Question

Parent Company Inc. successfully bids for Child Company Inc. in year X1. Parent Company Inc. has purchased all of Child's shares outstanding for $8,500. Following

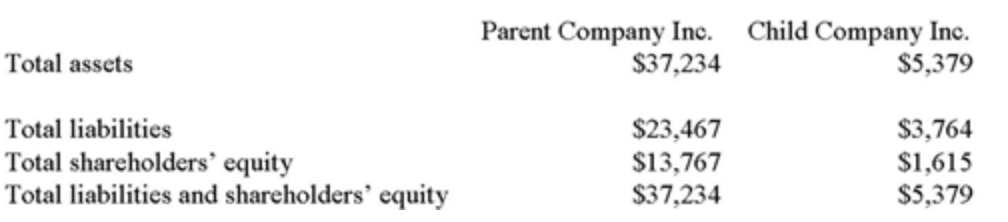

Parent Company Inc. successfully bids for Child Company Inc. in year X1. Parent Company Inc. has purchased all of Child's shares outstanding for $8,500. Following are excerpts from both companies' financial statements for year X1, prior to the acquisition.

Also assume the following information: the acquisition was accounted for using the purchase method. $1,500 of the excess price relates to depreciable assets, and those assets have an additional useful life of 10 years at the time of the acquisition. Parent Company Inc. uses the straight line depreciation method and has a 34% tax rate. The combined net income for both companies for year X2 (excluding any expenses that need to be recorded as a result of the purchase method accounting for the merger) was $1,560. What would be total assets in the consolidated financial statements for the date on which the merger became effective?

A. $50,008

B. $49,498

C. $41,508

D. $44,113

Parent Company Inc. $37,234 Child Company Inc. $5,379 Total assets Total liabilities Total shareholders' equity Total liabilities and shareholders' equity $23,467 $13,767 $37,234 $3,764 $1,615 $5,379Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started