Question

Parent purchased 100% of Sub on 1/1/20x1. The worksheet that follows was prepared immediately after purchase. The purchase price reflects the following information. All fair

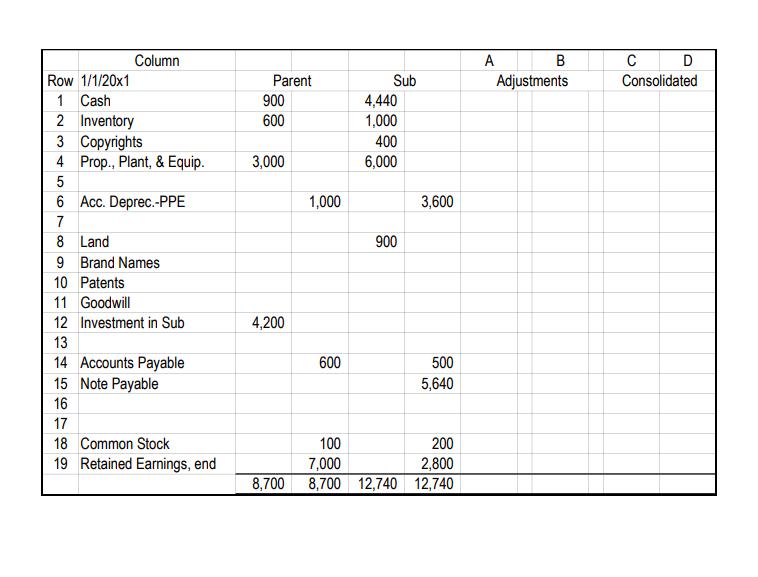

Parent purchased 100% of Sub on 1/1/20x1. The worksheet that follows was prepared immediately after purchase. The purchase price reflects the following information. All fair and book values are the same except as noted. The fair value of Inventory is $940 (Sub uses LIFO), of Copyrights is $450 (5 years remain), of Prop., Plant, & Equip. is $2,800 (8 years remain), and of Land is $1,000. In a prior year, Sub issued an $8,000 noninterest-bearing note payable. The note was recorded at its net present value discounted at the then market rate of 6%. Its balance on Sub’s books reflects the use of effective interest. The note has a fair value of $5,970, as the market rate is now 5% on 1/1/20x1. The note is due in six years. The Sub has brand names with a fair value of $120, with an indefinite life, and patents worth $300, having a 10-year remaining life. Amortizations are done on a straight-line basis, except for the note, which uses effective interest. The following parts are unrelated except as noted. Round all numbers to nearest whole dollar.

Column Row 1/1/20x1 1 Cash 2 Inventory 3 Copyrights 4 Prop., Plant, & Equip. 5 6 7 8 Land 9 Brand Names 10 Patents Acc. Deprec.-PPE 11 Goodwill 12 Investment in Sub 13 14 Accounts Payable 15 Note Payable 16 17 18 Common Stock 19 Retained Earnings, end Parent 900 600 3,000 4,200 8,700 1,000 600 Sub 4,440 1,000 400 6,000 900 100 7,000 8,700 12,740 3,600 500 5,640 200 2,800 12,740 A B Adjustments C Consolidated D

Step by Step Solution

3.52 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

At the date of consolidation Parent Sub Dr Cr Dr Cr Dr Cr Dr ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started