Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Parent Ltd acquired 55% of the shares of Subsidiary Ltd in the beginning of the year for $550,000. All identifiable assets and liabilities of

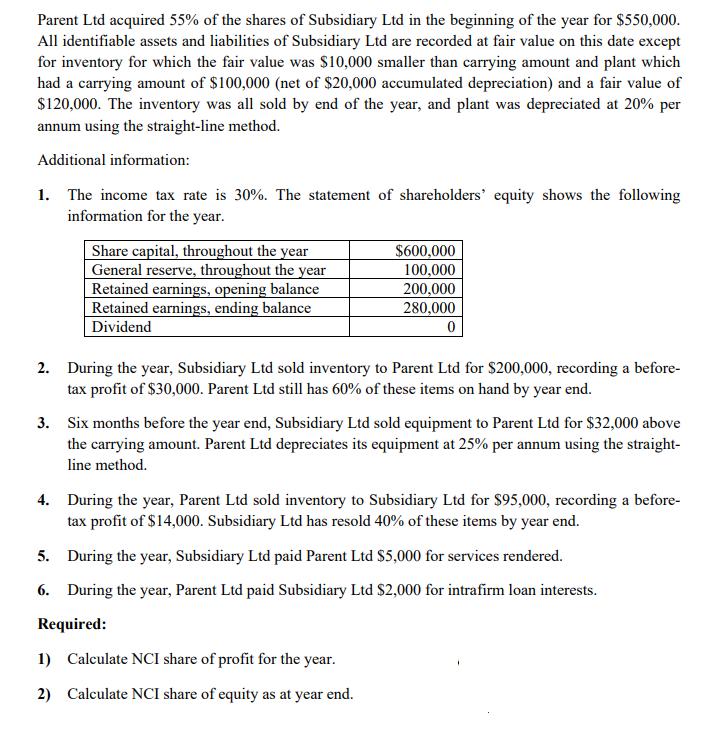

Parent Ltd acquired 55% of the shares of Subsidiary Ltd in the beginning of the year for $550,000. All identifiable assets and liabilities of Subsidiary Ltd are recorded at fair value on this date except for inventory for which the fair value was $10,000 smaller than carrying amount and plant which had a carrying amount of $100,000 (net of $20,000 accumulated depreciation) and a fair value of $120,000. The inventory was all sold by end of the year, and plant was depreciated at 20% per annum using the straight-line method. Additional information: 1. The income tax rate is 30%. The statement of shareholders' equity shows the following information for the year. Share capital, throughout the year General reserve, throughout the year Retained earnings, opening balance Retained earnings, ending balance Dividend $600,000 100,000 200,000 280,000 2. During the year, Subsidiary Ltd sold inventory to Parent Ltd for $200,000, recording a before- tax profit of $30,000. Parent Ltd still has 60% of these items on hand by year end. 3. Six months before the year end, Subsidiary Ltd sold equipment to Parent Ltd for $32,000 above the carrying amount. Parent Ltd depreciates its equipment at 25% per annum using the straight- line method. 4. During the year, Parent Ltd sold inventory to Subsidiary Ltd for $95,000, recording a before- tax profit of $14,000. Subsidiary Ltd has resold 40% of these items by year end. 5. During the year, Subsidiary Ltd paid Parent Ltd $5,000 for services rendered. 6. During the year, Parent Ltd paid Subsidiary Ltd $2,000 for intrafirm loan interests. Required: 1) Calculate NCI share of profit for the year. 2) Calculate NCI share of equity as at year end.

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Rage a1 Solution Part1 NC share Amounts 1he Year the Year 280000 200000 foo0o Adjustments U...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started