Answered step by step

Verified Expert Solution

Question

1 Approved Answer

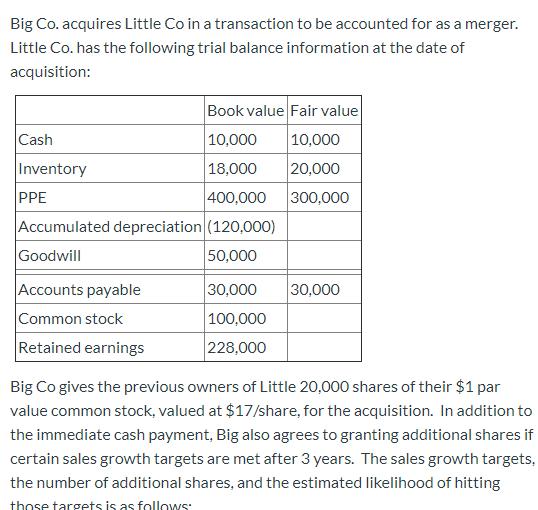

Big Co. acquires Little Co in a transaction to be accounted for as a merger. Little Co. has the following trial balance information at

![]()

![]()

![]()

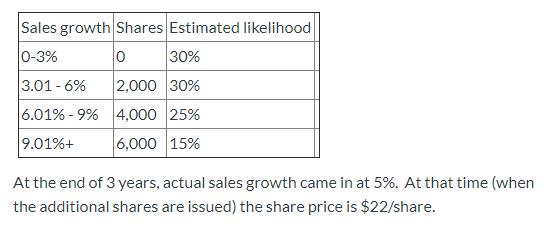

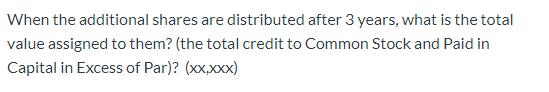

Big Co. acquires Little Co in a transaction to be accounted for as a merger. Little Co. has the following trial balance information at the date of acquisition: Book value Fair value Cash 10,000 10,000 Inventory 18,000 20,000 PPE 400,000 300,000 Accumulated depreciation (120,000) Goodwill 50,000 Accounts payable Common stock Retained earnings 30,000 30,000 100,000 228,000 Big Co gives the previous owners of Little 20,000 shares of their $1 par value common stock, valued at $17/share, for the acquisition. In addition to the immediate cash payment, Big also agrees to granting additional shares if certain sales growth targets are met after 3 years. The sales growth targets, the number of additional shares, and the estimated likelihood of hitting those targets is as follows: Sales growth Shares Estimated likelihood 0-3% 30% 3.01 - 6% 2,000 30% 6.01% - 9% 4,000 25% 9.01%+ 6,000 15% At the end of 3 years, actual sales growth came in at 5%. At that time (when the additional shares are issued) the share price is $22/share. At the time of the acquisition, what is the expected value (# of shares) of the additional shares to be issued? (answer "xx,xxx shares") What dollar value is assigned to these shares? (xx,Xxx) How much goodwill is recorded as part of this transaction? (xx,xxx) When the additional shares are distributed after 3 years, what is the total value assigned to them? (the total credit to Common Stock and Paid in Capital in Excess of Par)? (xx,xx)

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Calculation of Expected Value of Additional Shares sales grow...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started