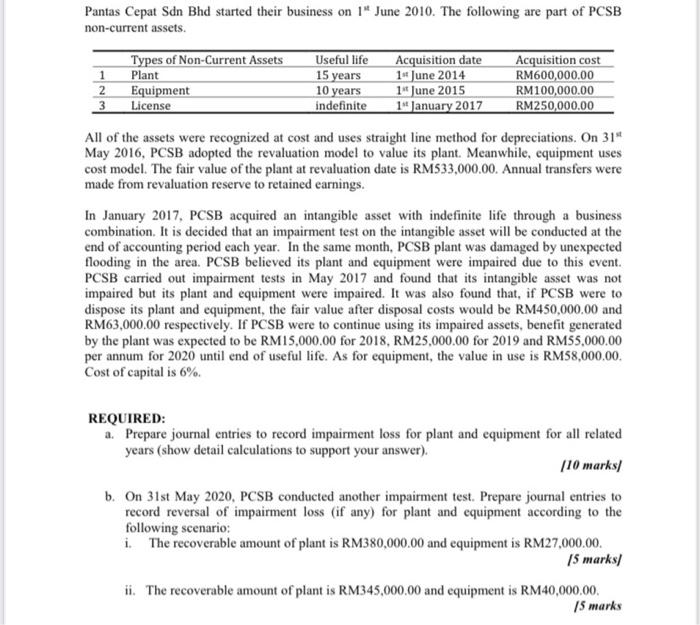

Pantas Cepat Sdn Bhd started their business on 19 June 2010. The following are part of PCSB non-current assets. Types of Non-Current Assets Useful life Acquisition date Acquisition cost 1 Plant 15 years 14 June 2014 RM600,000.00 2 Equipment 10 years 14 June 2015 RM100,000.00 3 License indefinite 14 January 2017 RM250,000.00 All of the assets were recognized at cost and uses straight line method for depreciations. On 31 May 2016, PCSB adopted the revaluation model to value its plant. Meanwhile, equipment uses cost model. The fair value of the plant at revaluation date is RM533,000.00. Annual transfers were made from revaluation reserve to retained earnings. In January 2017, PCSB acquired an intangible asset with indefinite life through a business combination. It is decided that an impairment test on the intangible asset will be conducted at the end of accounting period each year. In the same month, PCSB plant was damaged by unexpected flooding in the area. PCSB believed its plant and equipment were impaired due to this event. PCSB carried out impairment tests in May 2017 and found that its intangible asset was not impaired but its plant and equipment were impaired. It was also found that, if PCSB were to dispose its plant and equipment, the fair value after disposal costs would be RM450,000.00 and RM63,000.00 respectively. If PCSB were to continue using its impaired assets, benefit generated by the plant was expected to be RM15,000.00 for 2018, RM25,000.00 for 2019 and RM55,000.00 per annum for 2020 until end of useful life. As for equipment, the value in use is RM58,000.00. Cost of capital is 6%. REQUIRED: a. Prepare journal entries to record impairment loss for plant and equipment for all related years (show detail calculations to support your answer). 110 marks/ b. On 31st May 2020, PCSB conducted another impairment test. Prepare journal entries to record reversal of impairment loss (if any) for plant and equipment according to the following scenario: i. The recoverable amount of plant is RM380,000.00 and equipment is RM27,000.00. 15 marks) ii. The recoverable amount of plant is RM345,000.00 and equipment is RM40,000.00 15 marks