Question

Paper Company acquired 100 percent of Scissor Companys outstanding common stock for $370,000 on January 1, 2008, when the book value of Scissors net assets

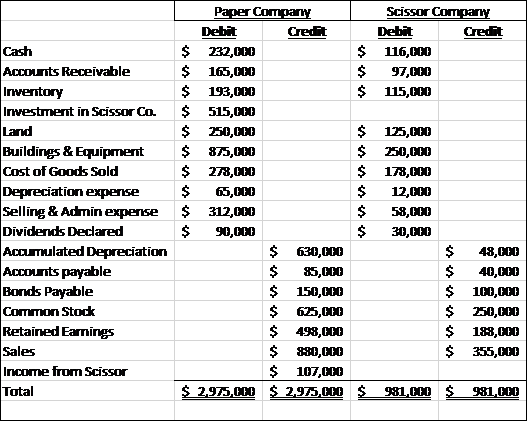

Paper Company acquired 100 percent of Scissor Companys outstanding common stock for $370,000 on January 1, 2008, when the book value of Scissors net assets was equal to $370,000 including Accumulated Depreciation of $24,000. Problem 1 summarizes the first year of Papers ownership of Scissors. Paper uses the equity method to account for investments. Scissors net income in 2009 was $107,000 and declared dividends of $30,000. The following trial balance summarizes the financial position and operations for Paper & Scissor as of December 31, 2009.

A. Prepare any normal equity method journal entries related to the investment in Scissor Company during 2009.

B. Prepare the eliminating entries needed as of December 31, 2009, to complete a consolidation worksheet.

C. Update T-Accounts for the investment & Income Accounts & Book Value Calculation:

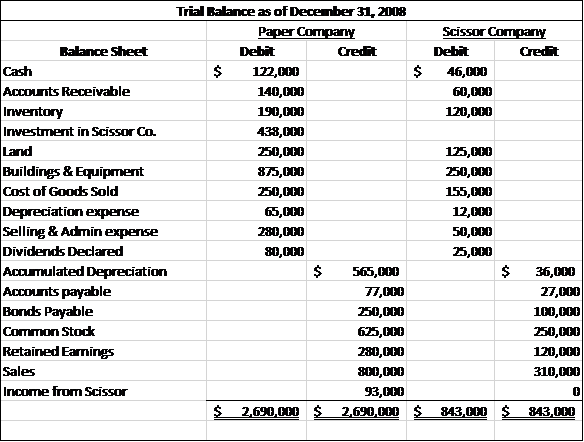

Information of problem 1 is shown below

Paper Company acquired 100 percent of Scissor Companys outstanding common stock for $370,000 on January 1, 2008, when the book value of Scissors net assets was equal to $370,000 including Accumulated Depreciation of $24,000. Paper uses the equity method to account for investments. During 2008 Scissor Companys net income was $93,000 and declared dividends of $25,000. Trial balance date for Paper & Scissors as of December 31, 2008, are as follows:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started