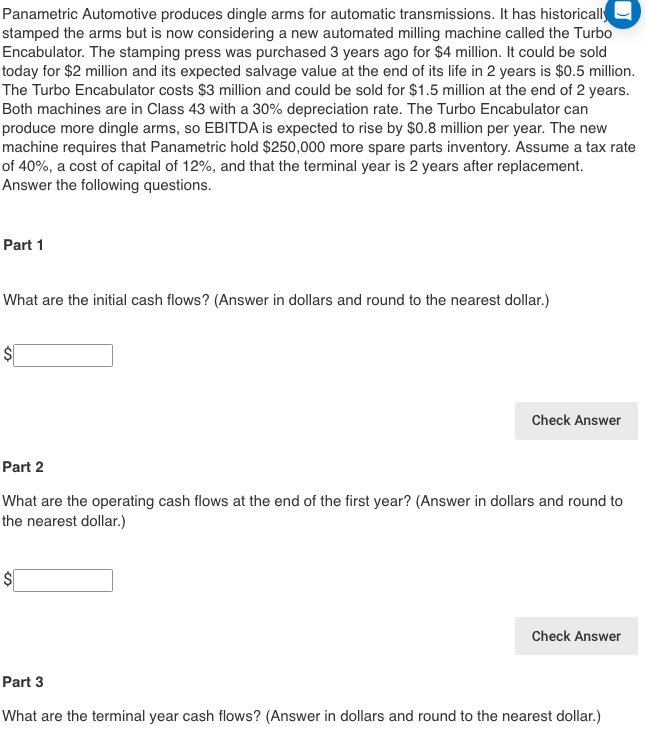

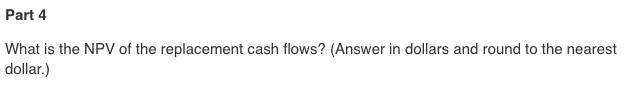

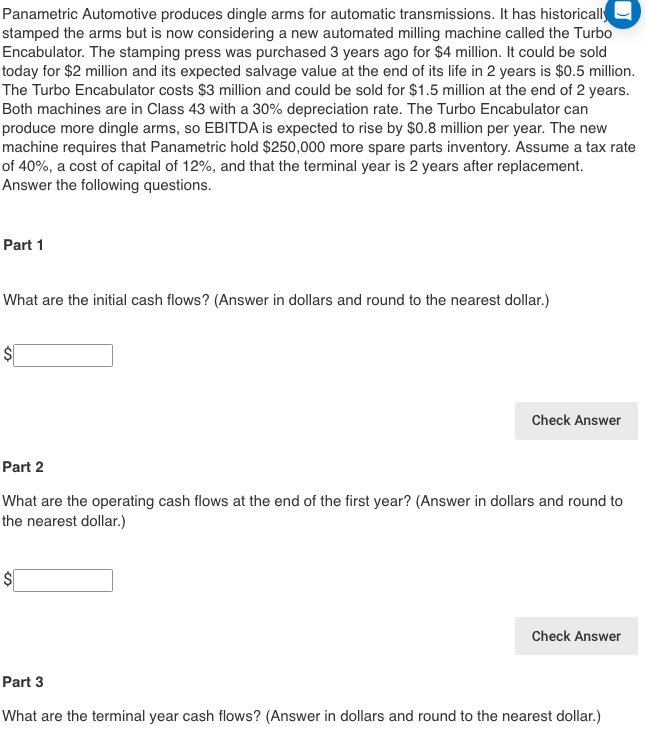

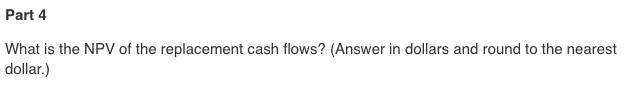

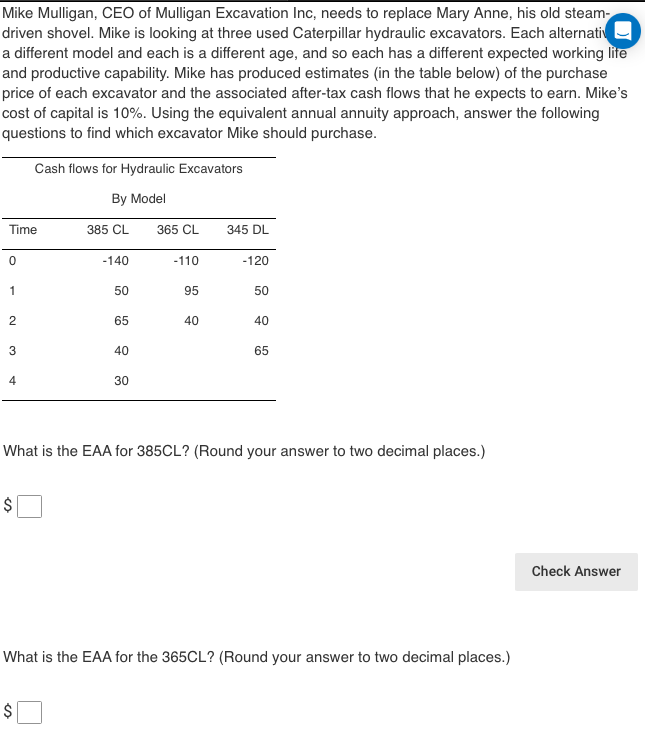

Panametric Automotive produces dingle arms for automatic transmissions. It has historically stamped the arms but is now considering a new automated milling machine called the Turbo Encabulator. The stamping press was purchased 3 years ago for $4 million. It could be sold today for $2 million and its expected salvage value at the end of its life in 2 years is $0.5 million. The Turbo Encabulator costs $3 million and could be sold for $1.5 million at the end of 2 years. Both machines are in Class 43 with a 30% depreciation rate. The Turbo Encabulator can produce more dingle arms, so EBITDA is expected to rise by $0.8 million per year. The new machine requires that Panametric hold $250,000 more spare parts inventory. Assume a tax rate of 40%, a cost of capital of 12%, and that the terminal year is 2 years after replacement. Answer the following questions. Part 1 What are the initial cash flows? (Answer in dollars and round to the nearest dollar.) $ Check Answer Part 2 What are the operating cash flows at the end of the first year? (Answer in dollars and round to the nearest dollar.) $ Check Answer Part 3 What are the terminal year cash flows? (Answer in dollars and round to the nearest dollar.) Part 4 What is the NPV of the replacement cash flows? (Answer in dollars and round to the nearest dollar.) Mike Mulligan, CEO of Mulligan Excavation Inc, needs to replace Mary Anne, his old steam- driven shovel. Mike is looking at three used Caterpillar hydraulic excavators. Each alternativ a different model and each is a different age, and so each has a different expected working lite and productive capability. Mike has produced estimates (in the table below) of the purchase price of each excavator and the associated after-tax cash flows that he expects to earn. Mike's cost of capital is 10%. Using the equivalent annual annuity approach, answer the following questions to find which excavator Mike should purchase. Cash flows for Hydraulic Excavators By Model Time 385 CL 365 CL 345 DL 0 -140 -110 -120 1 50 95 50 2 65 40 40 3 40 65 4 30 What is the EAA for 385CL? (Round your answer to two decimal places.) Check Answer What is the EAA for the 365CL? (Round your answer to two decimal places.) $ What is the EAA for 345DL? (Round your answer to two decimal places.) Panametric Automotive produces dingle arms for automatic transmissions. It has historically stamped the arms but is now considering a new automated milling machine called the Turbo Encabulator. The stamping press was purchased 3 years ago for $4 million. It could be sold today for $2 million and its expected salvage value at the end of its life in 2 years is $0.5 million. The Turbo Encabulator costs $3 million and could be sold for $1.5 million at the end of 2 years. Both machines are in Class 43 with a 30% depreciation rate. The Turbo Encabulator can produce more dingle arms, so EBITDA is expected to rise by $0.8 million per year. The new machine requires that Panametric hold $250,000 more spare parts inventory. Assume a tax rate of 40%, a cost of capital of 12%, and that the terminal year is 2 years after replacement. Answer the following questions. Part 1 What are the initial cash flows? (Answer in dollars and round to the nearest dollar.) $ Check Answer Part 2 What are the operating cash flows at the end of the first year? (Answer in dollars and round to the nearest dollar.) $ Check Answer Part 3 What are the terminal year cash flows? (Answer in dollars and round to the nearest dollar.) Part 4 What is the NPV of the replacement cash flows? (Answer in dollars and round to the nearest dollar.) Mike Mulligan, CEO of Mulligan Excavation Inc, needs to replace Mary Anne, his old steam- driven shovel. Mike is looking at three used Caterpillar hydraulic excavators. Each alternativ a different model and each is a different age, and so each has a different expected working lite and productive capability. Mike has produced estimates (in the table below) of the purchase price of each excavator and the associated after-tax cash flows that he expects to earn. Mike's cost of capital is 10%. Using the equivalent annual annuity approach, answer the following questions to find which excavator Mike should purchase. Cash flows for Hydraulic Excavators By Model Time 385 CL 365 CL 345 DL 0 -140 -110 -120 1 50 95 50 2 65 40 40 3 40 65 4 30 What is the EAA for 385CL? (Round your answer to two decimal places.) Check Answer What is the EAA for the 365CL? (Round your answer to two decimal places.) $ What is the EAA for 345DL? (Round your answer to two decimal places.)