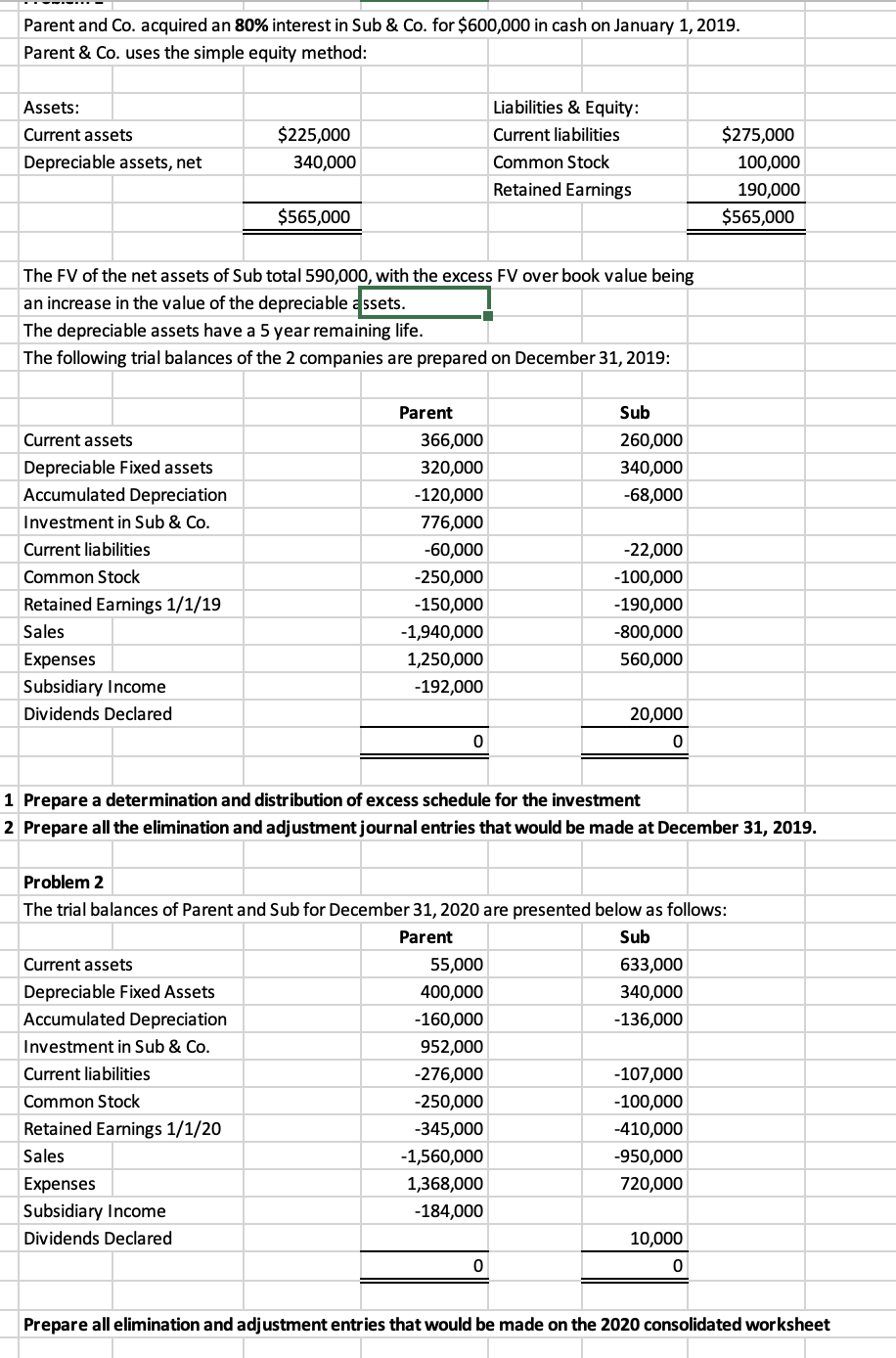

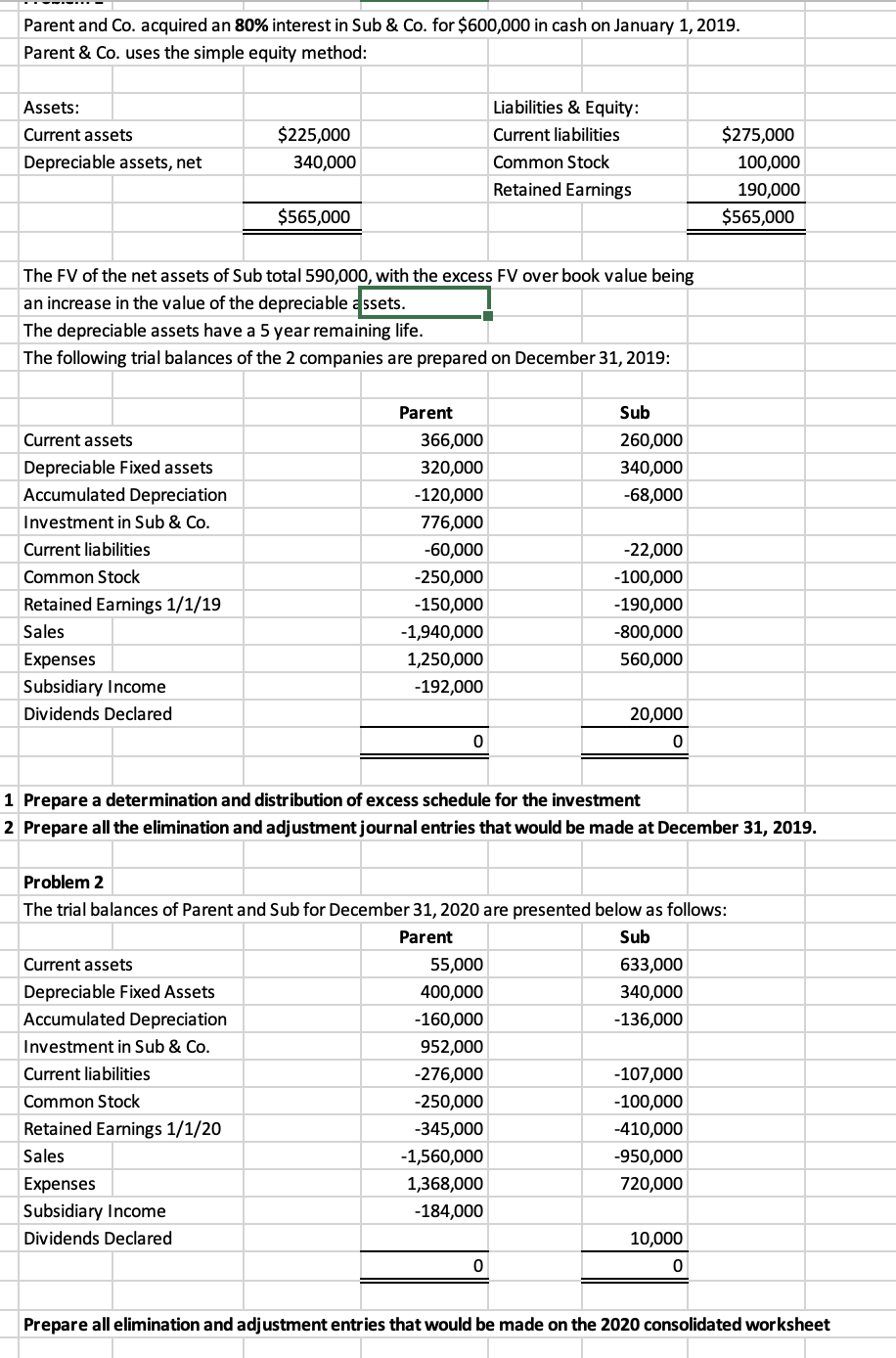

Parent and Co. acquired an 80% interest in Sub \& Co. for $600,000 in cash on January 1, 2019. Parent \& Co. uses the simple equity method: \begin{tabular}{|l|r|} \hline Assets: & \\ \hline Current assets & $225,000 \\ \hline Depreciable assets, net & 340,000 \\ \hline & $565,000 \\ \hline & \\ \hline \end{tabular} The FV of the net assets of Sub total 590,000, with the excess FV over book value being an increase in the value of the depreciable a ssets. The depreciable assets have a 5 year remaining life. 1 Prepare a determination and distribution of excess schedule for the investment 2 Prepare all the elimination and adjustment journal entries that would be made at December 31, 2019. Problem 2 The trial balances of Parent and Sub for December 31, 2020 are presented below as follows: \begin{tabular}{|l|r|r|r|} \hline & & Parent & \multicolumn{1}{|c|}{ Sub } \\ \hline Current assets & 55,000 & 633,000 \\ \hline Depreciable Fixed Assets & & 400,000 & 340,000 \\ \hline Accumulated Depreciation & 160,000 & 136,000 \\ \hline Investment in Sub \& Co. & 952,000 & \\ \hline Current liabilities & 276,000 & 107,000 \\ \hline Common Stock & 250,000 & 100,000 \\ \hline Retained Earnings 1/1/20 & 345,000 & 410,000 \\ \hline Sales & & 1,560,000 & 950,000 \\ \hline Expenses & 1,368,000 & 720,000 \\ \hline Subsidiary Income & 184,000 & 10,000 \\ \hline Dividends Declared & & 0 & 0 \\ \hline & & & \\ \hline \end{tabular} Prepare all elimination and adjustment entries that would be made on the 2020 consolidated worksheet Parent and Co. acquired an 80% interest in Sub \& Co. for $600,000 in cash on January 1, 2019. Parent \& Co. uses the simple equity method: \begin{tabular}{|l|r|} \hline Assets: & \\ \hline Current assets & $225,000 \\ \hline Depreciable assets, net & 340,000 \\ \hline & $565,000 \\ \hline & \\ \hline \end{tabular} The FV of the net assets of Sub total 590,000, with the excess FV over book value being an increase in the value of the depreciable a ssets. The depreciable assets have a 5 year remaining life. 1 Prepare a determination and distribution of excess schedule for the investment 2 Prepare all the elimination and adjustment journal entries that would be made at December 31, 2019. Problem 2 The trial balances of Parent and Sub for December 31, 2020 are presented below as follows: \begin{tabular}{|l|r|r|r|} \hline & & Parent & \multicolumn{1}{|c|}{ Sub } \\ \hline Current assets & 55,000 & 633,000 \\ \hline Depreciable Fixed Assets & & 400,000 & 340,000 \\ \hline Accumulated Depreciation & 160,000 & 136,000 \\ \hline Investment in Sub \& Co. & 952,000 & \\ \hline Current liabilities & 276,000 & 107,000 \\ \hline Common Stock & 250,000 & 100,000 \\ \hline Retained Earnings 1/1/20 & 345,000 & 410,000 \\ \hline Sales & & 1,560,000 & 950,000 \\ \hline Expenses & 1,368,000 & 720,000 \\ \hline Subsidiary Income & 184,000 & 10,000 \\ \hline Dividends Declared & & 0 & 0 \\ \hline & & & \\ \hline \end{tabular} Prepare all elimination and adjustment entries that would be made on the 2020 consolidated worksheet