Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Parent Ltd acquired 100% interest in Subsidiary Ltd on 1 January 2019. At that date, Subsidiary Ltd.s net assets were represented by its shareholders equity

Parent Ltd acquired 100% interest in Subsidiary Ltd on 1 January 2019. At that date, Subsidiary Ltd.’s net assets were represented by its shareholders’ equity consisting of the share capital of $100,000 and retained earnings of $70,000.

On the date of the acquisition, Parent Ltd and Subsidiary Ltd agreed the following;

- Subsidiary’s Land had a fair value of $180,000 (carrying amount $100,000).

- Subsidiary had a patent with a fair value of $100,000 (was not previously recognized in Subsidiary’s book). The patent is to amortize over 10 years on straight line basis.

- Subsidiary had inventories that were $30,000 lower than fair value. These inventories were sold by 30 June 2019.

The following intra-company transactions occurred during the year ending 30 June 2020.

- On 1 May 2020, Subsidiary Ltd purchased goods for $150,000 from Parent Ltd on credit at cost plus 50% mark up. As at 30 June 2020, 40% of the inventory was still on hand and 25% of the amount owing for the sales remain unpaid.

- On 1 June 2019, Parent Ltd sold inventory to Subsidiary Ltd for $85,000, recording a before-tax profit of $30,000. By 30 June 2019, Subsidiary Ltd has sold one-third of these to other entities making profits of $54,000, and the remaining inventory was sold by 30 June 2020 for $132,000 to external parties.

- On 1 December 2019, Parent Ltd sold an item of machinery for $104,000 to Subsidiary Ltd. At the date of sale, Parent Ltd had recorded the asset at a carrying amount of $80,000 (accumulated depreciation: $20,000. depreciation rate: 10% p.a. straight-line method).

- Parent Ltd provided a warehouse to Subsidiary Ltd on 1 March 2019. The rent is $12,000 per annum and payable in arrears 6 monthly on 31 August and 28 February each year. Both companies record accruals.

Prepare the following

- Acquisition analysis at 1 January 2019

- A consolidation worksheet for the year ending 30 June 2020 (use the template provided, add more lines if necessary: show all workings. You do not need to submit the journal entries as these entries will not be marked)

- A consolidated Statement of Changes in Equity for the year ending 30 June 2020.

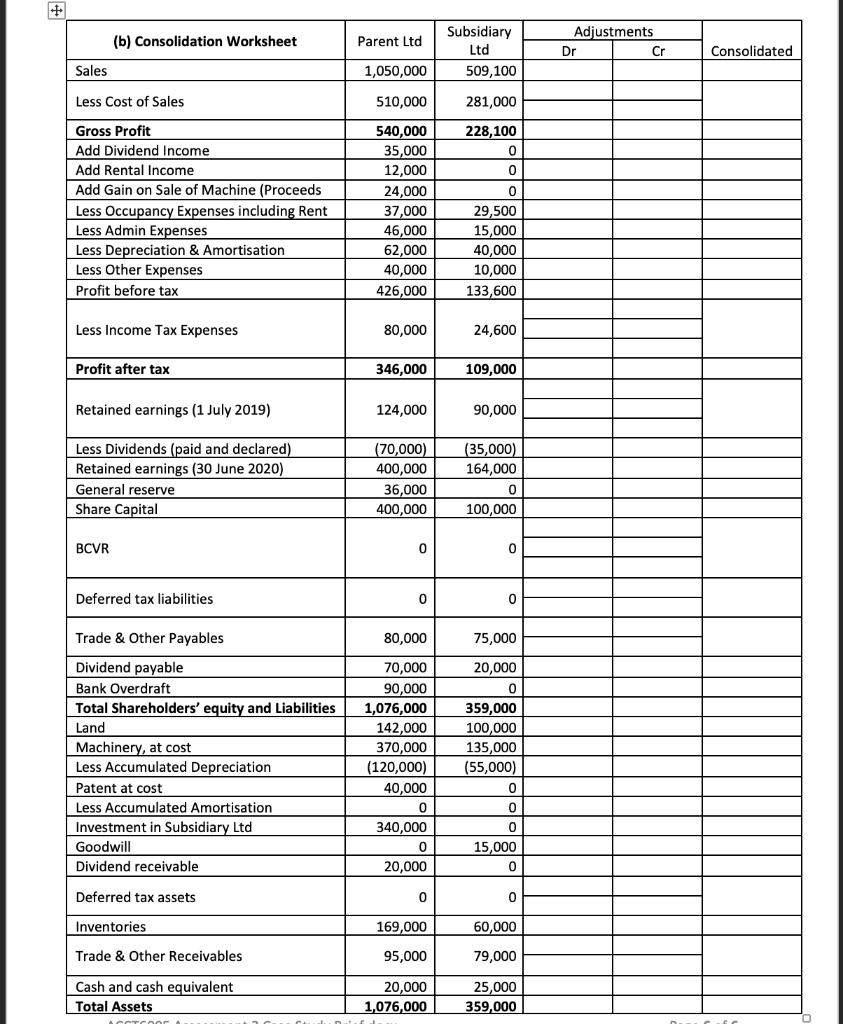

Subsidiary Adjustments (b) Consolidation Worksheet Parent Ltd Ltd Dr Cr Consolidated Sales 1,050,000 509,100 Less Cost of Sales 510,000 281,000 Gross Profit 540,000 35,000 228,100 Add Dividend Income Add Rental Income 12,000 Add Gain on Sale of Machine (Proceeds 24,000 37,000 Less Occupancy Expenses including Rent Less Admin Expenses 29,500 46,000 15,000 Less Depreciation & Amortisation 40,000 10,000 62,000 Less Other Expenses 40,000 Profit before tax 426,000 133,600 Less Income Tax Expenses 80,000 24,600 Profit after tax 346,000 109,000 Retained earnings (1 July 2019) 124,000 90,000 Less Dividends (paid and declared) Retained earnings (30 June 2020) (35,000) 164,000 (70,000) 400,000 General reserve 36,000 Share Capital 400,000 100,000 BCVR Deferred tax liabilities Trade & Other Payables 80,000 75,000 Dividend payable 70,000 20,000 Bank Overdraft 90,000 Total Shareholders' equity and Liabilities 359,000 100,000 1,076,000 Land 142,000 370,000 (120,000) Machinery, at cost 135,000 (55,000) Less Accumulated Depreciation Patent at cost 40,000 Less Accumulated Amortisation Investment in Subsidiary Ltd Goodwill Dividend receivable 340,000 15,000 20,000 Deferred tax assets Inventories 169,000 60,000 Trade & Other Receivables 95,000 79,000 Cash and cash equivalent |Total Assets 20,000 1,076,000 25,000 359,000 ACCTCOer

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

ACQUISITION ANALYSIS AS AT 1ST jANUARY 2019 Face Value of Share Capital 100000 Retained Earnings 70000 Revaluation Surplus 150000 Goodwll 20000 Total ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started