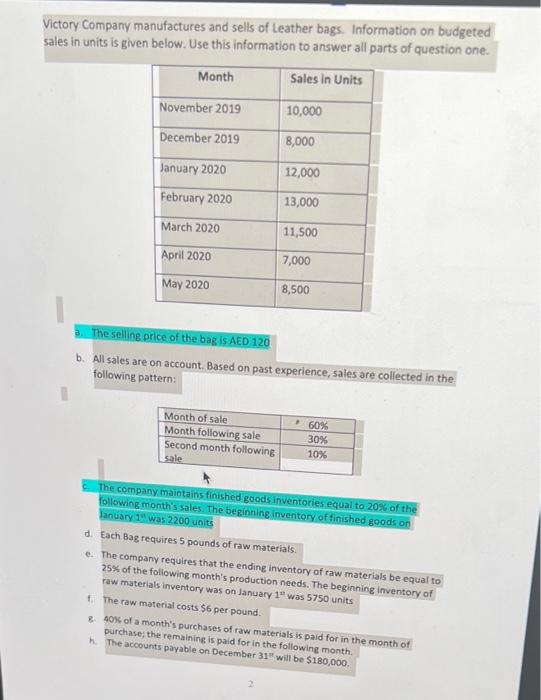

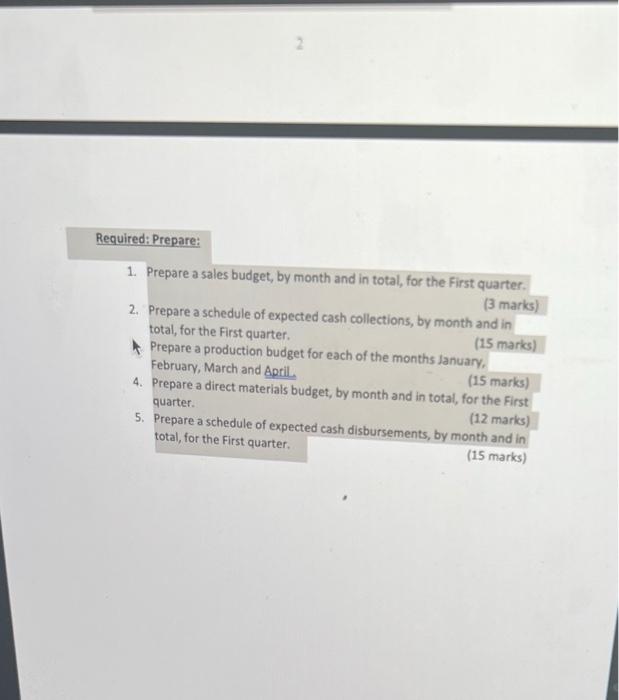

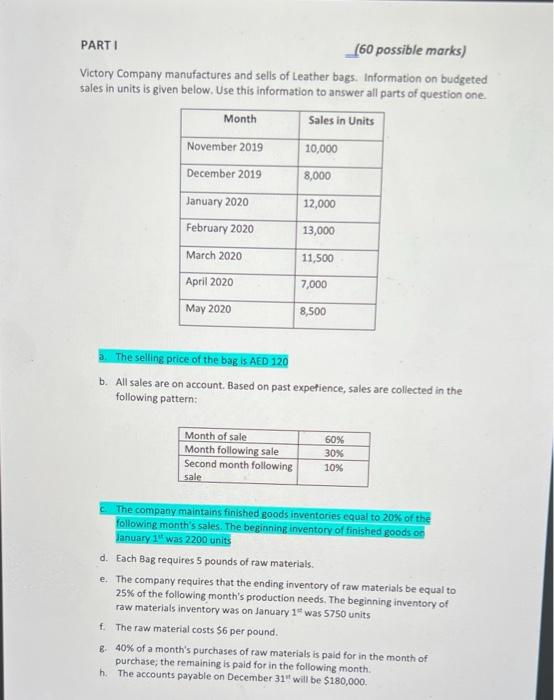

PAMT I we0 portible moriat) a. M salei are an sccoumt, taud on patt eiperlenon wher are colteded in the Bodowis pacen Lencivitiwas zato sning d. tuch meg requers 5 pound of vere muteriale C. The compung tequiri that be endive invitory of me muterials be ngual to row materlali imentory was os linuary 14 was 575 unth 1. The row miterte coutise per fousd porituie the remiline a pold tor in the folowing nond A. The acceont parable en oecentier 31 wit be sibsodo Aeivitibuas B martul fts mitu. Victory Company manufactures and selis of Leather bags. Information on budgeted sales in units is given below. Use this information to answer all parts of question one. 3. The selling price of the bag is AED 120 b. All sales are on account. Based on past experience, sales are collected in the following pattern: 6. The company maintains finished goods inventories equal to 20% of the following month's soles. The beginning inventory of finished goods or d. Each Bag requires 5 pounds of raw materials. e. The company requires that the ending inventory of raw materials be equal to 25% of the following month's production needs. The beginning inventory of raw materials inventory was on January 111 was 5750 units 1. The raw material costs $6 per pound. g. 40k of a month's purchases of raw materials is paid for in the month of purchase; the remaining is paid for in the following month. h. The accounts payable on December 31 " will bo $180,000. 1. Prepare a sales budget, by month and in total, for the First quarter. (3 marks) 2. Prepare a schedule of expected cash collections, by month and in total, for the First quarter. (15 marks) Prepare a production budget for each of the months January, February, March and April. (15 marks) 4. Prepare a direct materials budget, by month and in total, for the First quarter. 5. Prepare a schedule of expected cash disbursements, by month and in total, for the First quarter. (15 marks) Victory Company manufactures and sells of Leather bags. Information on budgeted sales in units is given below. Use this information to answer all parts of question one. 3. The selling price of the bag is AED 120 b. All sales are on account. Based on past expefience, sales are collected in the following pattern: c. The company maintains finished goods inventories equal to 20ks of the following month's sales. The begining inventory of finished goods on January 11 was 2200 units d. Each 8ag requires 5 pounds of raw materials. e. The company requires that the ending inventory of raw materials be equal to 25% of the following month's production needs. The beginning inventory of raw materials inventory was on January 1 was 5750 units f. The raw material costs $6 per pound. B. 40% of a month's purchases of raw materials is paid for in the month of purchase; the remaining is poid for in the following month. h. The accounts payable on December 31 will be $180,000. Required: Prepare: 1. Prepare a sales budget, by month and in total, for the First quarter. (3 marks) 2. Prepare a schedule of expected cashicollections, by month and in total, for the First quarter. (15 marks) 3. Prepare a production budget for each of the months January, February, March and April. (15 marks) 4. Prepare a direct materials budget, by month and in total, for the First quarter. (12 marks) 5. Prepare a schedule of expected cash disbursements, by month and in total, for the First quarter. (15 marks)