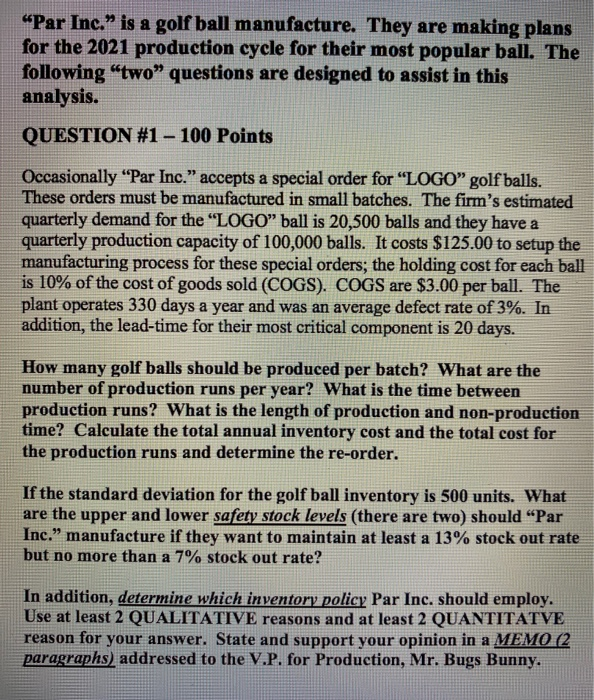

"Par Inc. is a golf ball manufacture. They are making plans for the 2021 production cycle for their most popular ball. The following two questions are designed to assist in this analysis. QUESTION #1 - 100 Points Occasionally "Par Inc." accepts a special order for LOGO golf balls. These orders must be manufactured in small batches. The firm's estimated quarterly demand for the LOGO ball is 20,500 balls and they have a quarterly production capacity of 100,000 balls. It costs $125.00 to setup the manufacturing process for these special orders; the holding cost for each ball is 10% of the cost of goods sold (COGS). COGS are $3.00 per ball. The plant operates 330 days a year and was an average defect rate of 3%. In addition, the lead-time for their most critical component is 20 days. How many golf balls should be produced per batch? What are the number of production runs per year? What is the time between production runs? What is the length of production and non-production time? Calculate the total annual inventory cost and the total cost for the production runs and determine the re-order. If the standard deviation for the golf ball inventory is 500 units. What are the upper and lower safety stock levels (there are two) should "Par Inc." manufacture if they want to maintain at least a 13% stock out rate but no more than a 7% stock out rate? In addition, determine which inventory policy Par Inc. should employ. Use at least 2 QUALITATIVE reasons and at least 2 QUANTITATVE reason for your answer. State and support your opinion in a MEMO (2 paragraphs) addressed to the V.P. for Production, Mr. Bugs Bunny. "Par Inc. is a golf ball manufacture. They are making plans for the 2021 production cycle for their most popular ball. The following two questions are designed to assist in this analysis. QUESTION #1 - 100 Points Occasionally "Par Inc." accepts a special order for LOGO golf balls. These orders must be manufactured in small batches. The firm's estimated quarterly demand for the LOGO ball is 20,500 balls and they have a quarterly production capacity of 100,000 balls. It costs $125.00 to setup the manufacturing process for these special orders; the holding cost for each ball is 10% of the cost of goods sold (COGS). COGS are $3.00 per ball. The plant operates 330 days a year and was an average defect rate of 3%. In addition, the lead-time for their most critical component is 20 days. How many golf balls should be produced per batch? What are the number of production runs per year? What is the time between production runs? What is the length of production and non-production time? Calculate the total annual inventory cost and the total cost for the production runs and determine the re-order. If the standard deviation for the golf ball inventory is 500 units. What are the upper and lower safety stock levels (there are two) should "Par Inc." manufacture if they want to maintain at least a 13% stock out rate but no more than a 7% stock out rate? In addition, determine which inventory policy Par Inc. should employ. Use at least 2 QUALITATIVE reasons and at least 2 QUANTITATVE reason for your answer. State and support your opinion in a MEMO (2 paragraphs) addressed to the V.P. for Production, Mr. Bugs Bunny